Published on: 09/17/2021 • 4 min read

Avidian Report – What Are The Harry Truman Economists Saying?

INSIDE THIS EDITION:

Harry Truman was once quoted saying, “Give me a one-handed economist. All my economists say ‘on the one hand…, then ‘but on the other….” And in many ways, investors today seem to be using the Harry Truman economist playbook when assessing the current economic situation. This might be attributed to the range of scenarios that may ultimately play out from where we are today. This week’s report discusses two possible economic scenarios and, more importantly, what equity investors might consider under each scenario.

On one hand

The chart below shows the United States GDP Growth Rate has climbed over the last three quarters at a moderate pace. All of this, after a massive recovery in the third quarter of 2020 as the economy reopened post-covid.

United States GDP Growth Rate

And although Wall Street firms have reduced Q3 and Q4 GDP estimates, they have increased GDP forecasts for 2022. By doing so, they are signaling a belief that economic growth could very well continue into the next year, supported by significant fiscal stimulus.

In this scenario, inflation either surprises the upside, especially if supported by wage growth or remains sticky at a higher-than-consensus plateau.

Under this situation, the Fed is trapped, so they must remain dovish, at least versus the rest of the world to control the dollar.

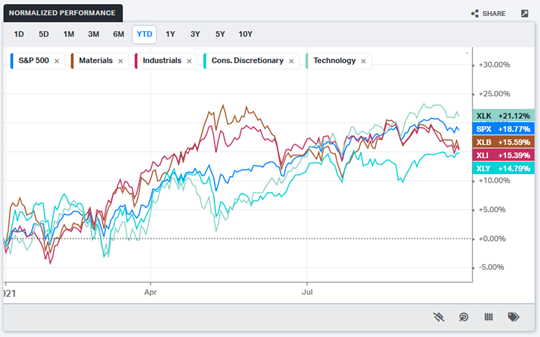

Under this investment thesis, investors might favor cyclical equities, particularly consumer services, because demand is pulled forward versus long-duration growth stocks. Other cyclical equities that might catch investors’ attention include industrials, materials, and some pockets of the tech sector. Although, we would guess that investors looking at the tech sector might be extremely selective and demand more attractive valuations.

On the other hand

On the flip side, we could see a delayed and/or much smaller fiscal stimulus and weakening consumer confidence, leading to meaningfully slower growth.

This might be more concerning to investors because if accompanied by inflationary pressure, we could potentially find ourselves in a stagflation situation like the 1970s.

In this scenario, high-quality factor equities might not perform, and investors might be better served by transitioning to more defensive positioning.

The bond market is clearly in the deflation camp, with the great Treasury auctions in recent weeks and huge corporate supply. However, if the bond market is wrong here, then investors need to be prepared. After all, it would not necessarily surprise us if higher treasury issuances occur in the third and fourth quarter, which would pressure interest rates higher. Eventually, the debt ceiling will likely be raised, and the two infrastructure bills, although smaller than advertised, get passed. More importantly, this would keep the Fed in an ex-post model versus setting policies based on forecasts, and they may find themselves in a situation where they have to understate inflation and control yields like Japan has done. Under this situation, it makes sense for investors to layer on some, albeit modest, inflation hedges in their portfolios, especially in a world that seems likely to push fiscal stimulus as far as it can or until something breaks.

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*