Published on: 12/21/2023 • 8 min read

Take the Opportunity to Tax-Loss Harvest Before Year-End

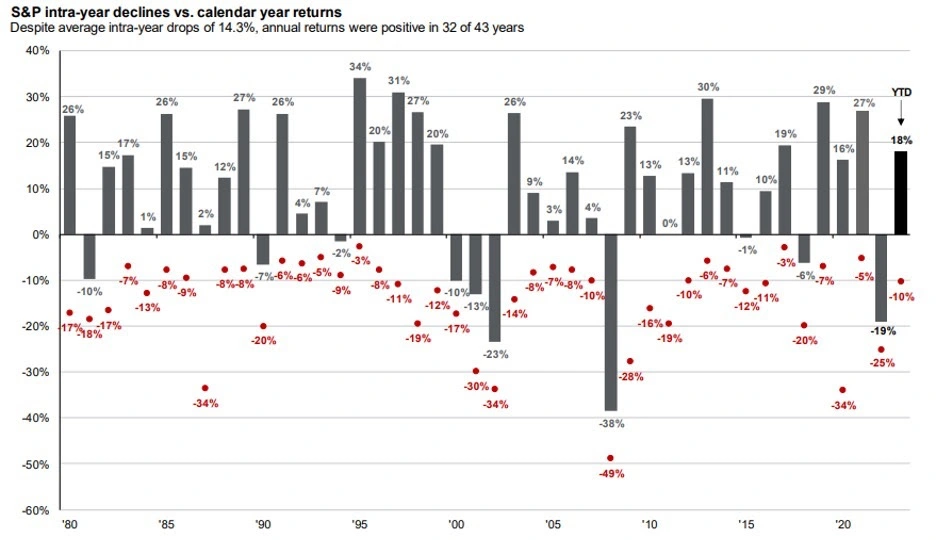

This year has been relatively strong for the broad equity markets. In fact, year-to-date through November 17th, the S&P 500 is up 18%. In fixed income, results have been more muted, but still positive with the Bloomberg US Aggregate Bond Index up by 0.54%.

However, even in a year like this one, where broad indices remain positive, there are still opportunities to tax-loss harvest and defer tax liabilities. After all, through November 17th, sector-level performance is more mixed, with utilities declining 9.5%, healthcare down 4.4%, and real estate off 3.4% for the year. These are areas of potential loss-harvesting even as investors seemingly ignore economic uncertainty and geopolitical risk.

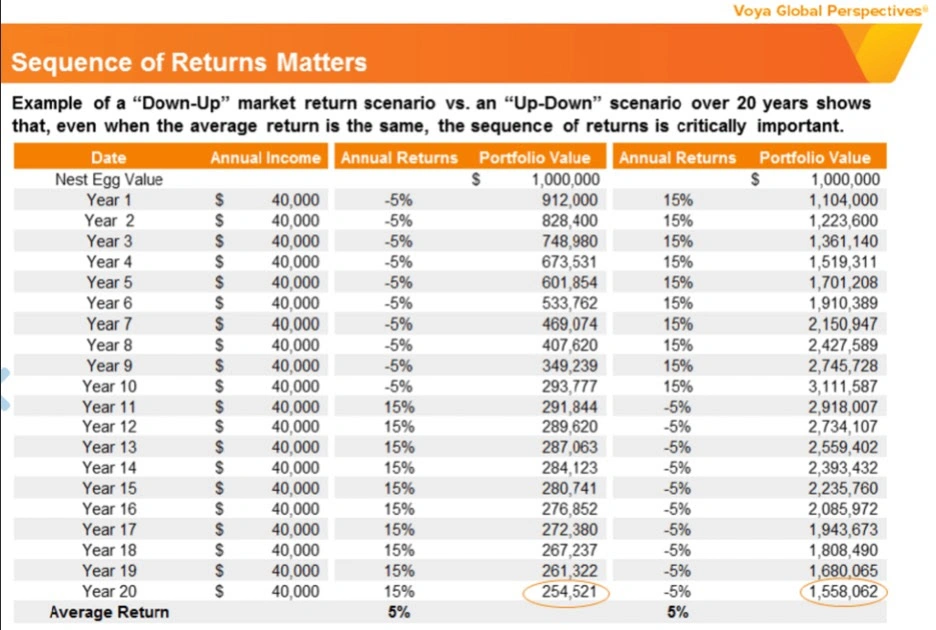

That said, before doing so investors should consider how specific entry points could yield different tax implications. This is what is often referred to as a sequence of return risk. As the table below shows, this sequence of return risk is, in fact, very real and can have a material impact on an investor’s bottom line.

What is tax loss harvesting?

Year-end tax harvesting is the practice of realizing a capital loss to offset a capital gain or income, thereby reducing the current year’s tax obligation. In other words, a tax loss harvest creates a valuable tax deferral.

A capital gain or loss is the difference between the cost basis and the sale price. Usually, the cost basis is what you paid for the investment. Any gain or loss is not realized until the investment is sold.

