Published on: 08/06/2020 • 8 min read

Avidian Report – 5 Observations from the Market this week and What They Mean for Your Portfolio

INSIDE THIS EDITION:

W5 Observations from the Market this week and What They Mean for Your Portfolio

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

Financial markets always provide a fair share of interesting data points and occurrences that if viewed through an analytical lens can lead to important insights. This week, rather than providing a weekly market report as we have done in the past, we are going to focus on some of the market developments or interesting data that we have seen and what it means for portfolios.

[toggle title=’Read More’]

Market observation #1: Market leadership continues to be dominated by a few names.

During this year, markets have been led by only a handful of names. As an example, the top panel in the chart below show how the S&P 500 including Apple, Microsoft, Alphabet, and Facebook have outperformed the broad tech sector when excluding Apple & Microsoft and the broad sector when excluding the technology sector, Alphabet, Amazon, and Facebook. The bottom chart is even more interesting in that it shows the divergence in returns even within the technology sector. In other words, even in the technology sector, the returns have been driven by only a handful of names. As we have mentioned previously, growth’s dominance driven by a few mega caps very well may continue despite high valuation multiples. We think that this is due to a combination of competitive dominance, their low capital requirements, and in many instances belonging to a group of companies that should be thought of as new consumer staples.

For investors, this means that being drastically underweight the few underlying constituents driving market returns higher this year, has created a bit of a performance drag and supports using an investment process that looks at appropriate exposures and the underlying holdings to ensure that portfolios are built with a great deal of intention rather than by accident.

Observation #2: Fear and Greed Index has been increasing over the last couple of weeks.

We have observed a slow and gradual move toward more greed sentiment in the market. The fear and greed index indicates extreme fear at 0, or extreme greed at 100. The closer to 100, the more greed there is in the market. Today, the index is approaching 70. This slow but gradual march toward more greed in markets is something to be watched because as greed rises, so too does risk. However, in our opinion, even extreme levels of greed may not matter this time around as the Fed has shown their willingness to intervene in markets should a drawdown occur or should the economy’s recovery falter. For portfolios, this means that investors must be balanced in their approach to portfolio construction while avoiding being underexposed to risk assets.

Observation #3: Despite the greed in markets, there is a fair amount of distress out there

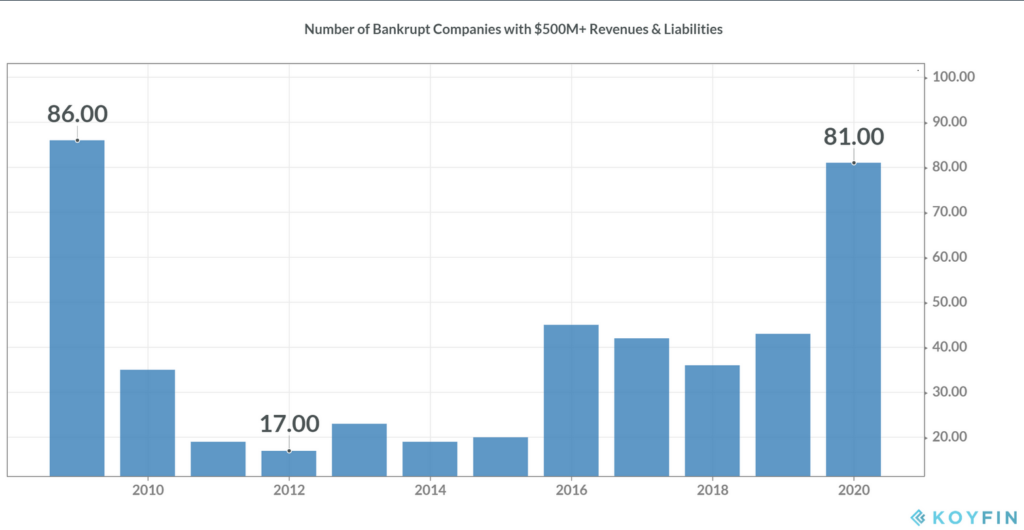

It is no secret that COVID-19 has resulted in quite a bit of distress across certain sectors including brick and mortar retail, energy and restaurants. However, it is becoming clear to us that this is not a normal level of distress. In fact, through August 4th, we had already seen 81 bankruptcy filings.

