Published on: 10/23/2020 • 7 min read

Avidian Report – Does A Strong Equity Market Recovery Mean A GDP Recovery Lies Ahead?

INSIDE THIS EDITION:

Does A Strong Equity Market Recovery Mean A GDP Recovery Lies Ahead?

Year-End Tax Planning Checklist 2020

Coronavirus / COVID-19 Resource Center

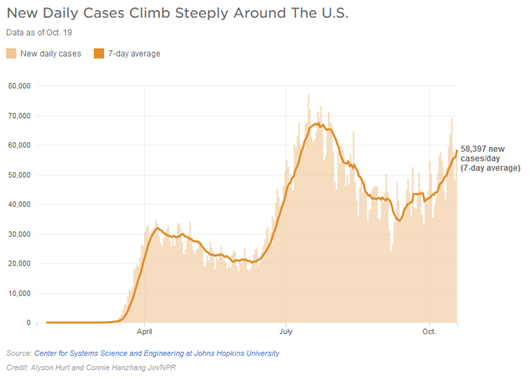

It has been a while since we provided a COVID-19 update as investor’s have shifted their focus to the upcoming November election. However, to be clear we think COVID bears some attention especially as we get into the cold winter months in many parts of the country and we have seen a rise in cases across the US.

[toggle title=’Read More’]

The good news of course is that despite the rise in daily cases, the daily number of deaths has remained under control. While there is typically a bit of a lag in this COVID-related death data, we think there is little in the data to suggest that we will see new economic lockdowns or major impediments to a gradual return to pre-COVID economic activity.

But, we do note that economic activity and recent equity market performance continues to be somewhat disconnected. We talked about this in a market commentary earlier in the year and from what we see today, that has not materially changed.

To provide some clarity on what we mean, all we have to do is look at the S&P 500. That index has now returned nearly double digits on the year while much of the economic data shows levels below their pre-COVID levels, especially as we look at year-over-year percentage changes in job data, travel data, and other service industry data.

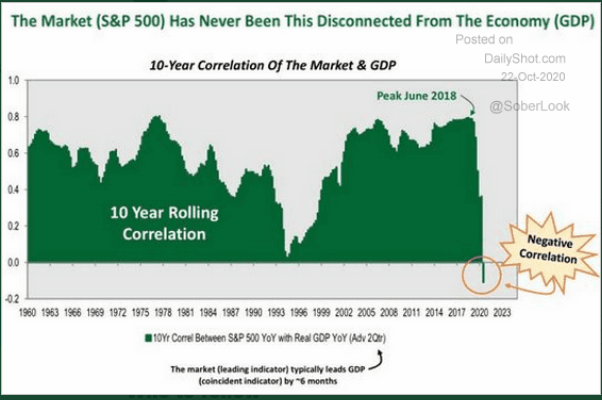

Additionally, we note that the 10-year correlation of the equity market as measured by the S&P 500 compared to GDP is for the first time showing a negative correlation, dating back to 1960.

In other words, the market is up while GDP is down significantly. Taking it a step further, if these 10-year rolling correlations were to return to a less atypical condition, either the S&P would have to decline, or GDP would have to play catch-up with the positive performance of equities. Based on the fact that the market tends to be a leading indicator by approximately 6 months, this chart would seem to indicate to us that equities are portending a meaningful GDP recovery in 2021. Whether that happens remains to be seen of course, but with talks about additional stimulus continuing and both presidential candidates likely to make stimulative action a key initiative, we think there is a relatively high probability that GDP continues its recovery as the amount of additional stimulus is likely to offset any weakness in consumption or export data.

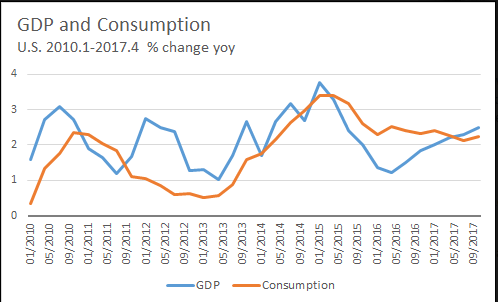

Historically, consumer consumption has been an important contributor to GDP, certainly through 2017 as shown in the chart below. However, it is our view that the regime during COVID-19 has possibly changed and now it is in fact investment and government spending that will likely drive GDP growth at least in the short- to intermediate-term.

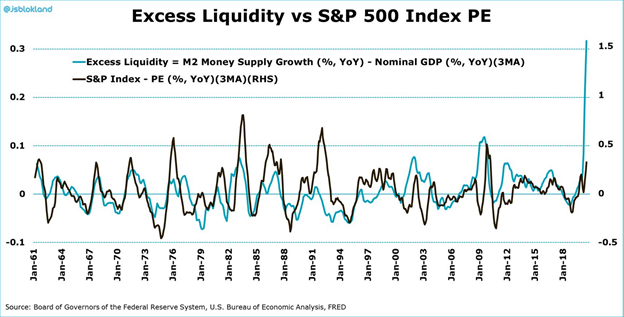

We can see the impact of this on the Fed Balance Sheet as the Fed has purchased assets and continued to employ easy monetary policy. In fact, in the week from October 9th until October 16th, the Fed boosted its balance sheet by $76.8B. This represents the largest increase in its assets since May and brought the Fed balance sheet size to $7.15 trillion.

The Federal Reserve Balance Sheet

The impact of course can be easily seen in equity prices and valuations. As the chart below indicates, excess liquidity, like that the Fed has injected into the market through asset purchases, opens up the possibility of higher equity valuations and a continued run-up in asset prices regardless of what may happen with the economy.

It is for these reasons we believe investors at this stage should consider being more fully invested despite the potential for short-term volatility due to the election over the coming weeks. Of course, we recognize that this is a tough call for many investors. However, a sound financial plan, like those we prepare for our clients at Avidian Wealth, can help ensure investors stay on track to meet their goals and not unnecessarily reduce investment exposure.

[/toggle]

What are the appropriate checklists for year-end tax planning?

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

From our experience, tax planners often develop checklists to guide taxpayers toward year-end strategies that might help reduce taxes. Throughout the year, we publish many timely tax-related articles (summarized here). In August this year, we also published our Top 10 Tax Planning Ideas for 2020. The tax filing season is now behind us. We have put together a year-end checklist of things that you should review. We have grouped the list into several different categories, such as “Filing Status” or “Employee Matters,” for ease of reading. As year-end approaches review each category that applies to your situation and consult with your tax advisor. Also, as this is an election year, we created a pice to compare the Trump vs. Biden Tax Policies.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*