Published on: 10/01/2020 • 6 min read

Is ESG Investing Another Bull-Market Craze or Here to Stay?

The environmental, social and governance (ESG) investing craze has become an ethical gold rush on Wall Street, as investors are attracted by the allure of earning higher returns while investing in “good” companies that occupy the moral high ground. Asset growth into ESG strategies has surged in 2020, as virtue signaling has gone mainstream. It’s woke. It’s trendy. It’s likely the hype surpasses the reality of what ESG will deliver to future investors.

Covid-19 pandemic helped accelerate the ESG trend

The ESG trend was already gaining traction ahead of Covid-19, but the pandemic appeared to generate even more interest in this new style of investing. While the number of ESG strategies and assets have grown significantly over the past couple of years, the surge in weekly inflows this year appears tied to the perception that there is no trade-off for investors who want to do well by doing good. According to recent report by Morningstar, 72% of sustainable funds (broader category than ESG) ranked in the top half of their Morningstar category on a year-to-date basis through the second quarter.

Difficulty in quantifying qualitative metrics

Unlike measuring revenues or returns, ESG metrics are mostly qualitative measures. It is inherently difficult to find a consensus on what metrics to include and how to assign a proper weighting to obtain an ESG score. Also, the SEC does not require companies to disclose specific ESG data, so there is a lack of consistency in ESG disclosures by companies. Given the lack of a clear and consistent process, companies can receive varying ESG scores from the different rating services. However, progress is being made as the Sustainability Accounting Standards Board is developing standards on industry-specific disclosure topics that can benefit both companies and investors.

Categories of ESG strategies and the need for due diligence

Investors have several options to consider when evaluating which ESG strategy they prefer. For example, an “impact investing” fund might invest exclusively in clean energy, while an “ESG exclusionary” fund will exclude specific companies and industries such as tobacco, guns, and gambling. The most popular strategy, particularly in the largest ETFs, is a broad-based “ESG inclusionary” fund that will essentially track the S&P 500 but adjust their component weightings based on a company’s ESG score. Without specific criteria or measurements for ESG scoring, a meaningful amount of discretion exists in determining which stocks are truly appropriate for ESG funds, particularly regarding social metrics. This leaves the door open for what is known as “greenwashing”, which involves making the fund appear more serious about ESG than it actually is. Therefore, it is crucial that investors do the necessary due diligence to understand and validate a fund’s ESG processes and disclosures.

The jury is still out on the performance of ESG strategies

The hype surrounding ESG was amplified this year with several claims that ESG funds outperformed the market through the Covid-19 crisis. Morningstar also reported that ESG funds in all 26 categories that they track outperformed their conventional index fund counterparts during the first 6 months of this year. Many investors began to think that they could have their cake and eat it too, which resulted in significant inflows into ESG Funds.

However, a more thorough review reflects that the recent outperformance is largely attributed to the high degree of correlation with the large cap, growth, momentum, and high-quality factors. Although not without criticism among the skeptics, the top holdings in most of the best performing ESG funds in the U.S. include Microsoft, Apple, and Alphabet. Each of these companies are in the top five holdings of the S&P 500 and have handily outperformed the index. Since the best performing U.S. ESG inclusionary funds tend to have a very high degree of correlation to the S&P 500, it is important for investors to assess the impact on overall portfolio diversification before investing in an ESG Fund.

The ESG trend is adding to an already crowded trade

I remember when Socially Responsible Investing (SRI) was becoming very popular in the mid and late 90s. Like today, the performance of those funds was primarily driven by a handful of large technology stocks. From my experience, the popularity of SRI faded quickly with the tech bubble bursting in 2000.

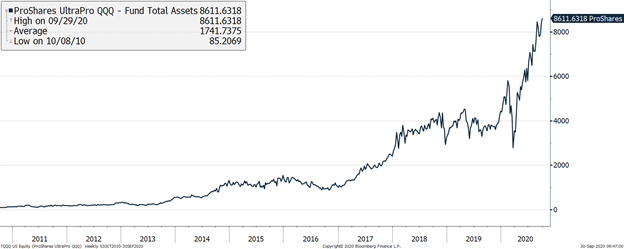

It is worth noting that the largest stocks in the Nasdaq index today are also among the top holdings across most of the best performing ESG funds and have become a very crowded trade as many investors continue to chase performance. For perspective, the chart below shows assets of the 3 X Levered, ProShares UltraPro QQQ (Nasdaq) ETF.

As global fiscal policy stimulus takes the lead from monetary stimulus, the aforementioned factors currently boosting the performance of most ESG funds will likely lead to a rotation toward different factors which could result in the underperformance of most ESG funds.

The future of ESG will take time to evolve

There are important societal benefits developing as companies continue to place considerable focus on ESG issues. Both investors and fiduciaries should integrate ESG related information into their fundamental investment process to improve their decision-making process. Efforts to refine the ESG scoring process and develop consistent disclosure requirements are improving and will continue to evolve over time.

In my view, the hype surrounding the above average performance expectations for ESG strategies is overstated. Those who are chasing performance in this space are likely to be disappointed. Investors must also recognize that these initiatives typically involve a cost, which detracts from a company’s bottom line. While there are many positive outcomes from the further development of ESG initiatives, it remains to be seen if investors will remain committed to ESG funds throughout a market cycle.

Given the myriad of different issues and potential pitfalls, most investors should consider talking to an investment professional when considering an ESG fund. The investment professionals at Avidian Wealth Management can help you navigate through the different alternatives, while also mitigating risk.

Disclaimer

The information herein has been obtained from sources believed to be reliable, but we do not guarantee its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security or product. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, made reference to directly or indirectly in this presentation will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of this article should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees is available for review upon request. ALL INFORMATION PROVIDED HEREIN IS FOR EDUCATIONAL PURPOSES ONLY – USE ONLY AT YOUR OWN RISK AND PERIL.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*