Published on: 04/16/2021 • 6 min read

Avidian Report – What are Business Cycle Indicators Telling Us about the Economic Recovery and Portfolio Positioning?

INSIDE THIS EDITION:

What are Business Cycle Indicators Telling Us about the Economic Recovery and Portfolio Positioning?

2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

Last week, we discussed broad macroeconomic trends and developments compared to our 2021 outlook.

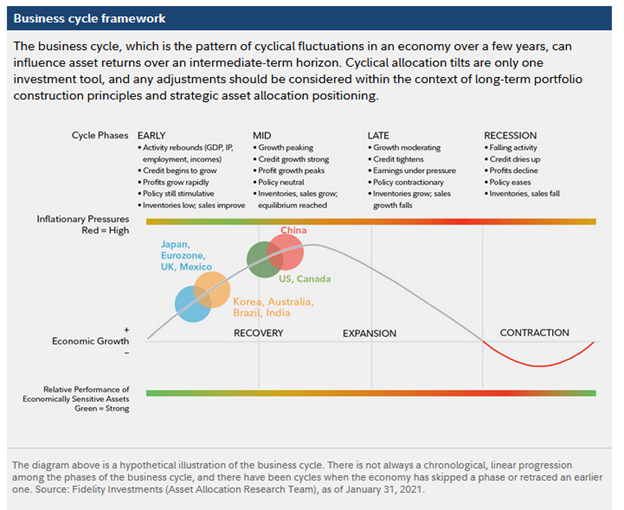

This week, we provide a more current update on several areas, including financial conditions (defined as the current state of financial variables that influence economic behavior), credit markets, equity markets, fixed income markets, and currencies. We believe it is important and beneficial for investors to understand which phase of the business cycle we might be in as it can help determine where to allocate capital as each phase of the business cycle can be supportive or challenging for different sectors or asset classes.

The chart below from Fidelity does an excellent job illustrating the four main business cycle phases and how those phases might be identified. While it is virtually impossible to pinpoint exactly where we are along the cycle, we believe it is possible to get pretty close if we pay attention to certain key indicators.

The discussion that follows, while less about the business cycle, could be helpful in understanding what we are seeing across important components of the economic cycle.

Financial Conditions and Credit Markets:

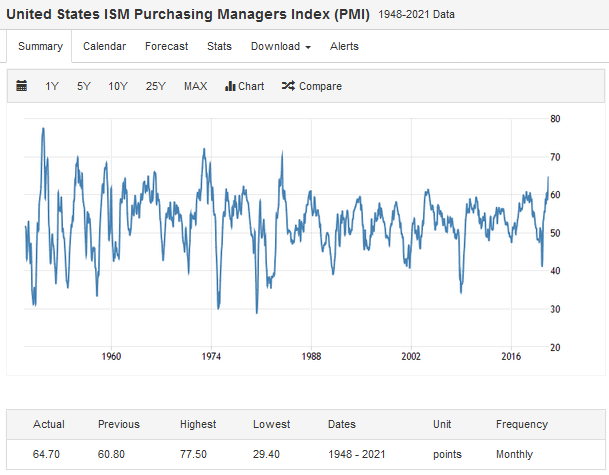

US financial conditions have loosened for the third consecutive week. The high yield market seems priced for perfection with the tightest yield spreads we have seen since 2007. This was also accompanied by the highest ISM Manufacturing print we have had since 1983.

In our view, this might introduce some downside risk to the high yield market and thus requires that investors keep a watchful eye on the high yield fixed income sector for both risk management and opportunity.

Outside of the US, we have also seen financial conditions easing in Europe, as confidence builds that the vaccine program has improved markedly over the past couple of weeks. If this continues, we think it is certainly supportive of both a European economic recovery and European equities.

More good news for the credit market is that despite the sudden unwinding of a large wall street firm a week ago due to their highly leveraged portfolio, there has been no immediate resulting spillover of contagion into the credit markets. At the height of the unwinding of their securities, there were some concerns that prime brokers involved might be looking to deleverage their own positions and lead to a wave of deleveraging that would bleed into the credit markets. This never materialized, and instead, we are seeing an increase in flight-to-quality positioning. We see this as a healthy transition.

