Published on: 01/08/2021 • 6 min read

Avidian Report – 2020 Market Recap. Some Thoughts on Markets and Inflation for 2021

INSIDE THIS EDITION:

2020 Market Recap. Some Thoughts on Markets and Inflation for 2021

Coronavirus / COVID-19 Resource Center

For this week, we will provide a brief recap of 2020 and then get into a high-level discussion of what we expect for 2021 across major asset classes including stocks and bonds, as well as our thoughts on important macroeconomic data points like inflation.

[toggle title=’Read More’]

As we all know 2020 was a year of surprises thanks in large measure to the global pandemic. In the first quarter, we saw a sharp double-digit selloff in response to economic lockdowns around the globe, massive travel restrictions that affected tourism and travel, as well as concerns over the ability of certain sectors to weather these challenges. At the same time, we saw strength from several sectors that facilitated remote work, enabled e-commerce, and allowed us as a global society to push through a very challenging time.

In markets, this post-COVID environment resulted in a K-shaped recovery scenario with a strong divergence in performance from what Main Street was experiencing in their day today. As we know, it is very rare that we see a divergence like what we saw in 2020 last for long periods of time, and this fact very much influenced how investors positioned portfolios during and after the emergence of the pandemic.

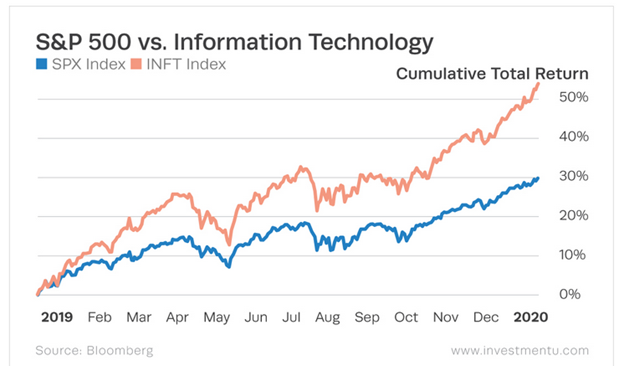

When it was all said and done, we saw strong performance across indices despite a very challenging backdrop. The S&P 500 for example, closed 2020 posting a gain of 18.4% assuming the reinvestment of dividends, with winners including software application companies, Internet retail, and Basic Materials. Among the worst-performing areas of the market were Oil and Gas, Diversified Banks, and Airlines.

Looking ahead to this year, our outlook largely hinges on health outcomes. Although the US and eurozone have in some cases paused their economic re-opening with partial lockdowns this winter, we believe that the market will largely look-through the virus situation.

We expect economic activity to continue to rebound, albeit slowly, on the back of supportive policy measures, generally improving business outlook and easy financial conditions.

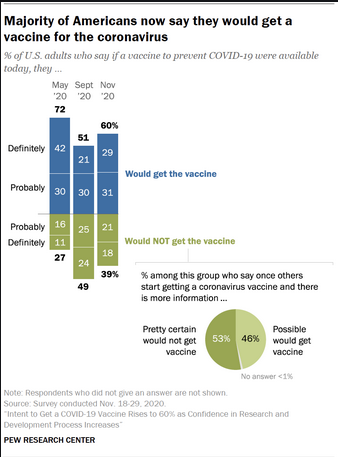

We expect the wide-scale rollout of a vaccine in the first half of 2021 to remain on track and once the vaccinations have been administered to growing portions of the population, the second half of 2021 could see a surge in economic growth as pent-up demand because of elevated savings rates in 2020 flows through the economy.

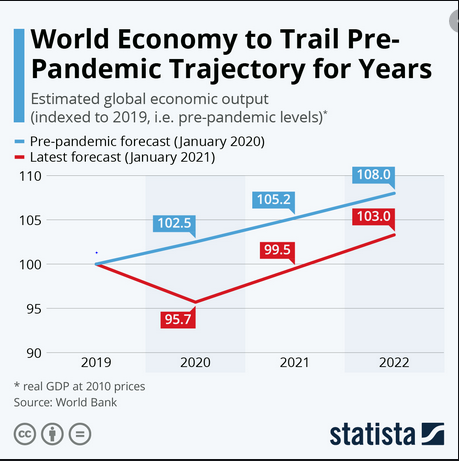

As a result, all major regions should see above-average growth in 2021 without triggering a rise in interest rates which should be capped by plenty of spare capacity, elevated unemployment rate, and the Fed’s new inflation framework. Although some believe there is a possibility that the world economy will trail its pre-pandemic trajectory for years, the consensus is that the US economy will return to pre-pandemic levels late in 2021.

As far as central banks go, we expect them to keep interest rates low as they support the post-pandemic economic recovery and assist in mitigating left tail risks by providing ample liquidity. An increase in the savings rate because of lockdowns and government stimulus may also drive consumer consumption and deliver robust profit growth while providing a further tailwind for equities. At the same time, a rise in earnings may bring valuations to more reasonable levels and bring record amounts of cash off the sidelines. Should this occur, we would expect additional tailwinds for a variety of financial assets.

As we look ahead to the remainder of the year, we think investors should keep an eye on central banks and inflation. These are likely to be valuable data points for portfolio positioning throughout the year. We expect central banks to remain supportive for an extended period as they have now adopted an average inflation targeting approach which may allow inflation to run above their 2% target, following several years of falling below target.

We also believe inflation should manage to remain below 2% this year given sizable output gaps around the globe. However, in the intermediate-term, we would not be surprised if we see inflation fall somewhere in the range of between 2.5% and 3.5%.

For investors, this simply means they must remain vigilant for surprises to the upside and downside and build portfolios that can perform under a wide range of scenarios. Lastly, risk management should be a key part of each investor’s approach to 2021. Should we get any surprises as we go into 2021, a disciplined approach to risk management might prove critical to remaining on track for achieving long term financial goals.

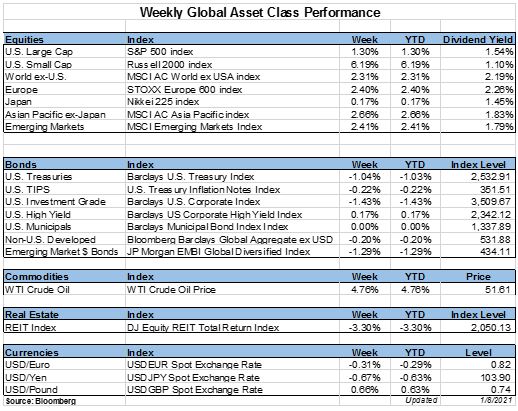

Weekly Global Asset Class Performance

[/toggle]

The team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*