Published on: 11/24/2021 • 7 min read

Avidian Report – It Is Time To Start Thinking About Tax Loss Harvesting

INSIDE THIS EDITION:

With only a few weeks until the new year, tax-loss harvesting season is once again upon us. While this year has been marked by strong gains again across many asset classes, it is still important to review accounts for opportunities to harvest losses. Especially, because specific entry points could yield different results for the year. This is what is often referred to as a sequence of return risks. As the table below shows, this sequence of return risk is in fact very real. Further, the sequence of return issues can in fact manifest on an intra-year basis.

Source: Voya

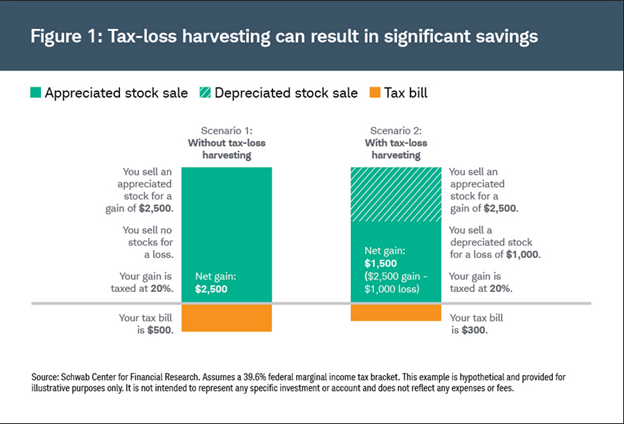

While “paper losses” are certainly not a pleasant experience during a period when equity markets have generally moved higher, investors should consider taking advantage of tax-loss harvesting opportunities where they exist. Tax-loss harvesting is a practice of realizing a loss to offset a gain or income, thereby reducing the current year’s tax obligation. Tax-loss harvesting often occurs in December, with December 31st being the last day to realize a capital loss.

A capital gain or loss is the difference between the cost basis and the sale price. Usually, the cost basis is what you paid for the investment. Any gain or loss is not realized until the investment is sold. There are two types of gains and losses: short-term and long-term. Short-term capital gains and losses are those realized from the sale of an asset held for one year or less. Long-term capital gains and losses are realized from the sale of an asset held longer than 1 year. Short-term capital gains are taxed at marginal tax rates on ordinary income. The top marginal federal tax rate on ordinary income for 2020 is 37%, just like it has been the last three years.

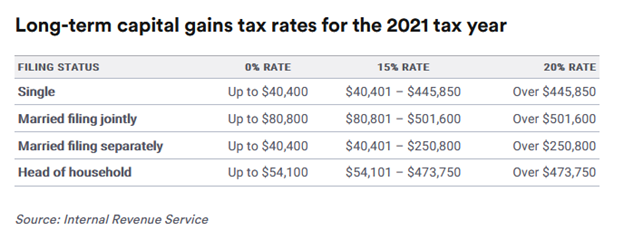

Long-term capital gains tax rates on the other hand are 0%, 15%, or 20% depending on your taxable income and filing status. Regardless of your tax bracket, tax rates for long-term gains are generally much lower than those for short-term capital gains.

As a part of prudent investment planning, tax-loss harvesting can effectively reduce the tax drag on the performance of a portfolio and provide a way to improve after-tax returns. However, to accomplish this the strategy must be implemented correctly.

Source: Charles Schwab

For example, let’s assume Mike has a $1,000,000 portfolio held in a taxable account. By the end of 2021, Mike has recognized $100,000 worth of long-term capital gains. Without making any further transactions, Mike has a capital gains tax liability of $15,000, assuming his long-term capital gains tax rate is 15 percent. The good news for Mike is that tax-loss harvesting can reduce this liability. For example, Mike might sell some stocks and bonds that experienced $50,000 in losses. If he sells those securities, the net gain can be reduced from $100,000 to $50,000. In this scenario, harvesting tax losses would save Mike $7,500 in taxes.

According to the tax code, short- and long-term losses must be used first to offset gains of the same type. But if losses of one type exceed gains of the same type, then excess losses can be used to offset the other type. Therefore, the most effective tax-loss harvesting strategy is to apply long-term capital losses to short-term capital gains. In the previous example, if Mike’s $100,000 gains are short-term and taxed at 37%, harvesting the same $50,000 in losses would save $18,500 of the current year’s tax liability.

