Published on: 03/25/2021 • 7 min read

Avidian Report – How Is The Economic Recovery Looking?

INSIDE THIS EDITION:

How Is The Economic Recovery Looking?

American Rescue Plan Act Relief Bill

For this week’s commentary, we wanted to focus on some key data points that speak to the progress of economic recovery. As we have mentioned before, we continue to believe the ability of the economic recovery to continue will largely hinge on the successful and wide-spread distribution of COVID-19 vaccines. What we note is that vaccines are now being administered at a rate of 2.5M per day. This is extremely encouraging and leads us to believe that the economic recovery widely expected in the second half of the year appears to remain on track.

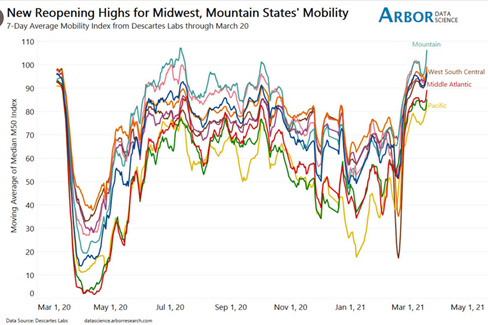

Although we have seen some countries reinstitute some rolling lockdowns due to COVID-19 flareups, we think these are likely to subside as vaccine distribution continues to improve outside of the US. Inside of the US, we are already beginning to see significant improvement as vaccines have become more widely available. As an example, Arbor Data Science compiles data about mobility. For the Midwest and the Mountain region of the US, we are now seeing reopening highs in terms of mobility. This indicates people are getting more comfortable going out. More likely than not, they are once again spending, which is critical to bringing consumer spending back to pre-COVID levels.

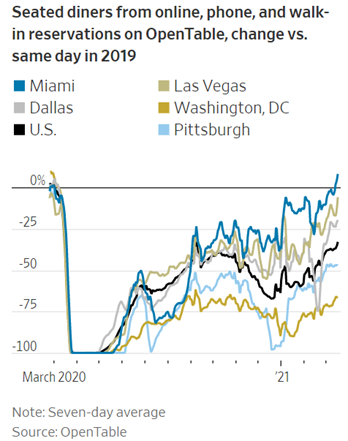

Data from Opentable seems to corroborate this data, in that reservations made through the restaurant application are gradually increasing, and in some states where lockdowns ended earlier, they see restaurant activity at near pre-covid levels. That said, we think trends in data for cities like Miami might be indicative of what we believe may happen as pent-up demand might look like coming out of the pandemic.

At the same time, we have to acknowledge the impact that stimulus is likely having on this data. As new stimulus checks are distributed, we fully expect at least some of those dollars to be put back into the economy through consumer spending, some of which may already be happening.

Looking at US small business sales across food & drink, retail and services sectors, we see a notable push higher with total sales values up more than 40% compared to last year.

As we look at data provided by Chase’s consumer card spending, the data is similarly improved compared to a year ago. While we are not yet to pre-COVID levels as highlighted by the orange line in the chart below, the trend is moving in the right direction, and we would not be surprised if, over the coming months, we don’t get back to and then exceed pre-COVID levels.

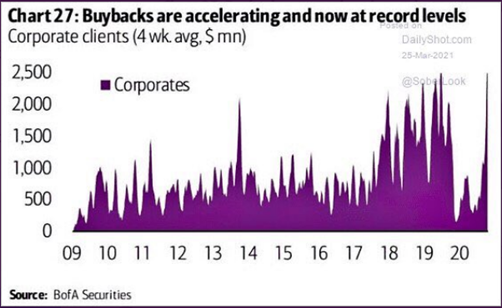

With such positive economic trends taking hold, it also appears that companies are taking notice and are getting more confident in the economy. We gather this from the increased buyback activity and, more importantly, from the increasing mention of corporate buybacks on company earnings calls.

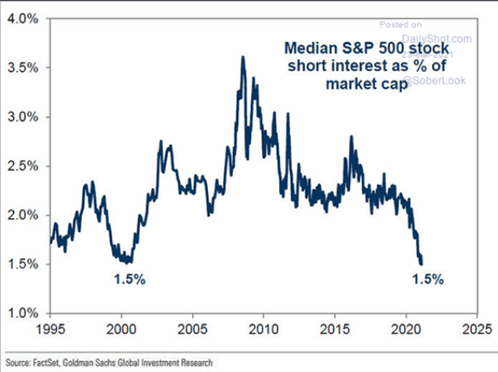

Investors seem to be echoing these positive views as well, with the Median S&P 500 company now seeing short interest drop to levels not seen since 2000.

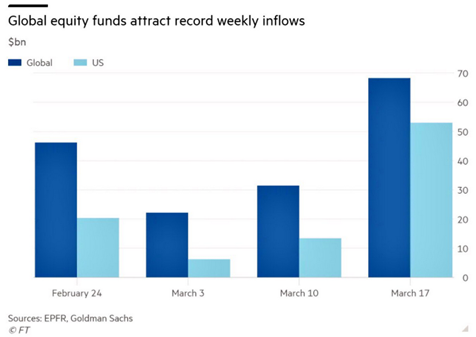

We are also seeing investors allocate increasing amounts of capital to both global and US equity funds. We think this is further evidence that investors are placing their bets that stimulus and a strong economic recovery will push equities higher.

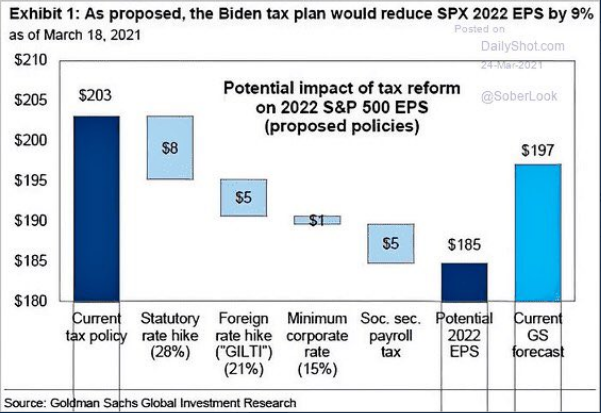

While we agree that stimulus is likely to support risk assets, we think there are certainly some risks on the horizon that investors must be aware of. One such risk is undoubtedly the proposed Biden tax plan which would increase the corporate tax rate. Based on analysis by Goldman Sachs, the potential impact based on current proposals could be a reduction in earnings per share of 9%. While we have some doubt that the tax plan would pass in its current form without considerable adjustment, this highlights the risk that equities could face should such a plan pass.

As a result, we continue to believe that investors should rely on their financial plans to guide them and weather volatility. Investing in a globally diversified portfolio with the ability to make tactical trades to adjust to a changing environment is one way to do that. Further, having that flexibility to be tactical within portfolios is likely to grow in importance as new policies are implemented and as the economic environment continues to evolve.

Weekly Global Asset Class Performance

American Rescue Plan Act Relief Bill

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Rolando Garcia, JD, CPA

Friday, March 12th, 2021

Congress approved another coronavirus relief bill on March 10, 2021, the American Rescue Plan Act of 2021. The passing of the $1.9 trillion bill comes on the heels of a long and close vote in the Senate last week. The new bill, expected to be signed into law by President Biden on March 12, includes provisions for stimulus payments, extended employment benefits, additional small business funding, and much more.

Read Full Article Here

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*