Published on: 02/11/2022 • 13 min read

Avidian Report – A Bitcoin Primer in Layman’s Terms

INSIDE THIS EDITION

A Bitcoin Primer in Layman’s Terms

Is Your Estate Plan Up To Date?

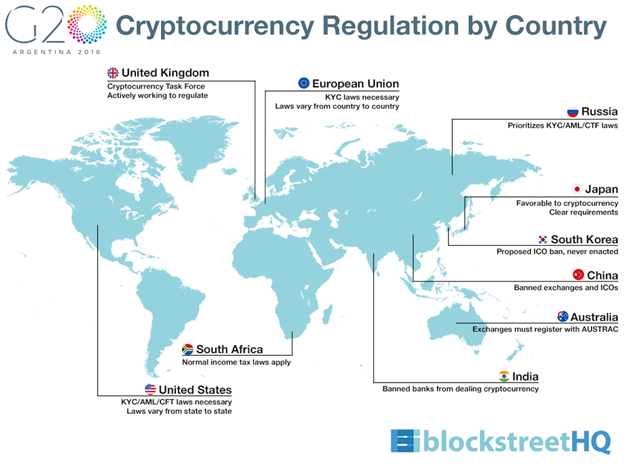

Bitcoin has garnered quite a bit of interest from investors and speculators for several years. As interest has grown, so has the polarization between believers and non-believers. Frankly, it remains challenging to know precisely how Bitcoin and other cryptocurrencies will evolve and, more importantly, be regulated.

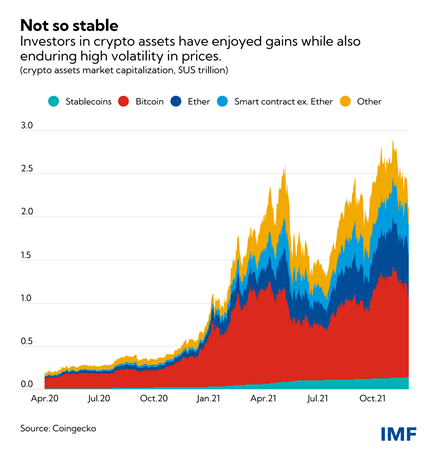

It also remains unclear whether cryptocurrencies’ return and volatility profile will rise or fall as they mature as a technology. For now, it has been a high return/high volatility asset class, with crypto assets seeing wild swings in price driven by a combination of supply/demand fundamentals, investor sentiment, and liquidity.

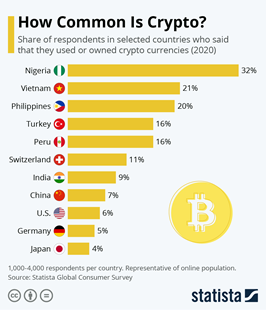

Regardless of the volatility, one thing is clear–more people worldwide are becoming aware of cryptocurrencies like Bitcoin and are adopting its use in some cases.

Will this be an enduring trend that changes the monetary system? It is hard to say, but we believe investors should nonetheless get educated as it is likely that the discourse over their use only intensifies over the coming months and years.

This weekly market report will thus focus on explaining Bitcoin in layman’s terms to provide our readers a better understanding of what it is and how it works.

What is Bitcoin?

As many already know, Bitcoin is a cryptocurrency. But what does that mean exactly? An analogy may help not only with the explanation but also to cement the idea. We will do our best to take what is often painted as a complicated concept into something simple.

In your day-to-day business, you might shake many hands as you meet clients and prospective clients. It is usually a simple action requiring that you extend your arm out toward your client or prospect. Now, imagine that instead of shaking a hand directly with your client or prospect, you must shake another person’s hand, who then will shake the hand of your client or prospect on your behalf.

Our financial system largely relies on a system that mirrors the latter scenario.

For example, when you go to a store to purchase a pair of shoes, banks, credit card providers, and others will take your money first, charge you a transaction fee, and then transfer the money to the shoe seller. This is the way it has always been, so we don’t ever consider it inefficient or strange. However, proponents of Bitcoin and other cryptocurrencies argue that under this structure, the only beneficiary is the bank or credit card company that will profit from storing, transferring, controlling, and then lending money. Of course, banks have done a good job delivering these services while making us believe that money is safer with them.

Those that believe in cryptocurrencies like Bitcoin don’t think it has to be this way.

The proponents of Bitcoin, and cryptocurrencies in general, argue that using digital currencies is akin to eliminating the middleman–in our example above, the bank–and allowing their users to execute financial transfers or exchanges directly with one another. Bitcoin and other cryptocurrencies are said to allow the transfer of value directly to anyone regardless of where they might be without an intermediary. But there is also another benefit to using cryptocurrency, and again it hits financial intermediaries directly in their profit centers. We are used to a separation between the value of the currency, storage, and the transference of that value. Because of this, banks profit by storing money, credit cards make money for allowing you to spend it, and possibly someone like Paypal or Venmo for enabling you to buy, sell, and manage its value.

