Published on: 08/14/2020 • 7 min read

Avidian Report – 5 Investment Themes to Watch as We Move Beyond COVID-19

INSIDE THIS EDITION:

5 Investment Themes to Watch as We Move Beyond COIVD-19

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

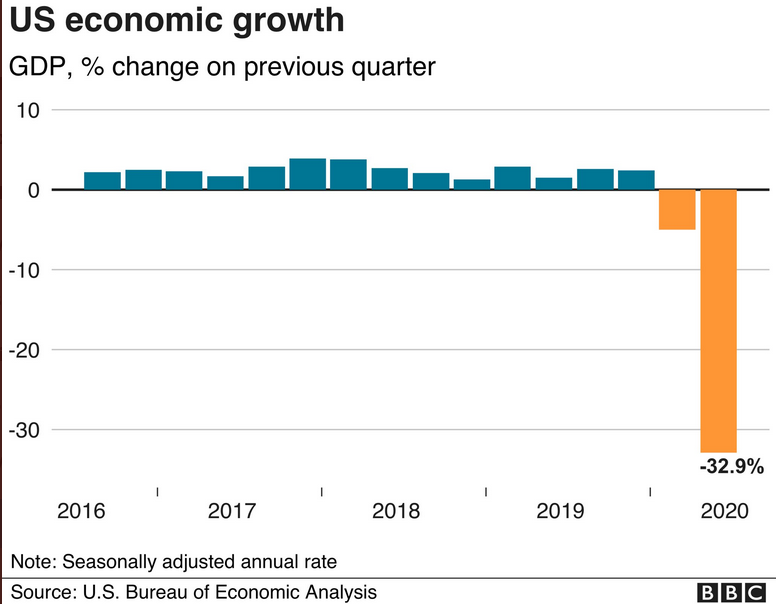

In the short-term we see GDP declining meaningfully due to the virus but eventually, we do believe things will return to a more normalized state.

[toggle title=’Read More’]

But normal does not mean the same. Things will most certainly be different post-COVID-19. More specifically, we believe technological adoption accelerates, monetary/fiscal policy evolves, lower yields on bonds make income hard to come by, and traditional asset allocation frameworks are called into question.

Technological adoption accelerates. COVID-19 has accelerated the trend toward full digitalization. This has occurred as businesses and people have been forced to adopt new ways to cope with mandatory work from home orders. This has led companies to gravitate toward cloud computing solutions and web conferencing tools. From a consumer point of view, we have seen a dramatic acceleration in business conducted online. As an example, Allstate insurance estimated that by the middle of April, 90% of all its auto claims were being submitted via its virtual tools. This is impressive because this represented a 50% increase from only 2 weeks prior. Similarly, Listrak conducted research on revenues from over 850 US eCommerce Domains and noted a 60% increase in year over year revenues in the weeks between April 15th and June 1st, and the year-over-year increases have not dissipated despite non-essential businesses reopening in June. While there are only a couple of examples, there are many others where it has become clear that the rate of technological adoption has increased since the start of the pandemic and is likely to have staying power long after COVID-19 is a distant memory.

Monetary/fiscal policy evolves. The great recession undoubtedly ushered in a new phase of monetary and fiscal policy actions taken by central banks. In today’s COVID environment, monetary and fiscal stimulus measures have been taken to unprecedented levels with a combination of rate cuts, paycheck protection programs, and other stimulus actions furthering the central bank’s intervention in free markets. This has caused the balance sheets of Central Banks around the world to balloon and has called into question whether the current monetary and fiscal policy regime is sustainable. One theory gaining traction in some circles is that of what is known as Modern Monetary Theory (MMT). This theory is an alternative to mainstream macroeconomic theory and argues that a government that issues its own fiat money can pay for goods, services, and financial assets without needing to collect taxes or issuing debt, that it cannot possibly default on debt denominated in its own currency, and has virtually no limits (except for inflation) to the amount of money it can create. Whether it is or not is beyond the point of the discussion here. However, one thing is for sure and that is that monetary and fiscal policy is likely to evolve in the years to come.

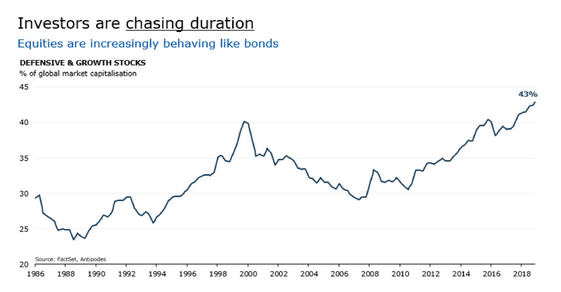

Equities should now be looked at like duration assets. We are now looking at equities like duration assets with multiple years of cash flows. This is necessitated by the difficulty investors are having finding yield from traditional fixed income. As you might imagine, this makes it difficult for retirees to generate sufficient income from their investments to cover their ongoing expenses. In response, we believe retirees must think differently about portfolio allocations. More specifically, they should view equities as sources of potential income to offset the shortfall left by fixed income. However, equities tend to exhibit more volatility but is also why pursuing this strategy requires having a long investment horizon. We fully expect the shift toward heavier equity exposures in retiree portfolios to continue, and potentially accelerate if we find ourselves in a more inflationary environment that may further reduce the appeal of traditional fixed income assets.

A more fragmented world has the potential to intensify geopolitical frictions and squeeze corporate profits. For the last couple of years, the world has seen a move toward more protectionism. This has caused geopolitical frictions to the surface and has caused more fragmentation in various parts of business and society than we have seen in the recent past. Technology appears to be at the center of this shift as governments around the world look to control information and data. Outside of technology, the world’s trade policies and tariff regimes are under review and negotiation. Take the US and China and the long-running trade impasse that has yet to garner a solution. This alone has pushed some firms to relocate manufacturing capacity as the world’s businesses and economies adjust. The implications, of course, are not limited to trade but also have the potential to squeeze corporate profits. Take, for example, a company based in the US but with manufacturing capacity in China who now must relocate their manufacturing operations back onshore, where labor and material costs are higher than China. This increased cost structure stands to crimp profit margins. We believe this fragmentation is only made worse by COVID-19 as travel restriction abound and concerns about supply chain disruptions amid a pandemic become reality. We think this theme has legs and could negatively influence not only profit margins but also the returns for risk assets.

The importance of global asset allocation grows. Of course, fragmentation like we discussed above also creates opportunities for those that have a global asset allocation framework as we do at Avidian Wealth Management. In fact, investors that have not allocated across geographies may be unable to realize a significant diversification benefit in the future. We believe this because fragmentation and more isolation between countries and economies are likely to produce more heterogeneous economic performance. As a result, we think adopting a globally diversified asset allocation framework will grow in importance if investors want to capture the benefits of the world’s economic output and corporate profits while lowering overall portfolio risk. With these key themes playing a role as we move into 2021 and beyond, we think a very strong case can be made for global asset allocation in portfolios as country selection will become more important than it has been in the recent past.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*