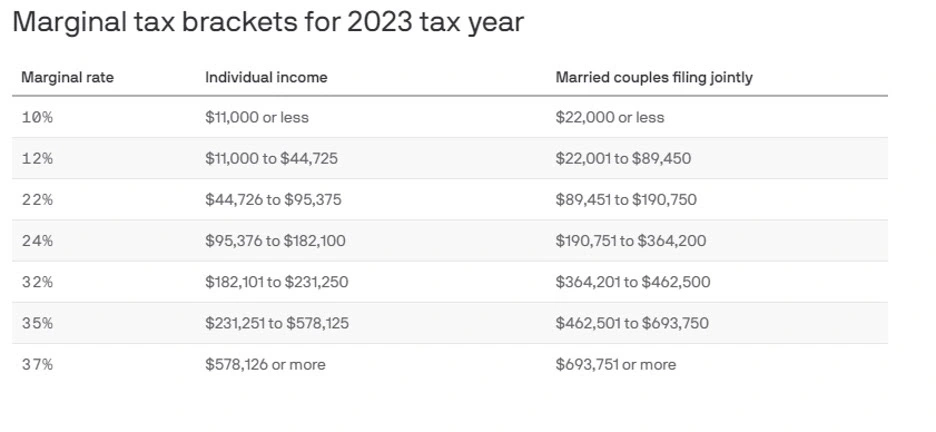

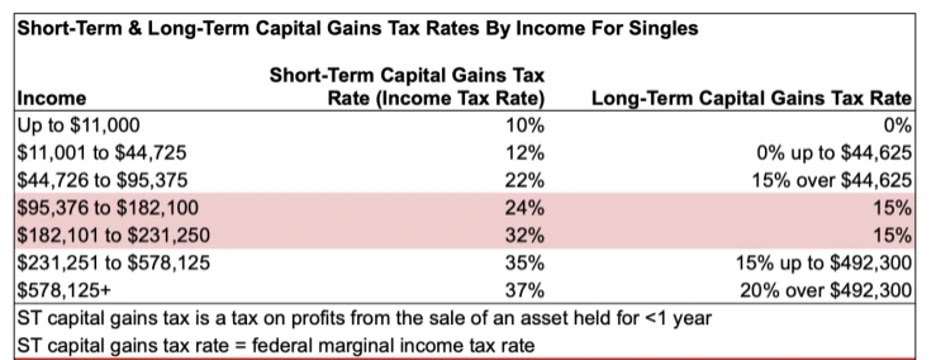

There are two types of gains and losses: short-term and long-term. Short-term capital gains and losses are those realized from the sale of an asset held for one year or less. Long-term capital gains and losses are realized from the sale of an asset held longer than one year. Short-term capital gains are taxed at marginal tax rates on ordinary income. The top marginal federal tax rate on ordinary income in 2023 is 37%, just like it has been for the last several years.

Long-term capital gains tax rates, on the other hand, are 0%, 15%, or 20%, depending on your taxable income and filing status. Regardless of your tax bracket, tax rates for long-term gains are generally much lower than those for short-term capital gains.

How does tax loss harvesting work?

As a part of prudent investment management services, tax loss harvesting can effectively reduce the tax drag on a portfolio’s performance and provide a way to improve after-tax returns. However, to accomplish this, the strategy must be implemented correctly and adhere to all tax loss harvesting rules.

So, how do you effectively harvest tax losses? Let’s take a look at an example.

Tax loss harvesting example

Let’s assume Mike has a $1,000,000 portfolio held in a taxable account. By the end of 2023, Mike has recognized $100,000 worth of long-term capital gains. Without making any further transactions, Mike has a capital gains tax liability of $15,000, assuming his long-term capital gains tax rate is 15 percent.

The good news for Mike is that tax loss harvesting can reduce this liability. For example, Mike might sell some stocks and bonds that experienced $50,000 in losses. If he sells those securities, the net gain can be reduced from $100,000 to $50,000. In this scenario, harvesting tax losses would save Mike $7,500 in taxes.

According to the tax code, short- and long-term losses must be used first to offset gains of the same type. But if losses of one kind exceed gains of the same type, then excess losses can offset the other type. Therefore, the most effective tax loss harvesting strategy is to apply long-term capital losses to short-term capital gains. In the previous example, if Mike’s $100,000 gains are short-term and taxed at 37%, harvesting the same $50,000 in losses would save $18,500 of the current year’s tax liability.

As you can see from this example, tax loss harvesting as a high-net-worth tax strategy needs to be carefully implemented. When selecting securities that have lost value for sale, investors need to be mindful not to deviate from their target asset allocation and diversification strategy. Most investors may choose to repurchase the same investment to maintain the proper asset mix. However, they must be careful of wash sale rules, which prohibit repurchasing a “substantially identical” security within 30 days before or after the selling date.

