Published on: 01/03/2020 • 4 min read

Avidian Report – Top Three Market Surprises in 2019

INSIDE THIS EDITION:

Top Three Market Surprises in 2019

Weekly Snapshot of Global Asset Class Performance

Secure Act of 2019

401k Plan Manager

As we enter a new calendar year, it offers us an opportunity to look back at 2019 and understand not only what worked and what didn’t work, but also why investments performed as they did. As part of our year-end review, we determined that there were three key surprises that drove the performance of investments across asset classes.

[toggle title=’Read More’]

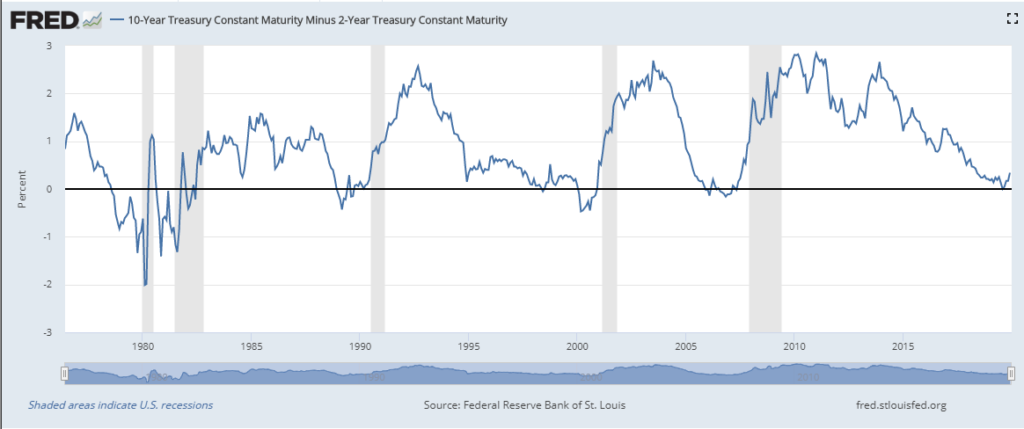

No.1 – Recession fears yet market rallied

Last year started with fears of economic recession lingering following a fourth-quarter 2018 decline that left investors undoubtedly shaken. Despite that, investor memory proved short and a roaring January foreshadowed 2019 returns. This was undeniably unexpected. Especially as the spread between the 2-year and 10-year US Treasury yield went negative in August in what has historically been a harbinger of recession. After all, all last five US recessions were preceded by a yield curve inversion. As investors grappled with fear, many decided to stay on sidelines. In hindsight, however, this was a misstep as both stocks and bonds finished the year on a strong note. In fact, a traditional balanced portfolio represented by 60% exposure to equities and 40% exposure to fixed income turned in their best performance in two decades.

No. 2 – Federal Reserve policy shifts surprised just about everyone

Coming into 2019, it was largely expected that the Fed would continue gradually increase interest rates in an effort to gain access to some, albeit limited, tools to fight an economic downturn. After the Fed increased interest rates by 0.25% in December 2018, it proposed two more rate hikes for 2019. Just as investors factored additional rate hikes into their expectations, the Fed shifted their stance and transitioned back to rate cuts after a brief pause in the first half of 2019. In the end, the Fed cut rates three times in the subsequent six months in what was yet another surprise to investors. Yet, despite investors’ disdain for surprises, sentiment remained resilient which supported a further rally higher in both equities and fixed income.

