Published on: 06/26/2024 • 5 min read

What Is Credit Risk for Investors?

What is credit risk? Understanding how credit risk factors into investment strategies is fundamental for anyone involved in the investment world. Credit risk refers to the potential loss an investor faces when a borrower fails to meet their obligations in accordance with agreed terms. This risk can arise from a variety of scenarios, such as business bankruptcy, defaulting on loan repayments, or downgrades in credit ratings, and can impact a lender’s willingness to lend money — plus much more.

For investors, it’s crucial to assess and manage credit risk so that their investments yield the expected returns without unforeseen losses. This article will delve into the intricacies of credit risk, its impact on investments, and investment risk management strategies to mitigate it, so that investors of all portfolio sizes can better manage their investments with an eye toward the future.

What are the main types of credit risk?

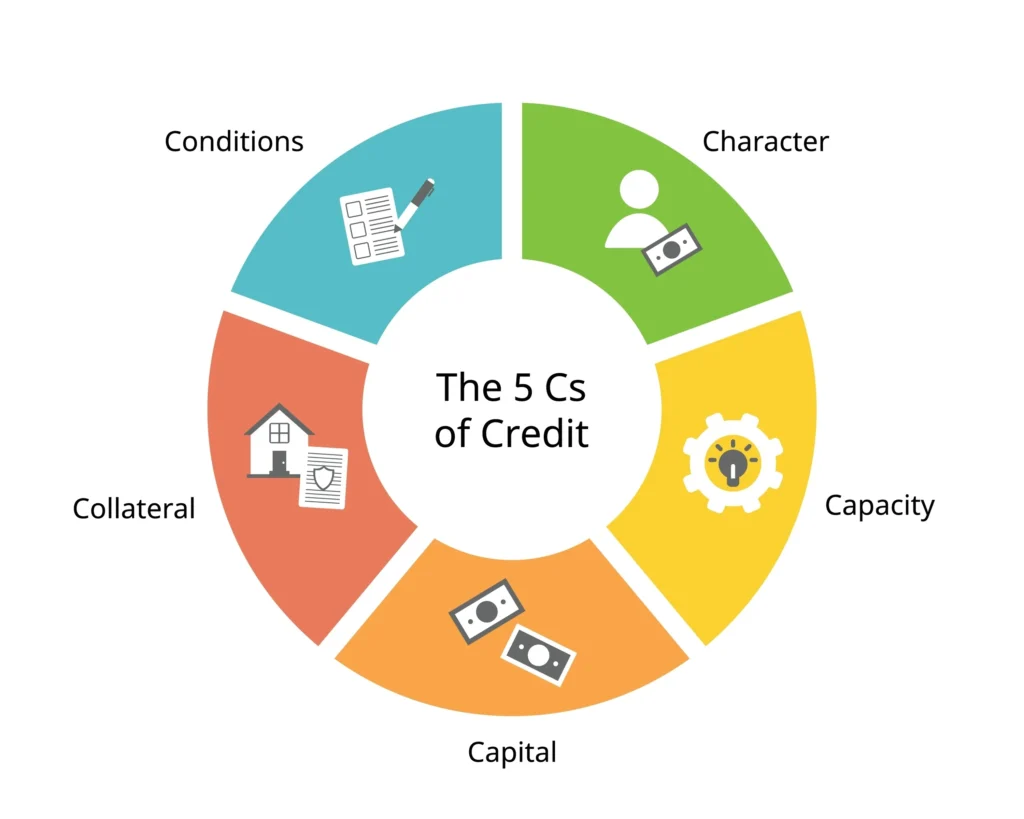

To expand on what was briefly explained above, the meaning of credit risk is much more complex than it appears. In simple terms, credit risk refers to the likelihood of a borrower not being able to fulfill their financial obligations towards lenders or investors. There are various types of credit risk that investors should be aware of and these are often referred to as the “5 C’s.”

What are the 5 C’s of credit risk?

