Published on: 11/09/2015 • 3 min read

Changes in Social Security Claiming Strategies – Not Good News for Many

As many of us found out in late October, Congress has put the kibosh on many Social Security claiming strategies that we at Avidian Wealth have used for years to boost our clients’ Social Security lifetime benefits. The law that was passed in October (that was primarily a budget bill) closes the “unintended loopholes” in the 15-year-old law that allowed for various “File and Suspend” Social Security Maximization Strategies (discussed in my recent article on Social Security).

The proposed law affects millions of Americans who plan to claim Social Security and who might have taken advantage of rules that would have let them increase their lifetime benefit by $32,000 and, for some households, upwards of $64,000. Overall, Americans stand to lose upwards of $9.5 billion per year in Social Security benefits (in 2006 dollars) because of the change in the law, according to 2009 report by the Center for Retirement Research at Boston College.

Under the new law, however, it will no longer be possible to file a restricted application for just spousal benefits. Also, for those becoming 62 after this year, deeming is extended through age 70. Deeming is the requirement that if you take a spousal benefit or a divorcee spousal benefit you need to also take your retirement benefit and vice versa. This leaves you with roughly the larger of the two benefits (not both).

In passing this law, congress may have presumed or assumed that the claiming strategies benefited mostly affluent Americans, but that’s not necessarily the case. Per Michael Kitces, the new rules will affect many dual-income couples who might have used the Social Security claiming strategies to maximize their household’s benefits.

Even with the rule changes, dual-income households should still do some Social Security benefit planning. In our experience, dual-income couples still need to figure out who is going to start early and who is going to start late. There are still some some start-stop-start strategies that are still relevant if you have dependent children or if you are a Surviving Spouse.

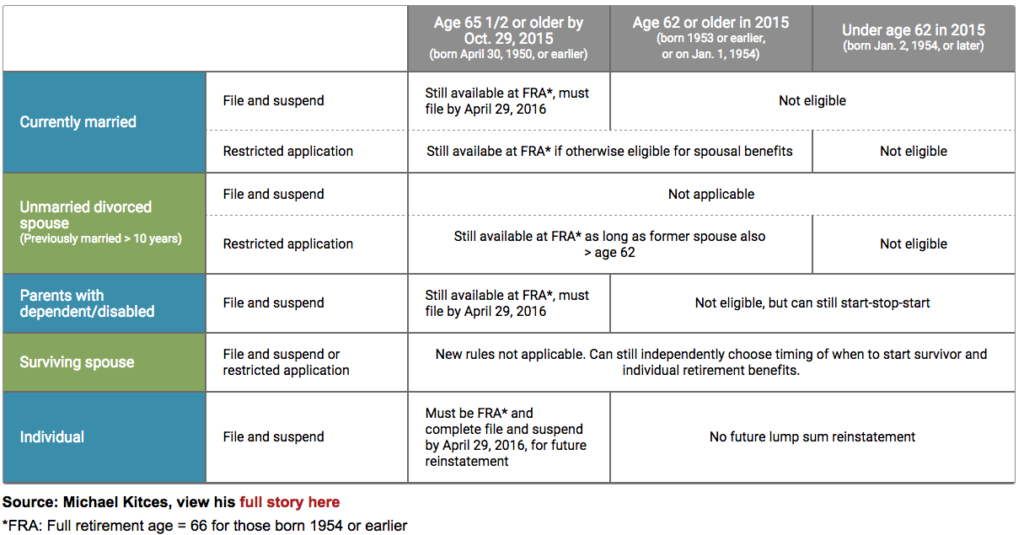

To help you understand these changes, I have included the table below that Michael Kitces recently put together that nicely summarizes how the law’s changes that will effect retirees that are in the process of making Social Security Benefit elections.

If you have any question as to how this will effect you, please call us or click on Ask a Question.

__________________________________________________________________________

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*