Published on: 03/19/2021 • 7 min read

Avidian Report – How Could Direct Lending be an Attractive Income Opportunity for Some Investors?

INSIDE THIS EDITION:

How Could Direct Lending be an Attractive Income Opportunity for Some Investors?

American Rescue Plan Act Relief Bill

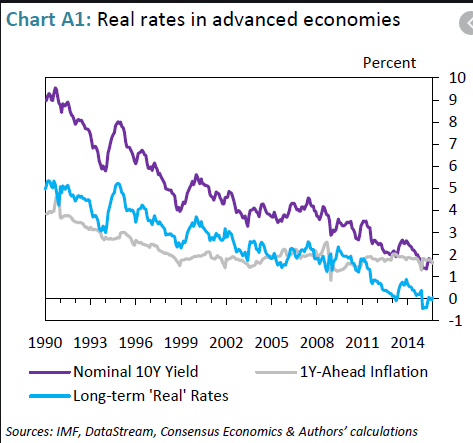

This week’s commentary will serve as an overview of why we believe the direct lending space could offer an attractive investment opportunity for qualified investors looking for income. As we have discussed previously, interest rates have been in steady decline for the last thirty years. As rates have trended lower, we have seen investors increasingly struggle to generate income with their portfolios without taking on substantially more risk.

Even within fixed income asset classes, the trend on yields has been lower. For example, the chart below shows fixed income yields over the last 20 years for 10-year treasuries, municipal bonds, investment-grade corporate bonds, and high yield bonds. As you will quickly notice, regardless of the fixed income sector, the ability for investors to generate similar yields to what they did 20 years ago is significantly diminished, which creates numerous challenges for investors trying to hit their income targets.

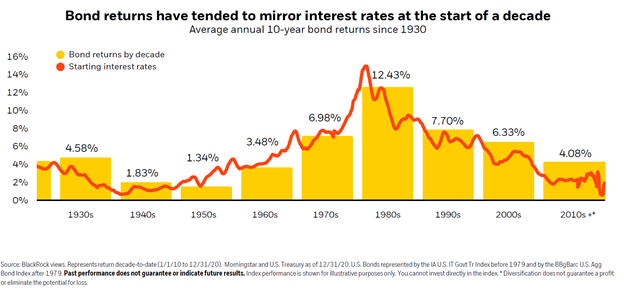

And many point to the historical correlation between interest rates at the start of a decade and bond returns as a basis for a lowered yield expectation going forward across fixed income.

For that reason, we think it is valid for investors to look at other opportunities outside of traditional fixed income markets to offset the income shortfall. This includes semi-liquid private credit funds that provide exposure to direct loans to companies with strong competitive advantages in the middle market.

While we acknowledge that direct lending has suffered some yield compression, we have not seen it to the same extent as we have in other income-generating asset classes. Further, there are other reasons outside of yield to like this particular asset class.

First, in the middle market, where direct lending is most prevalent, we have witnessed a sizeable reduction in bank-led financings going back to 2005. This has opened the door for private credit providers to fill the financing gap left in its wake while offering borrowers favorable terms that often include faster execution, increased structuring flexibility, and more efficient processes.

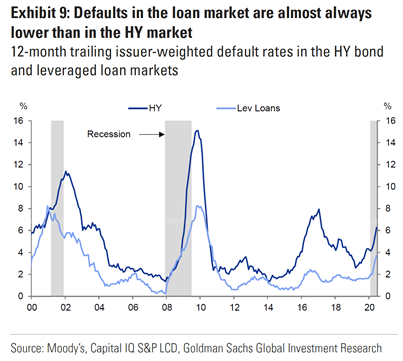

At the same time, we are currently seeing low default rates in the direct lending space, especially when compared to the high yield market, while offering a comparable income profile.