As you can see from this example, a tax loss harvesting strategy needs to be carefully implemented. When selecting securities that have lost value for sale, investors need to be mindful not to deviate from their target asset allocation and diversification strategy. Most investors may choose to repurchase the same investment to maintain the proper asset mix. However, they must be careful of wash sale rules, which prohibit repurchasing a “substantially identical” security within 30 days before or after the selling date. At Avidian Wealth Solutions, we select secondary securities that can be purchased when primary securities are sold to harvest losses in our investment models so that we avoid triggering wash sales thus preserving the benefits of the tax-loss harvesting.

It is important to note that the tax savings from tax-loss harvesting in a given tax year can overstate the true gains. Selling an investment at a loss and subsequently using the proceeds to purchase the same or similar security effectively resets the cost basis at a lower value and increases the embedded tax liability. If the security is repurchased and then sold in the future, investors need to pay the taxes that are being saved today through tax-loss harvesting. Put another way, the economic value of tax loss harvesting is largely a tax deferral rather than elimination of tax liability.

However, the postponed tax payment of appreciated securities is still extremely valuable in many ways.

First, the time value of money tells us that one dollar today is worth more than one dollar tomorrow. For example, if a $10,000 tax payment can be postponed for 5 years, an investor can simply set $9,000 on the side, invest in a 5-year risk-free treasury bond that returns 2% per year and receive $10,000 in 5 years. So, he effectively pays $9,000 rather than a $10,000 tax in current dollars.

Second, the tax payment is a real cash outflow from an investment portfolio. By realizing a loss, an investor can save taxes in the current year, which increases the amount of capital available for investment. To some extent, this is analogous to a dividend reinvestment plan (DRIP). In a DRIP, the investor does not take quarterly dividend distributions as cash; instead, dividends are directly reinvested in the underlying stock. The power of dividend reinvestment is manifested when it is compounded over long time horizons. Similarly, the longer an investor can defer the realization of capital gains and the higher the tax rate on capital gains, the more the investor will benefit from tax-loss harvesting.

Third, financial assets like stocks and bonds can receive a step-up in basis when an asset is passed on to a beneficiary upon inheritance. The step-up in basis readjust the value of an appreciated asset for tax purposes and therefore potentially eliminates the embedded capital gain liability altogether.

Fourth, donating highly appreciated securities can be a very tax-efficient way to support a philanthropic purpose. A donor not only can deduct the full fair market value of appreciated long-term assets held for more than a year but he or she avoids paying capital gains taxes on those securities.

Lastly, if capital losses exceed capital gains in a given year, an investor can use up to $3,000 of losses a year to offset ordinary income in future years.

To sum things up, tax loss harvesting is an active investment management strategy that potentially improves after-tax returns by deferring capital gains taxes into the future and increasing after-tax capital for investment today. Fundamentally, it reflects the most basic principle of finance – the time value of money. That is, when you save tax money today (loss harvesting) and pay it later, you maximize the net utility of each investable dollar in your portfolio.

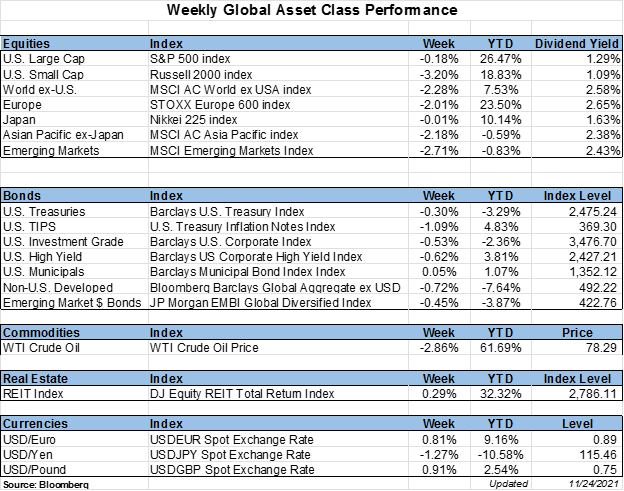

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*