Published on: 07/22/2015 • 5 min read

Why it Pays to Delay Taking Social Security

The Flawed Belief that Drives People to Start Social Security Early.

When it was started by FDR in 1935, Social security was started as “Old Age Insurance“ to protect Americans against living too long and running out of money. However, sometimes many of us mistakenly regard it as just one more investment that they should try to “maximize” – especially given the fact that we have all put a LOT of money into the Frust Fund (both we and our employers).

However, the fear that Social Security is going “bankrupt” and that you need your money NOW to maximize this benefit may persuade you to take benefits sooner rather than later. However, doing may have a big impact on how much money you and your family receive (especially for those of you that are married). I outlined this issue in Should I file for Social Security Early.

Central to this problematic point of view is a breakeven analysis in which people may not look at all of the possible issues (and assumptions to consider) such as:

- What are the income tax issues, if any?

- How long will I live?

- How will it impact my spouse?

- What will I do with the money?

- Is this the right “bucket” to tap first – verus my other savings vehicles?

- Do I need the money more now or will I need it more later?

Bottom line – all of us need to list the “pros and cons” specific to our particular situation.

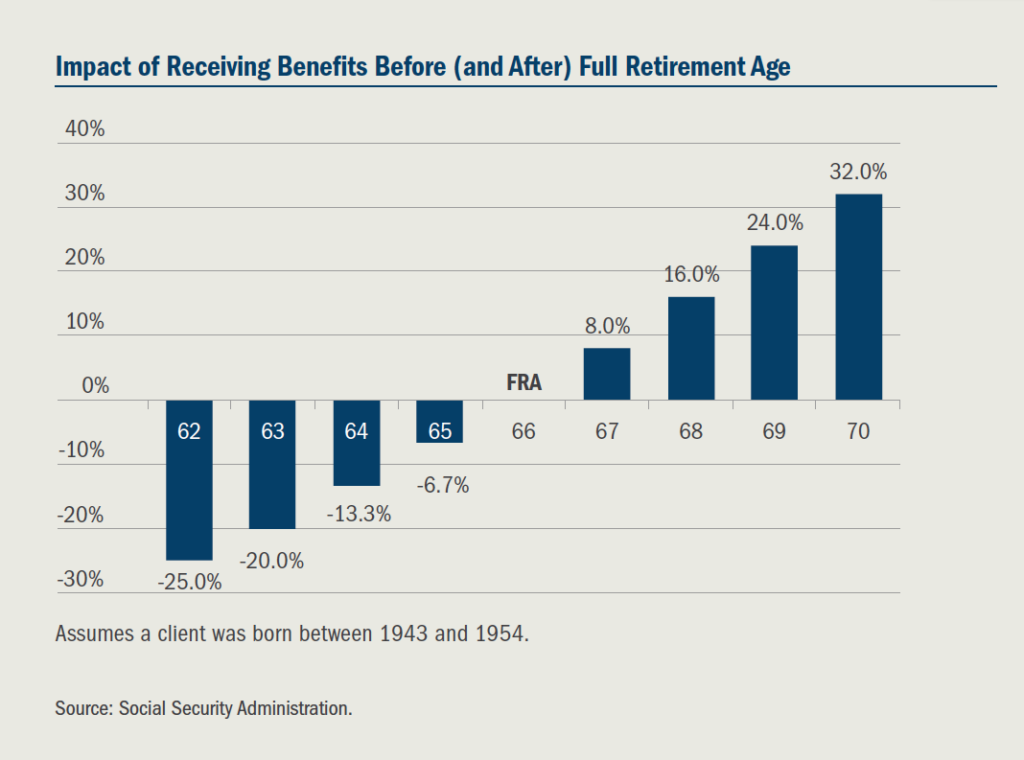

Between the ages of 62 and 70, your Social Security benefits rise about 7% or 8% for each year you defer taking them. By waiting until age 70, your monthly benefit will be approximately 76% higher, on an inflation-adjusted basis, than if you claimed at age 62 (see Chart 1):