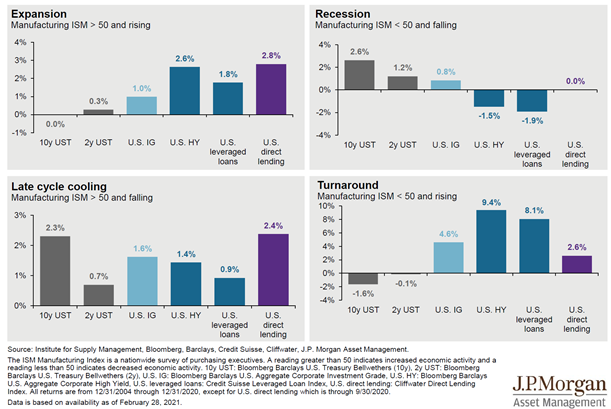

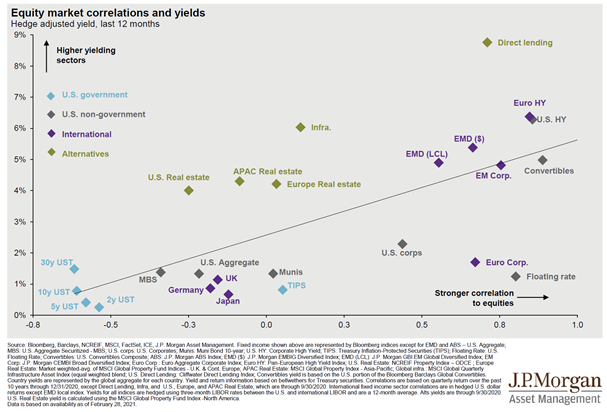

Compared to other fixed-income sectors, direct lending offers an attractive risk and return profile that investors can layer into traditional allocations to drive up income while not adding an asset class with as much historical volatility as corporate credit, senior loans, or high yield bonds. Additionally, with the economy set to continue a recovery following the pandemic, we like that this asset class has historically performed well during economic expansions, as well as, during turnarounds and late-cycle cooling periods.

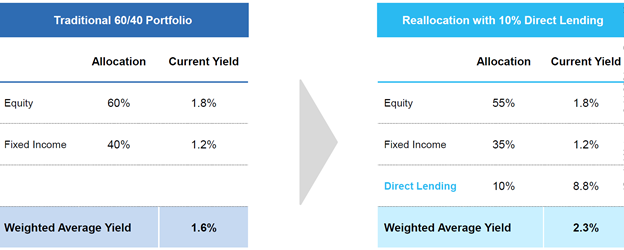

To illustrate the impact of adding an allocation to direct lending, this chart below compares a traditional 60/40 portfolio to a portfolio where 5% is reallocated to direct lending from both equity and fixed income. As you see, there is a meaningful pick-up in the weighted average yield.

Of course, we must talk about risks, and many of these semi-liquid direct lending funds available to investors have some default risk and liquidity risk.

Default risk can be an issue because this asset class is susceptible to the business cycle. For example, in a rising market, direct lending defaults are less common as borrowers lean into favorable business conditions to cover their debt service. However, when the business cycle experiences a down-turn, default risks naturally rise. That said, this risk can be mitigated through careful manager selection and by investing in direct lending funds that demand their loans to hold seniority in the capital stack, reducing capital impairment in default scenarios.

The second major risk that investors should look out for is liquidity risk. Many of the funds that operate in this market area do have liquidity provisions that limit fund redemptions. So, for any investor looking to allocate dollars to this opportunity set, it is imperative to be comfortable with long holding periods and potentially limited access to redemption opportunities.

The last thing worth mentioning about direct lending funds is that they often exhibit high correlations to equities. This means that investors must understand how an allocation to this asset class will affect overall portfolio volatility during different market regimes. An advisor familiar with direct lending opportunities, like those at Avidian Wealth Solutions, can certainly help determine if an allocation to these opportunities is suitable and, if so, how much should be allocated based on your goals and objectives.

Weekly Global Asset Class Performance

American Rescue Plan Act Relief Bill

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Rolando Garcia, JD, CPA

Friday, March 12th, 2021

Congress approved another coronavirus relief bill on March 10, 2021, the American Rescue Plan Act of 2021. The passing of the $1.9 trillion bill comes on the heels of a long and close vote in the Senate last week. The new bill, expected to be signed into law by President Biden on March 12, includes provisions for stimulus payments, extended employment benefits, additional small business funding, and much more.

Read Full Article Here

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*