Published on: 03/18/2022 • 5 min read

Avidian Report – Are Things Looking So Grim That Lift-Off in Risk Assets is Possible?

INSIDE THIS EDITION

Are Things Looking So Grim That Lift-Off in Risk Assets is Possible?

As a result, a positive reaction felt like a meaningful departure from bearish price action across many sectors. After all, in 2022, the S&P 500 is down more than 10% through the 50th trading day of the year.

The NASDAQ has fared worse with the tech-heavy index in a bear market year-to-date. Thus, it should be no surprise to investors that small business optimism and consumer sentiment have taken a hit, with consumer sentiment hitting its lowest levels since 2011. However, as the table above shows, a poor start to the year often does not mean that the rest of the year can’t turn around. In fact, on average, after the last six 10%+ corrections to start a year, the S&P 500 has returned more than 24%.

A big driver is that historically weak sentiment, often found during a corrective phase, can be an attractive buying opportunity for long-term investors. This is especially true when looking at unloved assets, often priced at material discounts relative to their intrinsic value. These securities often offer the best potential for sharp moves higher if catalysts materialize or if a situation goes from dire to not quite as terrible.

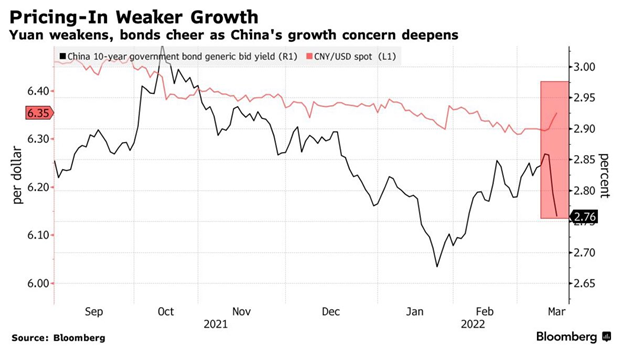

The Chinese economy had a moment like this as several data points pointed to a less than rosy economic picture. Concerns over weaker growth drove the yields on Chinese 10-year government bonds lower.

A move that was mimicked by Chinese high-yield US dollar-denominated high yield bonds was indicative of a flight to quality out of Chinese stocks and caused the worst one-day loss for the Hang Seng China Enterprises Index.

This helped make Chinese equities more attractive on a valuation basis, despite the missing change in sentiment.

However, on March 16, Chinese investors got the sentiment-shifting news that led to a monster rally when Beijing pledged to stabilize markets and announced that they were making progress working on a plan for US-listed Chinese companies. As a result, Hong Kong listed internet companies zoomed higher, and the Hang Seng Index posted its best one-day session since October 2008 with a return of just over 10%.

Source: Twitter @Anivestor

All this should serve as a great reminder that when things look the bleakest is often when the tide is about to turn. For investors, this means guarding against becoming overly optimistic when things go exceedingly well and becoming overly pessimistic when things look less constructive. It is a balancing act that can be made more palatable by observing data objectively, having self-awareness of market sentiment, and making decisions through a long-term lens. Doing these things adroitly will add to your long-term investment performance and set you up to achieve your financial goals and objectives.

Weekly Global Asset Class Performance

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*