Bitcoin and some other cryptocurrencies eliminate all these layers of fees because they can serve as value and a means to transfer store, and manage that value. This is because cryptocurrencies like Bitcoin are both digital value and a network that can store and transfer the bits of digital value. Value and usage of the value is simply one single system in the case of Bitcoin.

Why was Bitcoin created?

The creator of Bitcoin was a person or group of people that go by the name of Satoshi Nakamoto, who published a paper called “Bitcoin: A Peer-to-Peer Electronic Cash System.” Nobody knows precisely who Satoshi is because they have maintained anonymity. Regardless, Satoshi is credited for inventing Bitcoin and implementing the first blockchain database on which it runs.

Before discussing why Bitcoin was created, it is important to have a simple understanding of blockchain. Blockchain is simply a mathematical and computer-driven method of record keeping. The first time blockchain emerged as an idea for handling recordkeeping was in 1991, but not until Satoshi used it many years later to develop Bitcoin was it ever implemented.

As Satoshi saw it, the traditional financial and monetary systems have many problems, almost none more significant than the fact that not everyone worldwide has access to bank accounts or credit cards. Additionally, Satoshi believed that traditional financial systems could freeze the value, restrict the use of money, and currently operate during limited hours (think about bank hours), which inherently are problematic for users of traditional fiat currencies.

As a reminder, fiat currencies can be stored in a bank account and are given value because of an arbitrary decree issued by an authorizing body that has complete power over it. In the US, this is the US dollar, backed by the government and used in our economy as a medium of exchange. It is what the government has said can be used for exchanging goods and services.

Fiat Currency Description

- Money declared by government to be legal tender

- State-issued money which is neither convertible by law to any other thing nor fixed in value in terms of any objective standard

- Intrinsically valueless money is used as money because of government decree

- Intrinsically useless object that serves as a medium of exchange

As Satoshi saw it, these descriptors of fiat currency pretty much say in one way or another that all the money we have in our bank accounts is valueless, worthless, and only suitable for debt repayment. Satoshi also took issue with the fact that value and the means of exchange are separated from one another in the traditional financial system for the sole purpose of generating profits for banks and other financial institutions.

Bitcoin was Satoshi’s solution that would allow storing and sending value around the world without cost and time constraints while avoiding interaction with financial intermediaries or fiat currencies.

Source: Slolom

The reason that Bitcoin is often viewed as revolutionary is because of the blockchain that it runs on. So here, we will expand on the definition we used earlier of blockchain as simply a mathematical and computer-driven method of record keeping.

Consider a list of transactions where payments made to a recipient and from a sender are all listed in order as they occur on a single piece of paper. Once room on the page runs out, you have to continue writing the list of transactions on another piece of paper. When space runs out on each page, they create blocks linked to the pages of transactions that occurred before via something called a chain.

Said another way, blockchain represents sets of transaction data linked together. For Bitcoin’s blockchain, therefore, we should not be surprised to have it represent a record of Bitcoin transactions stored on computers worldwide, allowing it to keep three required characteristics of the blockchain technology intact—namely, decentralization, transparency, and immutability.

Decentralization

When we think about decentralization in blockchain, we should think about two things. First, we should think about how the data is stored in multiple computers worldwide. Second, we should think about the inability of one person or entity, governmental or non-governmental, to control any recorded or stored data.

This describes blockchain technology as it is entirely decentralized. It allows all the transaction data functions to be on a network of computers in geographically diverse places while requiring changes to the blockchain to go through a similarly decentralized consensus process. Doing this allows the data and network to be protected from tampering and error.

Let’s contrast that with our banking system, which the government oversees. The government, in this case, serves as the authority which issues currency. Then, banks can control where and how the transaction data is recorded, stored, and managed. They have complete discretion to use whatever systems, in whatever location, and with whatever security protocols they deem appropriate to conduct these major functions.

Transparency & Immutability

Blockchain is also highly transparent. As transaction data gets recorded, it becomes public on a ledger that anyone can see. Not only that, but even though everyone can see it, it is at the same time entirely impossible to alter it because the ledger is saved on a network of computers around the world. This built-in redundancy serves as a system of checks and balances that also makes it impossible for any entity to falsify transaction records and present them as true. This is not the case in other record-keeping methodologies, which can be more easily doctored. And this feature, which makes it impossible to change, forge, or alter data on the blockchain, is often referred to as immutability.

In short, transparency in the blockchain guarantees that each transaction is accounted for to the penny, and immutability describes the blockchain’s ability to maintain the integrity of data without worrying about it being changed.

Bitcoin is simply a use case of the blockchain, which is now increasingly being used form of payment and store of value.

How does Bitcoin work?

Hopefully, it is clear that the Bitcoin blockchain is just a running ledger of Bitcoin transactions. But how does this cryptocurrency work?