Equities:

For equities, we note a combination of a strengthening US dollar, along with more recent stabilization in Treasury yields, providing renewed support for long duration growth stocks. This has contributed to the flattening performance differential between cyclical stocks compared to defensive stocks. Banks have also lost some steam with the flatter yield curve across 2-year and 10-year tenors. We are also seeing big tech and large caps outperform value stocks, small cap and companies with weaker balance sheets. Overall, we think this indicates that having a more balanced exposure to both economically sensitive sectors and growth is appropriate at this time.

Investors have more recently also rotated away from commodity-oriented stocks in favor of tech and other high-quality companies with strong balance sheets. However, we think this largely is to be expected as this is a lower demand period for both oil and industrial metal commodities as the Chinese New Year does reduce short-term demand. For investors interested in either of these areas, the current weakness could be a tactical buying opportunity, especially as the combination of a sharp increase in demand meets structural deficits across certain sub-sectors within the commodity complex over the next couple of years.

Fixed Income and Inflation:

It is no secret that near-term inflationary pressures have been rising while the 10-year Treasury yield has been range-bound for the past few weeks. Inflation gauges like the PPI (last week) and CPI are likely to run hot over the next couple of months as they compare to a low base in 2020. The question for investors is whether this higher inflation period in the short-term will be transitory or whether it will set the stage for a more durable inflationary regime. That remains to be seen, but we believe investors should have some inflation hedges in their portfolios.

The bond market appears to be underestimating the short-term inflationary pressures over the next couple of years, so there may be an opportunity to add in these hedges for investors who have not done so.

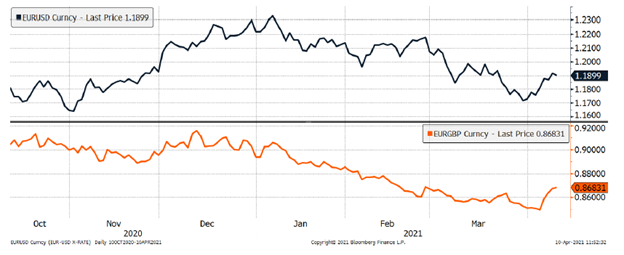

Currencies:

In currency markets, we are seeing evidence of growing confidence that the sharp improvement in the vaccine rollout in Europe might translate into faster economic growth. The Euro is finally strengthening vs. the US dollar. If this materializes further, then narrower growth differentials for the US might support a weaker dollar. According to the CFTC, the crowded dollar short trade has unwound quickly in recent weeks to a much more balanced market. Unless there is a geopolitical risk flare over Taiwan or Ukraine, we think there is more reason to believe a weaker dollar could be ahead. For stocks, we believe this favors the cyclical reflation trades.

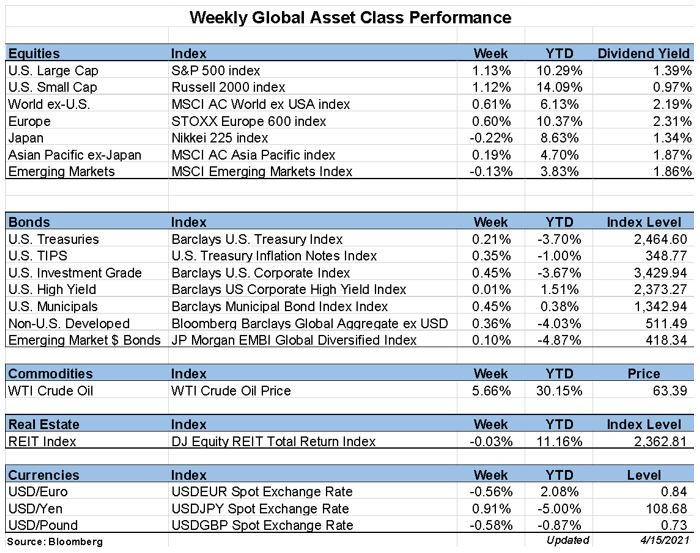

Weekly Global Asset Class Performance

2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

Written by Scott Bishop, MBA, CPA/PFS, CFP® | April 7th, 2021

Scott Bishop was on Barron’s Live Podcast (part of MarketWatch) with Andrew Keshner on April 7th. The topic was about “Make the Best out of our Complicated Tax Season”. A link to the webinar can be found below. Also, a summary of some of our discussion items can be found following the link.

Webinar Recording: Making the Best Out of Our Complicated Tax Season

Read Full Article Here

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*