Published on: 11/01/2019 • 5 min read

1031 Exchanges

1031 Exchanges

What real estate investors should know before deciding to sell their real property

This article will focus on the typical 1031 exchanges for most real estate exchange transactions when sellers wish to sell their business or investment property and reinvest their proceeds into another property. Keep in mind there are other types of exchanges, such as Involuntary Exchanges under Internal Revenue Code Section 1033 that involve government seizure, condemnation, and disasters. It’s best to seek advice from your tax advisor to understand which type applies to your unique situation.

You might be wondering, what about my personal residence? The answer is, personal residences do not fall under this code section. There is a separate gain exclusion tax benefit offered to taxpayers who sell their primary residence under internal revenue code section 121. Under the 1031 exchange code section, the property must be held for investment or used in a trade or business.

In reality, it’s practically impossible to find an exact “like-kind” property to exchange with another party. The good news is the federal tax code provides a much simpler process for deferring the tax. The 1031 code section of the internal revenue code lays out a framework to follow in order to properly execute a like-kind exchange that will qualify for tax deferral on recognition of the gain on the property being sold.

First, let’s focus on the timeline.

The time requirements in a 1031 exchange are very specific. From the closing date of the sale of the relinquished property, a taxpayer must remain aware of 2 specific time requirements:

- Identification Period: Properly identify potential replacement property within 45 calendar days

And

- Exchange Period: Close on the replacement property within 180 calendar days of the relinquished property sale – OR – by the due date (including extensions) for the taxpayer’s tax return for the taxable year in which the relinquished property was transferred, whichever is earlier.

Using a Qualified Intermediary.

A Qualified Intermediary (QI), also referred to as an Accommodator or Facilitator, is an entity that facilitates Internal Revenue Code Section 1031 tax-deferred exchanges. The role of a QI is defined in Treas. Reg. §1.1031(k)-1(g)(4).

1031 exchange transactions are not transactions that can be accomplished on your own. Using a Qualified Intermediary is essential for real property 1031 exchange transactions. The role of the QI is to ensure the 1031 exchange rules are followed according to the code section, and they facilitate the transfer of funds between parties. If the seller doing the exchange takes possession of the funds it could disqualify the whole 1031 exchange transaction. Having a QI protects the seller from this situation.

Greg Lehrmann, a board-certified attorney specializing in commercial real estate transactions, was featured on the STA Money Hour Radio Show on 950 KPRC AM to discuss 1031 exchanges. You can check out the replay here where Scott Bishop MBA, CPA/PFS, CFP® and Mr. Lehrmann discuss what 1031 exchanges are and how they work. Greg is the Texas and Division Manager for Asset Preservation Inc. which is a subsidiary of Stewart Title. Asset Preservation Inc. specializes in 1031 exchanges and acts as the third-party Qualified Intermediary for such transactions.

Let’s look at an example.

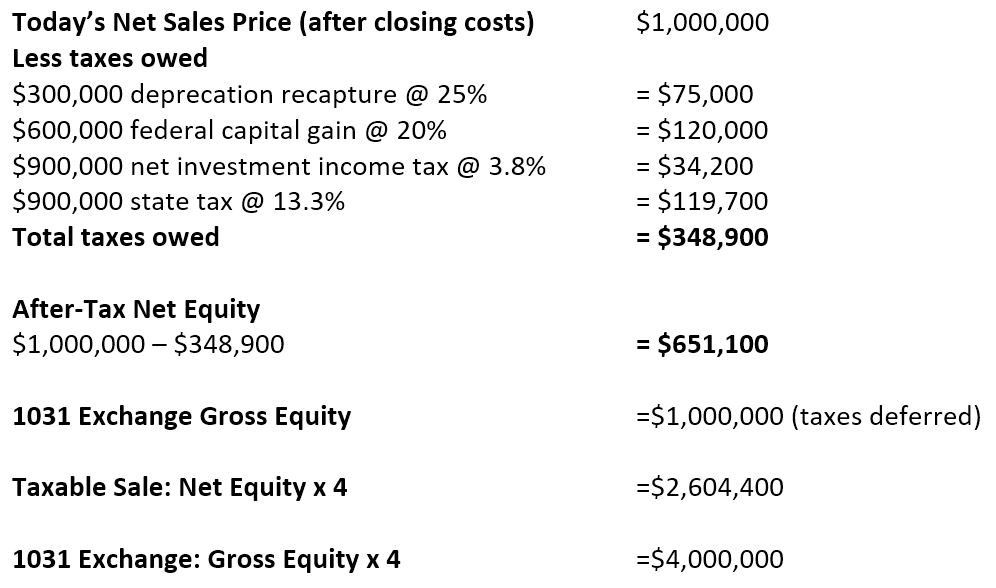

A married couple filing jointly sells investment property in California for $1,000,000 (net of closing costs) with no debt. The couple originally purchased the property for $400,000. Seventy-five percent, or $300,000 of the initial purchase price, was allocated to the building and has been fully depreciated. The capital gain is approximately $900,000 (today’s sales price of $1,000,000 minus the net adjusted basis of $100,000). This is the only source of the couple’s investment income. The couple’s modified adjusted gross income is $1,400,000 (which includes income from other sources and capital gain from this sale). This amount is used for calculating the net investment income tax. The couple will be taxed at 25% for their prior depreciation deductions taken, 20% federal capital gains tax rate, the 3.8% net investment income tax, and they will be in the 13.3% California state tax bracket.

The California taxpayers in this example could potentially purchase a replacement property that is worth approximately $1.4 million more by performing a 1031 exchange instead of a taxable sale. Exchanges if done properly may provide the opportunity to preserve equity, increase cash flow from larger replacement properties, and enable taxpayers to maximize return on investment.

What type of property is included in 1031 exchanges?

Like-kind property can include, but not limited to, single-family rentals, duplexes, apartments, industrial commercial property, land, including ranch land, or multi-family rental property. If you are not sure your situation falls into any of these categories, seek advice from your tax professional.

Let’s summarize.

Before you consider selling your real estate held for use in a trade or business or held for investment, consider whether you will be replacing it with another piece of real estate. If that is the case, you might want to take advantage of the 1031 exchange tax benefits that would defer the recognition of your gain and preserve your equity. Keep in mind the timeline and remember to engage a Qualified Intermediary who specializes in 1031 exchanges.

IMPORTANT DISCLOSURES:

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*