In 2009, the worst year for bankruptcy filings in recent history, saw only 86 filings total. In our view, the amount of distress already seen in some areas likely accelerates into year end. For investors, this means that extra care needs to be paid to fixed income at lower quality levels and individual equities. Further, investors looking to take advantage of beaten down sectors should take great care to not invest in something that is experiencing distress without understanding the potential risks. At Avidian Wealth Management we like using ETF’s in many cases because of the diversification benefit inherent with ETF’s. However, we do monitor underlying exposures on the equity side of the portfolio while also actively monitoring fixed income positions for any signs of deterioration in quality that might help us identify trouble spots early.

Observation #4: Homeownership is having a major resurgence.

At the height of the Great Financial Crisis homeownership fell substantially. However, starting in 2017 home ownership has trended higher while renting has become less popular. As the chart below shows, this year has been exceptional as it relates to home buying. While it is a bit counterintuitive to think that a COVID-19 economic recession would lead to this, we do believe it makes sense considering extremely low interest rates and more importantly, the renewed interest in suburban living following the pandemic and riots in many major US cities. Because COVID-19 may still be with us for some time, and interest rates are likely to remain near the 0 bound, we think this trend is likely to continue. For portfolios, more homeownership might help form part of a case for investments in related industries. While we are not advocating for a position currently, it is something investors should certainly watch as they look for opportunities in durable trends.

Observation 5: Parabolic stock returns appear to be in vogue.

As mentioned earlier, investors are showing signs of more greedy behavior. With it, we have seen parabolic returns in several stocks (Kodak, Wayfair Inc, Tesla) that have us wondering whether the moves are symptomatic of unprecedented stimulus, day trading retail investors hoping on a great fool to buy their stock from them later, or a side effect of more frictionless trading. This is evident in the performance of several individual stocks that we have watched in awe over the last several months.

Take Kodak (KODK), which announced repositioning some of its manufacturing capacity to producing chemicals with the help of a government loan, and subsequently saw its stock rocket higher by 2,190% (that’s not a typo) in a matter of days.

A story we read about this week made it all the more real. In short, a long/short fund manager took a short position in Kodak that amounted to 1% of their overall portfolio. It made sense in that it was a short of a dying business and for risk purposes was kept relatively small. Then suddenly out of left field the company announces that with a massive government loan, they were shifting their manufacturing capacity to produce pharmaceutical products in the middle of a pandemic. Retail investors then piled into the stock not knowing fully what they were buying, and the stock price rises from $2 to $60 per share in a span of 2 or 3 days. Suddenly, the fund manager who was short Kodak found himself with a paper loss of between 25-30% at the portfolio level. All of this because of a 1% position. In our view, government intervention in markets could cause these events to happen more regularly. While we are not short sellers, we do think that the implications are large for the current market and for portfolios exposed to certain strategies that take short positions. It also means keeping a close watch on any liquid alternative positions to ensure they are not exposed to strategies that might face similar risks. Obviously shorting is hard enough when markets are functioning as they should. But when the rules appear to change and unknown unknows surface more frequently and cause wild parabolic price moves, then shorting becomes nearly impossible and should be avoided within a portfolio’s mix of strategies.

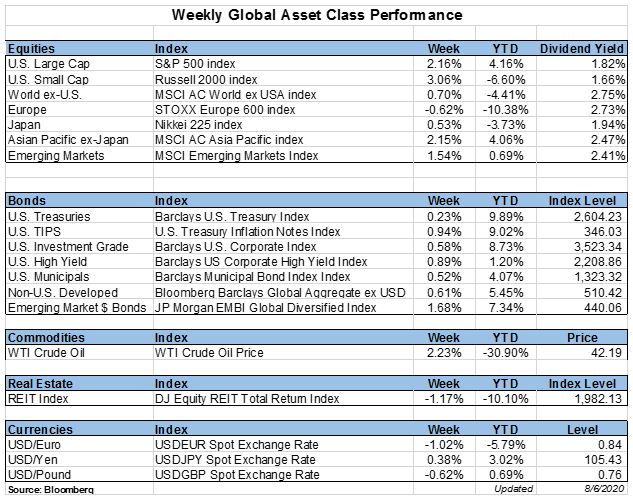

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*