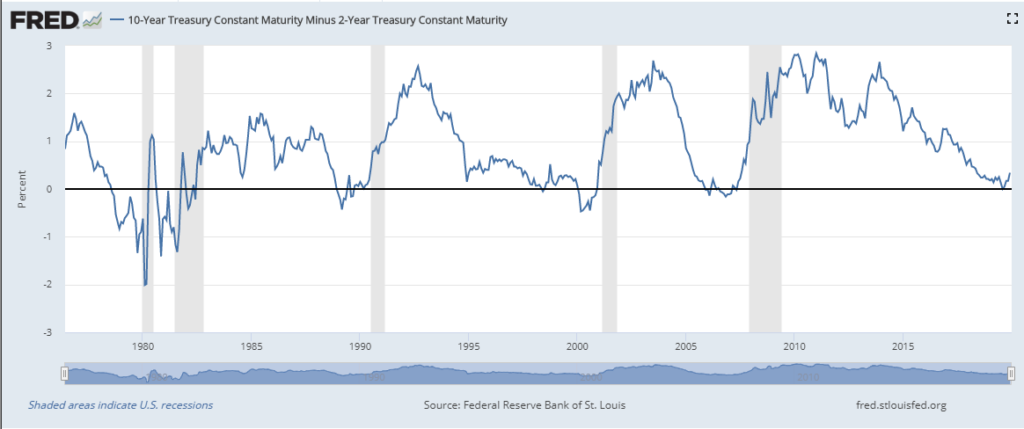

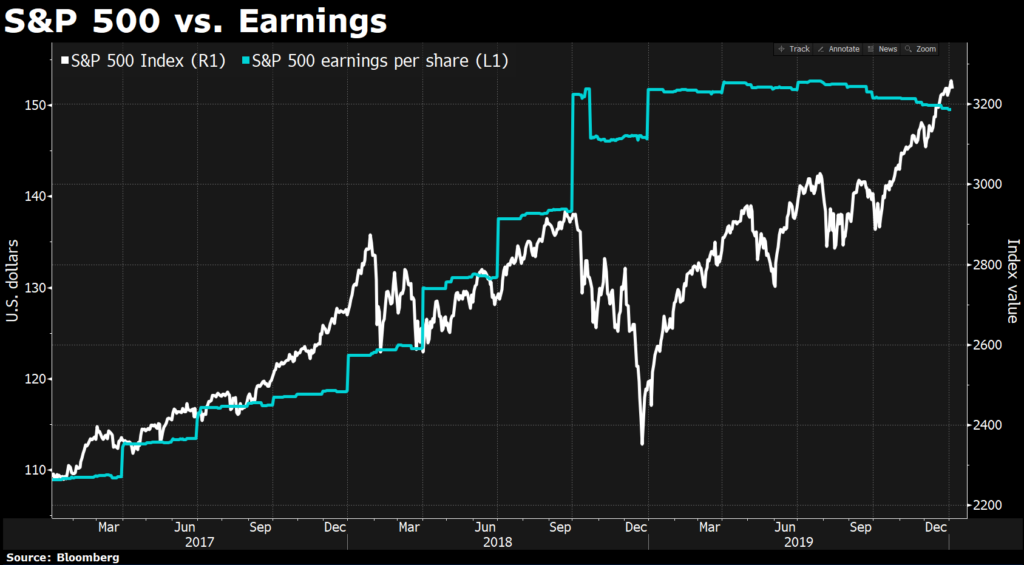

No. 3 – Fundamentals stopped mattering

Despite strong year-over-year earnings growth on the back of corporate tax cuts, the equity markets sold off sharply in December 2018. In fact, the fourth quarter represented the worst performance for global stocks since 2011. That sharp decline led to negative returns for both stocks and bonds for the calendar year 2018. In fact, cash was the only asset class that generated positive returns. Then last year, we witnessed a tremendous reversal despite flat corporate earnings. U.S. stocks closed the year with their best return since 2013 as the S&P 500 index delivered 31.48% and U.S. bonds returned 8.72%, driven by a flattening yield curve. The biggest surprise was not the return numbers, as we have seen similar returns in years prior. However, what did surprise was that it happened in the face of stagnant earnings growth, trade disputes, increasing tariffs and geopolitical uncertainty across the globe.

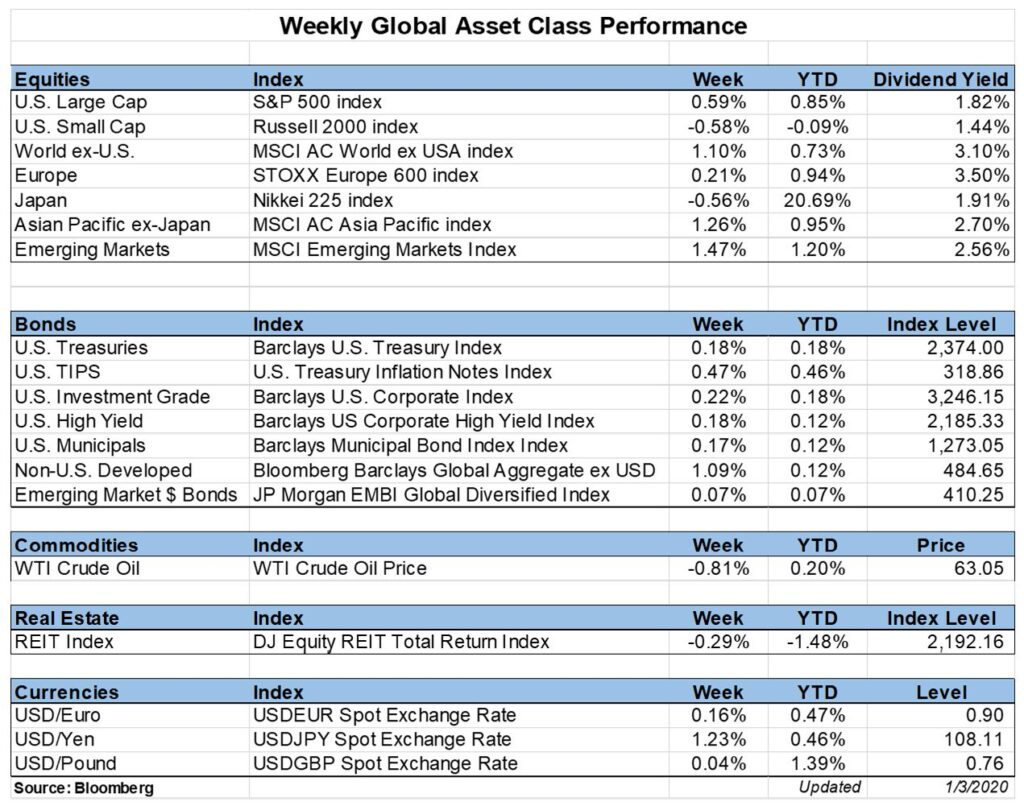

Weekly Global Asset Class Performance

[/toggle]

Secure Act of 2019

Written by: Scott A. Bishop, MBA, CPA/PFS, CFP

The $1.4 trillion spending package enacted on December 20, 2019, included the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which had overwhelmingly passed the House of Representatives in the spring of 2019, but then subsequently stalled in the Senate. The SECURE Act represents the most sweeping set of changes to retirement legislation in more than a decade.

Read Full Article Here

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*