Sometimes referred to simply as “the 5 C’s of credit,” the five types of credit risk, which are what creditors use to evaluate a borrower’s risk, are as follows.

- Character: This refers to the borrower’s reputation or track record for repaying debts. Lenders look at credit history and past interactions with creditors to gauge reliability and trustworthiness. An individual or business with a strong credit history is typically seen as a lower credit risk.

- Capacity: This evaluates the corporation’s ability to repay the loan. It involves analyzing revenue streams, financial statements, and existing liabilities to determine whether the corporation can comfortably meet its debt obligations. Financial ratios, such as the debt-to-income ratio, are often used to measure capacity.

- Capital: Capital refers to the borrower’s own investment in a project or the amount of money they have personally invested. A higher personal investment usually indicates lower credit risk, as it shows commitment and reduces default likelihood.

- Collateral: Collateral is an asset or assets pledged by the borrower to secure a loan. In the event of default, the lender has the right to seize the collateral to recover losses. Loans backed by collateral generally have lower interest rates due to reduced risk.

- Conditions: This pertains to the broader economic and industry conditions that might affect the borrower’s ability to repay the loan. Lenders consider factors such as interest rates, economic growth, and market trends in the specific industry.

By using investment portfolio strategies that help to evaluate these factors, investors can help mitigate potential losses and strive for more secure, profitable investments.

Why is credit risk important to consider?

When credit risk is properly assessed and managed, it helps prevent significant financial losses that arise from defaults.

For lenders, understanding credit risk ensures that loans are extended to borrowers who are most likely to repay, which in return, maintains liquidity and financial health.

For investors, evaluating credit risk enables them to make informed decisions, balancing potential returns with the associated risks. Essentially, the consideration of credit risk is fundamental to helping safeguard the interests of all financial stakeholders and maintain a stable economic environment.

Strategies for credit risk management

There are countless strategies for effectively managing credit risk. Here are some of the most effective and popular:

- Diversification: Spread investments across various borrowers, industries, and geographical regions to help minimize the impact of any single default.

- Credit Scoring Models: Utilize sophisticated credit scoring models to assess and predict the creditworthiness of potential borrowers.

- Regular Monitoring: Continuously monitor existing loans and borrowers’ financial health to identify early signs of credit deterioration.

- Private Investors: Engage with local Texas or Houston private investors who can assist in the management of credit risk by offering strategies for evaluating creditworthiness, diversifying investment portfolios with alternative investment strategies, and implementing robust risk assessment models to mitigate potential losses.

- Collateral Policies: Implement strict collateral requirements to protect against losses in the event of a default.

- Economic Conditions Analysis: Regularly analyze macroeconomic indicators and industry-specific trends to adjust lending strategies accordingly.

- Credit Insurance: Purchase credit insurance to cover potential losses from borrower defaults, providing an additional layer of security.

Work to mitigate the risk of investing with Avidian Wealth Solutions

Knowing the answer to the question “what is credit risk?” is only half of the battle. Credit risk is an inherent aspect of financial activities, and mitigating risk for investors means both understanding the fundamentals of credit risk and having effective credit risk management practices in place.

When you choose Avidian Wealth Solutions as your financial partner, you can put your mind at ease knowing that risk management is ingrained into what we do. Our team works tirelessly to put in plans in place that aim to mitigate the risk of investing and protect our clients’ financial assets. We understand that your financial well-being is crucial, and we help you choose effective measures to try to safeguard it.

Whether you are an individual investor or a corporate entity, our investment management services in Houston, Austin, Sugar Land, and The Woodlands are designed to offer you a diversified portfolio that aligns with your risk tolerance and investment goals.

Schedule a conversation with us today to learn more.

More Helpful Articles by Avidian:

- How are Health and Savings Related?

- The Importance of Succession Planning

- Key Considerations When Creating a Buy-Sell Agreement

- 8 Ways to Maximize Retirement Savings

- The Importance of Corporate Wealth Management

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*