Published on: 11/20/2020 • 7 min read

Avidian Report – A Few Reasons to Remain Constructive on Equities

INSIDE THIS EDITION:

A Few Reasons to Remain Constructive on Equities

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Coronavirus / COVID-19 Resource Center

We wanted to use this week’s commentary to highlight some of the things we are seeing across equity markets as we continue to actively monitor the worsening COVID-19 situation in many geographies.

[toggle title=’Read More’]

Before we get into a discussion about markets however, we do want to provide some key takeaways from the Center for Disease Control (CDC) surveillance indicators that track the levels of COVID-19 virus circulation and associated illnesses.

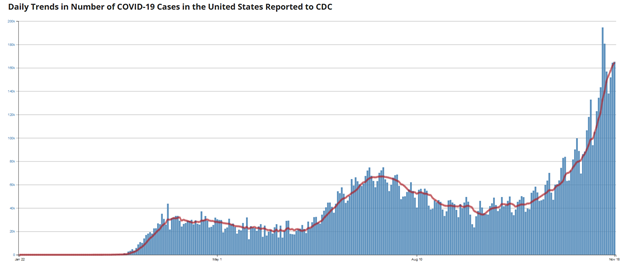

As the chart below shows, the daily trends in the number of COVID-19 cases in the United States have more recently spiked higher and started what some may consider the third wave. What is causing the recent spike is unknown, but we can posit that it has been driven by colder weather in many parts of the country as well as a possible lull in vigilance and caution as people simply tire of the virus and its lifestyle impacts.

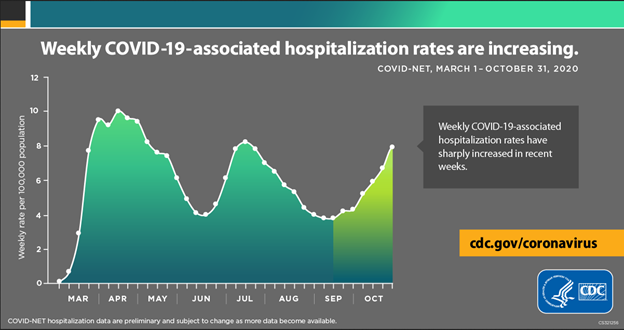

As cases have risen, we also note that hospitalization rates are similarly increasing. And this may be a more worrying development as rising hospitalizations take a greater toll on hospital capacity and generate more fear.

The better news, is that even with the rising case count and hospitalization rate, the daily deaths in the US caused by COVID-19 reported to the CDC has not returned to the levels we saw in the very early stages of the pandemic.

As investors, however, we must continue keeping a close eye on COVID-related mortality trends because we do believe that a rising death toll could be the one thing that spurs wide-spread lockdowns that could have a meaningful economic impact. And despite the fact that we have seen some restrictions return in several states and calls from the CDC to postpone Thanksgiving holiday travel, there remains no reason to believe that a nationwide lockdown is imminent.

Further, we believe there are several reasons to remain constructive on equities.

For one, there appears to be little political will to reimpose broad-based restrictions and mandatory lockdowns that could negatively affect the economy. Although one of the big fears for investors leading up to the US election was that a Biden presidency would mean taking huge steps back in the fight to reopen the economy. But, all indications, for now, are that President-elect Biden remains equally focused on the economy as he is on keeping American’s safe from COVID-19. In fact, he said earlier this week that he will not pursue a national lockdown as he does not want to shut-down the economy. Of course, we don’t know if that view will change in a worsening situation but we believe that encouraging vaccine news over the last two weeks is likely to relieve pressure put on the government to take a much tougher stance via restrictions.

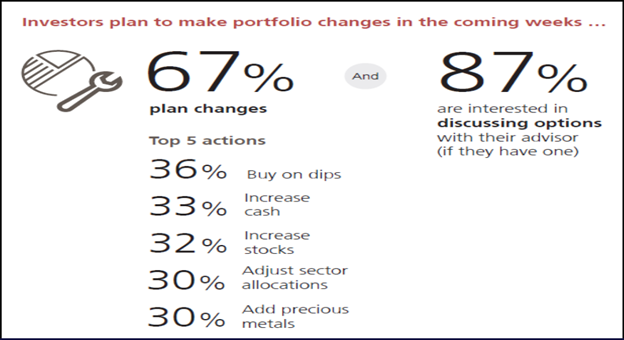

Second, as investors learned earlier this year the economy and stock prices can move in opposite directions. Remember after all that just as the economy shut down across the country in the first quarter of 2020, equity markets quickly looked ahead to improvements that would occur once economic activity restarted. We believe this was a combination of investors looking ahead to better times ahead, and the trend toward “buying the dip” that investors have become so accustomed to. In other words, whenever we have seen a dip in risk assets, investors appear to be ready to step in and provide a bid. We believe this is likely to continue. Of course, this is all just conjecture until we see some data. But UBS conducted a survey recently that seems to back up our thinking here. In their survey, respondents showed that more than a third of them are ready to “buy the dip” and another third said they would be looking for dips in stocks to add to their portfolios.

And why not? After all, it appears as though stimulus checks and other forms of liquidity provided to Americans have left them with healthy cash reserves compared to what they have been accustomed to for the last decade. In fact, this year deposits held in checking accounts have soared to a 10-year record.

To us, this is money that will be eventually put back into the economy and provide fundamental support to equity prices as earnings recover into the next year.

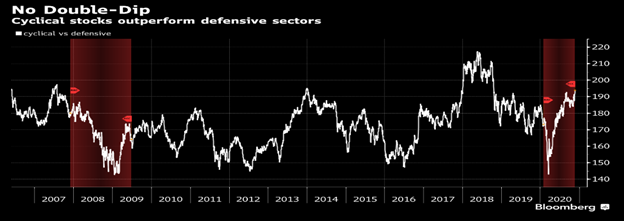

Add to all of this that we continue to have a sympathetic Fed open to allowing inflation to run hot and both senate and congress reopening talks over reaching another COVID-19 stimulus plan and there is a pretty good case to be made for being bullish stocks heading into 2021. Especially because any bad news we get is likely to be met with some counteracting force that stands to support the economy and boost asset prices. Cyclical stocks and the yield curve seem to also corroborate this view with both showing little indication that a slowdown is afoot. More specifically cyclical outperforming defensive stocks and the yield curve maintaining its upward slope tell us that optimism for improvement remains high.

Weekly Global Asset Class Performance

[/toggle]

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

There is no question that 2020 has been a year that everyone just wants to put behind them and hope for a brighter 2021. But before you start thinking about 2021, do not forget about your 2020 year-end tax and financial planning because there are still opportunities and strategies to consider, at least from a planning perspective, to take advantage of before year-end.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*