Published on: 05/29/2024 • 7 min read

Challenges and Opportunities of Investing in Private Markets

For high-net-worth individuals seeking to diversify their investment portfolios and potentially amplify returns, exploring private markets can be both an alluring and daunting prospect. If you’re considering adding investment vehicles from private markets to your portfolio, it is absolutely critical that you understand the nuances of private market investing so that you can make informed decisions.

In this article, we delve into the challenges and opportunities inherent in private market investments, examining what they are, how to access them, their advantages, as well as how they differ from public markets. Whether you’re a seasoned investor or just venturing into the realm of private markets, this guide aims to equip you with the knowledge needed to navigate these high-net-worth strategies.

Key Takeaways

- Private markets offer the potential for higher returns and diversification.

- Access to private markets can be challenging but is possible through various avenues.

- Understanding the differences between public and private markets is essential for effective investment strategies.

- While returns on private market investments may dip in the short term, patient investors often stand to see higher, long-term gains when they partner with the right investment firm.

What are private markets?

Private markets encompass investments not publicly traded on stock exchanges. They include a diverse range of assets such as:

- Private equity

- Venture capital

- Real estate

- Private debt

Unlike public markets, where securities are readily tradable, private market investments often involve longer holding periods and limited or no liquidity. However, they offer unique opportunities for investors to participate in a broader universe of growing companies, real estate projects, and alternative assets that are not accessible through publicly traded securities.

How to access private markets

Accessing private markets can be daunting due to barriers like high minimum investment requirements and limited availability. However, several avenues exist for investors to participate. Some private market examples include the following:

- Direct investments: Large institutions will often invest directly into a company or real estate project by directly sending funds to the target company either with an equity interest, as a lender or some combination. In turn, the institution will then gain a position on the capital table as an equity holder or creditor depending on the deal.

- Special purpose vehicles: Similar to a direct investment, an SPV can be used to aggregate smaller institutions and private individuals’ capital to invest directly into a company.

- Drawdown funds: Also known as vintage funds, this has traditionally been the most common method of investing in private markets for most investors. Unlike a mutual fund or ETF, a drawdown fund will have a fine life of 10+ years which typically starts with a capital raise period, followed by an investment period and finishes with a period of harvesting and distributing proceeds to investors.

- Evergreen funds: One of the most recent product developments in the private investing arena is the evergreen fund. Unlike a drawdown fund, an evergreen fund has a perpetual life. Evergreen funds were created to mitigate some of the challenges with drawdown funds for smaller investors like vintage year diversification, minimum investment size, and illiquidity.

While each avenue has its advantages and considerations, partnering with a reputable wealth management firm like Avidian Wealth Solutions can provide tailored solutions and access to exclusive opportunities in the private market space.

What is the difference between public and private markets in investing?

While both public and private markets offer avenues for wealth accumulation, they operate within different frameworks that impact factors such as liquidity, regulation, and investor access.

| Aspect | Public Markets | Private Markets |

| Liquidity | High | Low |

| Regulation | Stringent | Less Stringent |

| Transparency | High | Variable |

| Ownership | Fractional | Direct |

| Investor Base | Retail and Institutional | Accredited investors and institutions |

| Reporting Requirements | Strict | Flexible |

In public markets, securities are bought and sold on the stock market, providing investors with high liquidity and transparency. Publicly traded companies are subject to stringent regulatory requirements, with reporting standards enforced to promote transparency and accountability. This accessibility to information and liquidity makes public markets suitable for investors seeking to buy and sell assets quickly.

Conversely, private markets involve investments in assets not traded on public exchanges. This includes ventures like private equity, venture capital, and real estate syndications. Private market investments typically require longer holding periods and offer lower liquidity compared to their public counterparts. Regulatory oversight in the private market space is generally less stringent, allowing for greater flexibility in investment strategies and structures.

What are the advantages of investing in the private sector?

Investing in the private sector offers several advantages, including:

- Higher potential returns: Private market investments have historically outperformed public investment strategies in terms of overall returns, due to their focus on early-stage companies and niche opportunities.

- Diversification: Private market investments can facilitate executing essential portfolio strategies like diversification and balance by providing exposure to assets with low correlation to traditional stocks and bonds.

- Control and influence: Direct ownership of private assets allows investors to have a more active role in decision-making and potentially influence the success of the investment.

Disadvantages of private market investment

Despite the potential rewards, investing in private markets can come with its share of drawbacks:

- Illiquidity: Unlike publicly traded securities, private market investments often lack liquidity, making it challenging to exit positions quickly.

- Unique risks: Private market investments often bring along unique risks due to factors such as limited transparency, longer investment horizons, greater concentrations and greater execution risk for individual companies..

- Fees and expenses: Participating in private market investments may involve higher fees and expenses compared to traditional investments, reducing overall returns.

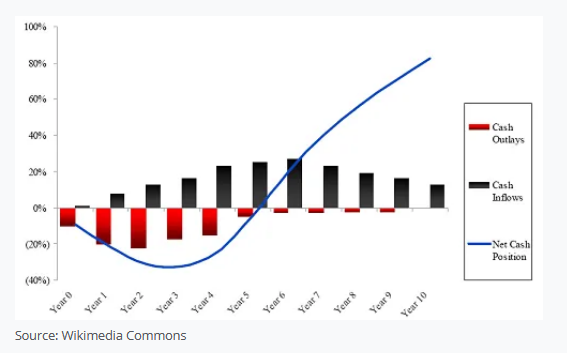

Understanding the J-curve in private equity investing

The J-curve trend in private equity investment refers to the pattern of returns experienced by investors over time. Initially, after making investments in private equity funds, investors often see a period of negative or low returns, followed by a gradual improvement and eventual positive returns. This pattern resembles the shape of the letter “J” when plotted on a graph, hence the term “J-curve.”

A few important notes regarding this phenomenon:

- During the initial investment phase, investors may not see immediate returns on their capital.

- Private equity investments often involve longer holding periods compared to public market investments.

- Private equity firms typically engage in value-creation activities such as operational improvements. These initiatives may take time to positively impact the value of the investments.

- Exiting investments at the right time, often after implementing the above-mentioned strategies, is crucial for generating favorable returns.

- Private equity funds typically charge management fees and expenses, which are incurred regardless of the fund’s performance.

Overall, the J-curve private equity trend reflects a potential, but temporary dip in returns before realizing the full benefits of their investments over the long term. Despite the initial challenges, patient investors who understand and account for the J-curve effect may ultimately reap the rewards of investing in private equity.

Use Avidian Wealth Solutions for your private market investing strategy

Successfully navigating the complexities of private market investing requires trusted insight and a customized approach tailored to individual goals and risk tolerance. As an experienced investment firm in Houston, Avidian Wealth Solutions provides comprehensive wealth management services, including access to private market opportunities for investors looking to deepen their investment portfolio.

Our team of seasoned professionals can help you develop a strategic investment plan aligned with your financial objectives and guide you through the process of accessing private markets. Schedule a conversation with us today to help yourself unlock the potential of private market investing and work towards achieving your long-term financial goals.

More Helpful Articles by Avidian:

- How Was Stock Market Performance in January 2024?

- 8 Benefits of Small Business Tax Accounts

- What is Comprehensive Wealth Management?

- Individual Bonds vs. Bond Funds: What is the Difference?

- The Difference Between a Legacy Trust vs. a Dynasty Trust

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*