How does tax loss harvesting work at Avidian Wealth Solutions?

How does tax loss harvesting work? At Avidian Wealth Solutions, we select secondary securities that are purchased when primary securities are sold to harvest losses. This allows us to avoid triggering wash sales, thus preserving the benefits of the tax losses harvested.

It is important to note that the tax savings from tax loss harvesting in a given tax year can overstate the true gains. Selling an investment at a loss and subsequently using the proceeds to purchase the same or similar security effectively resets the cost basis at a lower value and increases the embedded tax liability. If the security is repurchased and then sold in the future, investors need to pay the taxes that are being saved today through tax loss harvesting.

Put another way, the economic value of tax loss harvesting is essentially a tax deferral rather than an elimination of tax liability, but it delivers many benefits to the investor.

Potential benefits of tax loss harvesting

1. Time value of money

First, the time value of money tells us that one dollar today is worth more than one dollar tomorrow. For example, if a $10,000 tax payment can be postponed for 5 years, an investor can set $7,835 on the side, invest in a five-year risk-free treasury bond that returns 5% per year, and receive $10,000 in five years. So, he effectively pays $7,835 rather than a $10,000 tax in current dollars.

2. Cash outflow

Second, the tax payment is an actual cash outflow from an investment portfolio. By realizing a loss, an investor can save taxes in the current year, which increases the amount of capital available for investment. To some extent, this is analogous to a dividend reinvestment plan (DRIP). In a DRIP, the investor does not take quarterly dividend distributions as cash; instead, dividends are directly reinvested in the underlying stock. The power of dividend reinvestment is manifested when it is compounded over long time horizons. Similarly, the longer an investor can defer the realization of capital gains and the higher tax rate on capital gains, the more the investor will benefit from tax loss harvesting.

3. Step-up in basis

Third, financial assets like stocks and bonds can receive a step-up in basis when an asset is passed on to a beneficiary upon inheritance. The step-up in basis readjusts the value of an appreciated asset for tax purposes and therefore potentially eliminates the embedded capital gain liability altogether.

4. Tax-efficient way to support philanthropic causes

Fourth, donating highly appreciated securities can be a very tax-efficient way to support a philanthropic purpose. A donor not only can deduct the full fair market value of appreciated long-term assets held for more than a year but he or she avoids paying capital gains taxes on those securities.

5. Potential to offset future income

Lastly, if capital losses exceed capital gains in a given year, an investor can use up to $3,000 of losses annually to offset ordinary income in future years.

What time of year should I do tax-loss harvesting?

Tax-loss harvesting can be performed at any time during the year, but many investors find the end of the year to be a particularly advantageous time. This is because it aligns with the annual tax planning process when investors have a clearer picture of their capital gains and losses for the year.

Implementing tax-loss harvesting at this time allows investors to offset realized capital gains and potentially reduce their tax liability for that year. Furthermore, any excess losses can be carried forward to offset gains in future tax years. However, it’s important to keep in mind that tax situations can vary greatly among individuals, so it’s advisable to consult with a tax professional before implementing this strategy.

Wondering if tax-loss harvesting could complement your financial plan? Let’s talk.

A tax-loss harvest plan is an active investment management strategy that improves after-tax returns by deferring capital gains taxes into the future and increasing after-tax capital for investment today. Fundamentally, it reflects the most fundamental principle of finance — the time value of money. When you save tax money today (loss harvesting) and pay it later, you maximize the net utility of each investable dollar in your portfolio.

However, that doesn’t mean that the decision to realize losses before year-end is easy. That is where an Avidian wealth advisor can help. At Avidian, our advisors can help you assess whether a year-end tax loss strategy is right for you and help you implement it in a way that is aligned with your financial goals, retirement tax strategies, and objectives. If this is something that you need help with, schedule a conversation with one of our financial advisors in Houston, Austin, Sugar Land, or The Woodlands.

More Helpful Articles by Avidian Wealth Solutions:

- 4 Tips For Guarding Your Nest Egg From Inflation

- What Does a Private Wealth Manager Do in Austin?

- What Are RMDs?

- Your End-of-Year Tax Planning Checklist

- What is the Repatriation Tax in the US?

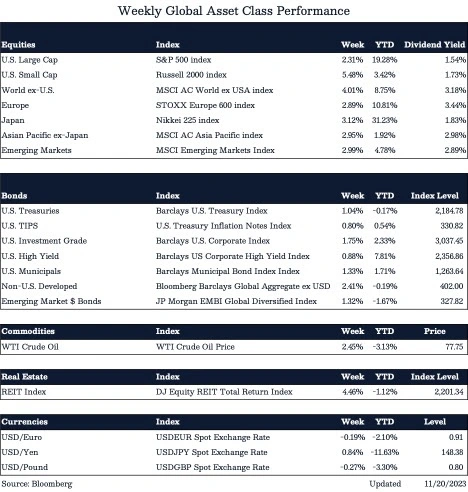

Weekly global asset class performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*