As mentioned earlier, the blockchain that Bitcoin runs on is a network of computers with Bitcoin software. Whenever a Bitcoin transaction happens, data is distributed to each of the computers that make up the network. Each computer is known as a node, and their role is one of transaction validation and posting to the ledger, then sent to all other nodes on the network. Because each data block has a set data limit, blocks have to be created as those limits are reached. On average, a new block is created, validated, and published to the blockchain every 10 minutes.

The next logical question is who is installing Bitcoin software on their computers to create, validate, and publish?

These are the miners. Miners install Bitcoin software on their computers and then help keep the blockchain working. They do this by focusing on data integrity, consistency, and permanence as they put new Bitcoin transactions onto the blockchain and then distribute those new blocks to the other nodes that make up the network.

However, for a new block to be accepted on the network, miners compete to validate the transactions. They do this in exchange for Bitcoin, which keeps the Bitcoin network running with auditing functions in place.

Since mining is complex and highly technical, the only thing you must know is that each time a miner verifies a new block of transactions, new Bitcoins are minted. Miners are then paid by a combination of those newly minted Bitcoins or the transaction fees collected from Bitcoin users when they transact in the cryptocurrency.

Bitcoin Supply

The Federal Reserve has the authority to print infinite amounts of dollars. It is no wonder they have seemingly been on track to do that for years. Thus, creating the potential for a longer-term currency devaluation. Bitcoin is different in this regard.

One of the main things Satoshi programmed into Bitcoin was a supply cap. More specifically, he set the supply limit at 21 million Bitcoin. This decision in the programming is thought to produce the result that Bitcoin purchasing power will rise over time, especially if demand exceeds the limited supply available.

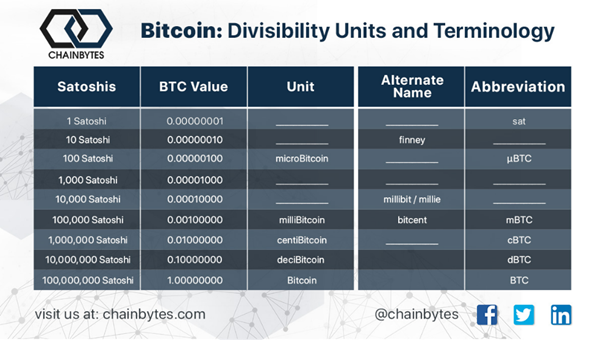

With limited supply, many wonder what happens if there isn’t enough Bitcoin. The reality is that nothing happens. Bitcoin is divisible just like the US dollar is. The following chart shows us the divisibility units and terminology associated with these fractional parts of a Bitcoin.

Source: Chainbytes

As you can see in the table, one Satoshi is one hundred millionth of a Bitcoin. This is a tiny fractional unit, even relative to the divisibility of the US dollar, which means it can be used as a way to make day-to-day transactions. This divisibility factor is what Satoshi designed to make it a viable medium of exchange.

Storing & Transferring Bitcoin

You may have heard of the term wallet to describe the place where Bitcoin can be stored and transferred. However, did you know that not all wallets are created equally? Several types of wallets are categorized based on how secure they are. The most secure wallets are cold storage, while less secure wallets are classified as hot storage. The bullet points below help describe the differences between hot and cold storage.

Hot storage

- Software wallets located on internet-connected devices

- Can be on a computer, smartphone, or exchange

Cold storage

- Hardware wallets located on devices not connected to the internet

- Dedicated cold storage options available in the market include Ledger, Trezon, and BC Valult

- Also include paper wallets, wood wallets, and fireproof metal wallets

- Safest wallets since their presence outside of an internet environment prevent hacking

Whether Bitcoin is stored in hot or cold wallets, each wallet has a private key and a public key. These are sometimes called addresses and represent a secret alphanumeric number generated at random and provide a few purposes.

Private keys give complete control of the Bitcoin associated with it. This is used to send Bitcoin to any other person. Once sent, the transaction cannot be undone.

On the other hand, public keys are generated based on the private key and are only used to receive Bitcoin. In other words, a public key cannot be used to send Bitcoins.

A person can safely send and receive Bitcoin by having two distinct keys.

Another way to think about the public keys is your bank account number and routing number, which you can provide to anyone to receive money transfers into your account. Private keys are like a bank website user ID and password, which you log into and then initiate an outgoing transfer to someone else.

Despite all the transaction security that exists on the Bitcoin blockchain, it should be noted that transactions, contrary to popular belief, are not entirely anonymous. All someone would need are the amount of Bitcoin in a transaction, date and time information, and a public address used, and transactions can be traced. Nonetheless, the merits of Bitcoin as a store of value are compelling, and the possibility that a well-defined regulatory regime could one day make Bitcoin a non-speculative component of a traditional portfolio.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*