Published on: 12/23/2020 • 7 min read

Avidian Report – How the Transition to Renewable Energy will Affect Geopolitics and The US Dollar

INSIDE THIS EDITION:

How the Transition to Renewable Energy will Affect Geopolitics and The US Dollar

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Coronavirus / COVID-19 Resource Center

This week’s commentary marks the last of five installments where we have been discussing five major trends that we believe investors should be watching as we move into 2021. As investors, we must keep an eye on what is happening today but must also be keenly aware of what is likely to happen tomorrow.

[toggle title=’Read More’]

That idea is the reason we have spent the last five weeks discussing long-term secular trends that we see have a high probability of occurring over the coming years. After all, it is this type of thinking that can also help us make sure to be exposure to the correct long-term secular trends which history has shown can greatly influence the long-term success of investment portfolios. For the last couple of weeks, we have shared the chart below and we keep it here this week as a gentle reminder that longer-term regimes and trends can provide information about which the asset classes might ultimately perform well in the future.

That backdrop once again informs our discussion of the fifth trend we will discuss in this series: the accelerating transition from fossil fuels to renewable energy sources and how this holds broad implications for geopolitics and the US dollar.

Because many of our readers are based in Houston and have some, or in some cases most of their wealth concentrated in the energy sector, we think this may catch your eye. However, we want to stress that the secular trend we will discuss while related to the energy sector, has the potential to have a broader impact on investments due to what may happen with the US dollar and geopolitics going forward.

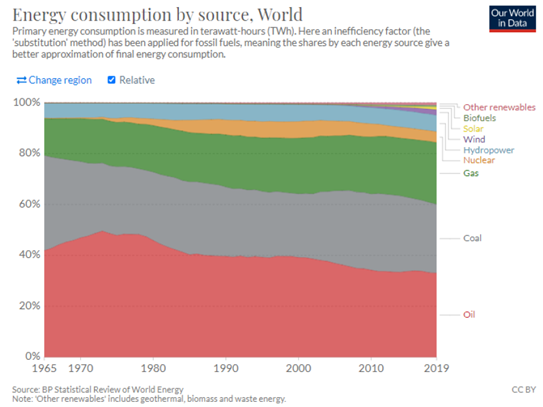

Looking at the sources of global energy consumption shown in the chart below, fossil fuels still make up more than 80% of the world’s consumption while the other sources make up much less at below 20%. However, this is only one side of the story.

The other side of the story is that the costs of renewable energy is low today, and only trending lower. The chart below actually shows the average cost of energy per megawatt hour in North America. With five energy sources depicted, we see that wind and solar are now under $50, which is cheaper than natural gas, nuclear, and coal.

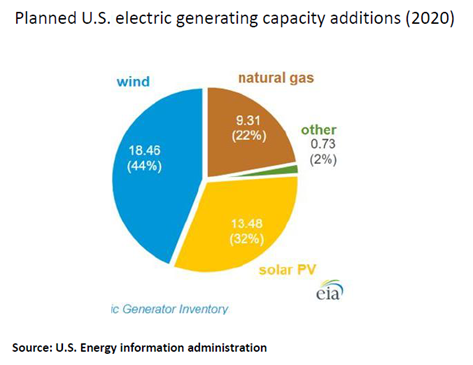

Further, it should be no surprise when we look at planned 2020 additional capacity additions for the US, wind and solar take up more than 2/3 of the projected added capacity.

Because there is more being invested into these renewable sources of energy, we are also seeing a secondary effect that should only help accelerate adoption. Namely, increasing economies of scale which flatten and lead to decreasing costs of deploying these clean energy sources. In essence, a very positive feedback loop for the continued rollout of more and more renewable energy sources.

While the chart above shows these trends in the US, the two charts that follow paint a very similar picture outside of the United States too. The first chart below shows renewable energy generated from renewable sources in 1966 while the second chart below shows the same data as of 2019 but with a notable difference – the world in 2019 was generating far more energy from renewable sources than in the 1960s. As we look ahead, we see this trend continuing due to three main reasons. First, there is a big support for green energy sources in emerging markets like China due to pollution issues that create the impetus for reducing emissions from fossil fuels. Second, there is a global push to switch to green energy to minimize climate change. Lastly, there is a huge desire from China, India, and Europe to gain energy independence, a status that the United States has enjoyed for years. It is this third point that stands to benefit these other countries from a geopolitical standpoint.