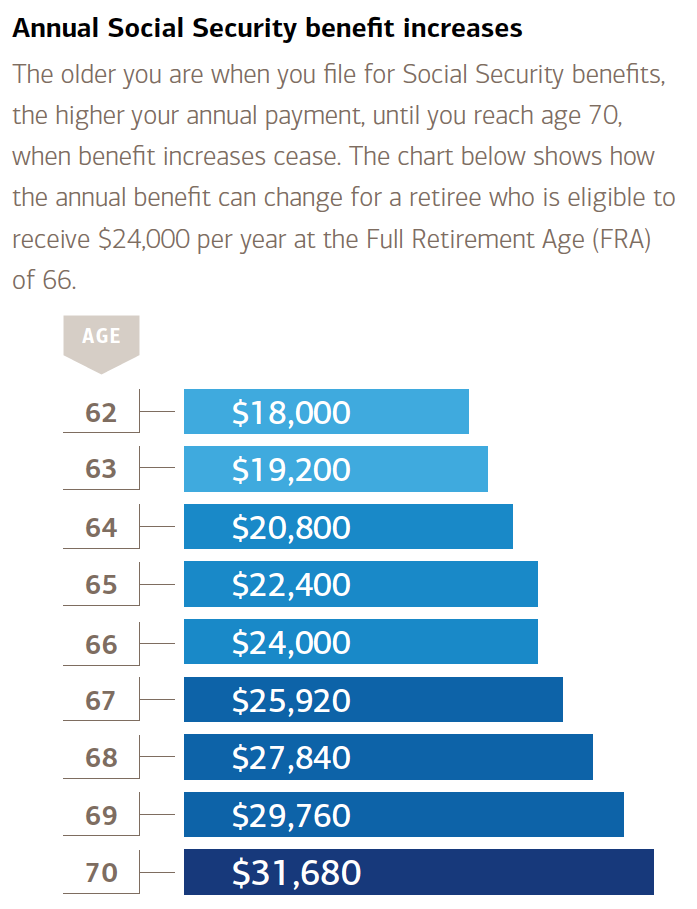

Here’s the breakeven puzzle: Let’s say you wait to take Social Security so you can get a higher monthly benefit. How old will you be before the total value of your higher benefits catches up with the amount you would have received had you started taking Social Security years earlier – and will you (or your spouse) live that long? As you can see in the chart below, it does pay to wait (See Chart 2):

When I run a typical analysis for clients, depending on the assumptions made, I find that the average breakeven age is usually somewhere about age 80. Unless you reach that age, you would have been better off starting earlier. Also, if you don’t spend those benefits but invest them instead (and earn a rate greater than the Social Security annual increase / COLA), the breakeven age can take even longer. In addition, if you are married, you may be eligible for and should also consider maximization strategies, as I have outlined in Social Security Claiming Strategies for Married Couples.

So based on guesses about your lifespan and what you’ll earn by investing your benefits, you might think it best to take benefits early – but are you thinking about the benefit correctly and making the right assumptions?

Once you start doing this break-even analysis, you’re looking at Social Security purely as an investment on which you want to earn the highest return. Although this is a good exercise, your should not stop there. Social Security is not solely a retirement “investment”. Rather, Social Security is an “insurance policy” that protects you from a major risk: living a very, very long time and running out of money. Think about other types of insurance. You buy home insurance, for example, to protect against the possibility of damage or total loss. If your home never burns down, is the money you spent on insurance premiums a loss? No. You pay for protection, not profits. That’s also true for Social Security.

The Ultimate Payoff – A Retirement “Hedge”

Social Security benefits are paid for as long as you live. The average 65-year-old will live about 20 more years; many people that age will live much longer (see the Chart 3):

Those benefits are immune to a stock market collapse. They rise to offset inflation. While most 401(k) and traditional IRA distributions are fully taxable, no more than 85% of Social Security payments are subject to federal tax, and most states don’t tax Social Security.

Finally, waiting to receive a larger benefit means that survivor benefits based on your earnings will be larger too. That helps your surviving spouse (if your spouse isn’t collecting a larger amount based on his or her own work record). This is terribly important for women, who on average outlive their husbands and are more likely to need survivor benefits. Breakeven analysis can turn out to be a bad break for them.

In the end, sit down with your tax and financial planning team to determine how best to utilize this important asset and benefit – Don’t “shoot from the hip”!

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor.

STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*