In fact, it is because of this that you have much wider investment implications outside of just the energy sector that investors must factor into their decisions, with many already beginning to ask whether energy independence will ultimately pose a challenge to the Petrodollar system we have become so accustomed to.

For those not familiar with the history, in the wake of the collapse of Bretton Woods, the US was able to convince OPEC to denominate oil in US dollars and led the world to stock up on the US dollar as a means of being able to purchase oil. This gave the US a huge advantage because it simultaneously created demand for US dollar denominated assets from all over the world. It was also beneficiary for the US in that it helped drive non-inflationary growth even while running large budget deficits.

To conclude and connect these dots, what this really means in short is that rising renewable energy could lead to energy independence across the globe, causing the disappearance of the Petrodollar system and as a result lessen the demand for US dollars, then we might see a weaker US dollar.

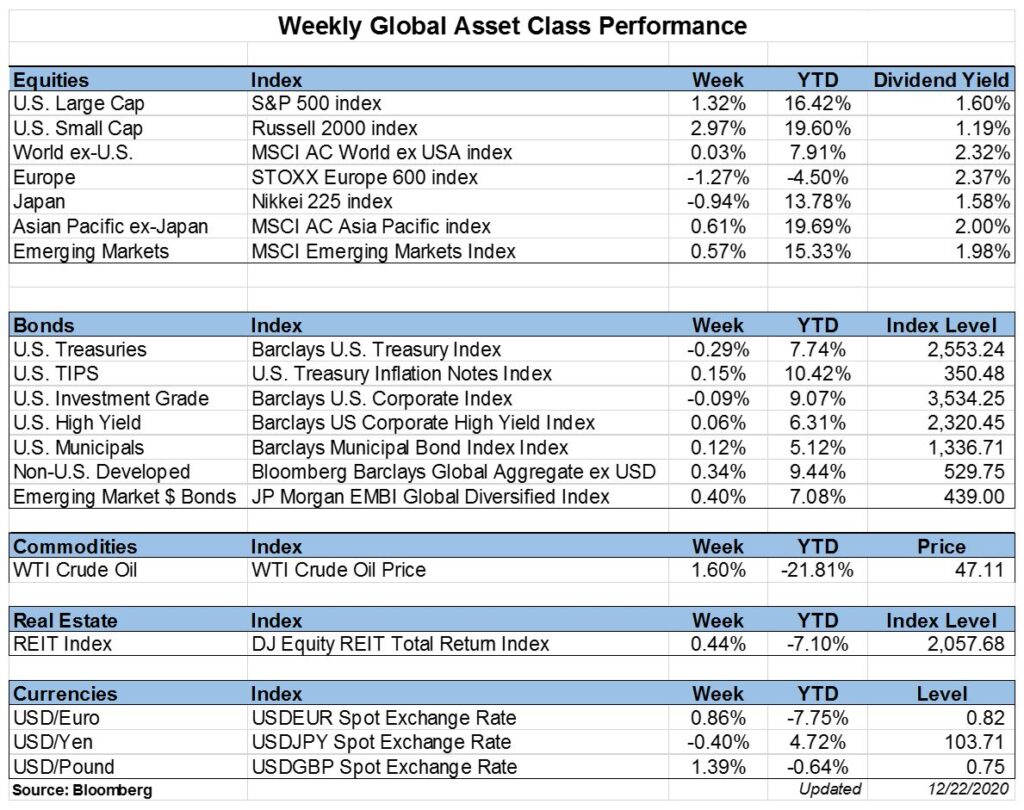

Weekly Global Asset Class Performance

[/toggle]

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

There is no question that 2020 has been a year that everyone just wants to put behind them and hope for a brighter 2021. But before you start thinking about 2021, do not forget about your 2020 year-end tax and financial planning because there are still opportunities and strategies to consider, at least from a planning perspective, to take advantage of before year-end.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*