Published on: 07/02/2020 • 8 min read

Avidian Report – Keeping Good Balance Matters

INSIDE THIS EDITION:

Keeping Good Balance Matters

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

We continue to believe that positioning for the current market should be both balanced and flexible. This reflects our view that the upside and downside risks are close to even and very difficult to call due to the uncertainty still surrounding COVID-19. We believe investors should deploy capital gradually and be highly selective while resisting the fear of missing out (FOMO).

[toggle title=’Read More’]

Considering the need to remain balanced, this week we walk through several data points, both positive and negative, that we believe we, as investors, need to keep an eye on as we navigate a highly uncertain environment.

Reasons to be bullish

COVID-19 Stimulus Supportive of Asset Prices: we have been constructive on stocks despite this, in large part because of central bank policy and coordinated stimulus measures around the globe. In the United States alone, stimulus in response to COVID-19 has already eclipsed the response to the Great Recession. As the chart clearly illustrates, the response to COVID-19 has been truly unprecedented, and amazingly, there remains a high possibility that the Fed does even more if we see the economy fail to recover, or if asset prices drop sharply. Fed support at present has been and continues to be, one of the leading reasons to be long risk assets in our view.

The following chart may help explain why.

As you might see in the chart, the stimulus provides excess liquidity that can inflate multiples. While that can go on for a while, if the world’s central banks begin tapering their stimulus and draw liquidity out of the system, it could also pull the rug out from under those multiples. Although we do not see that tapering occurring just yet, investors need to keep a close watch on central bank comments and action as it relates to Money Supply.

Top 5 S&P500 Constituents Well Positioned for a COVID and post-COVID Economy: The top constituents in the S&P 500, Microsoft, Apple, Amazon, Facebook, and Alphabet, makeup nearly 25% of the index value. It is fortunate for the broad market that those names are also well positioned to perform well in both a COVID-world and a post-COVID world. With solid balance sheets, wide competitive moats, and a focus on technology that we use daily, these companies should perform well despite COVID-19 impacts. There is a reason we have repeatedly referred to some of these companies as the new consumer staples. As the chart below shows, they have greatly outperformed the broad S&P 500 and Russell 2000 and do provide some defensive benefits should the economy take longer to reopen and recover.

Non-Manufacturing Data Recovering: ISM Non-Manufacturing bounced sharply in June to 57.1, far exceeding its estimate of 50. The increase was fueled by a combination of higher production, new orders, and improving export orders. Perhaps more encouraging is that the June reading also compared favorably to the 45.4 it posted for May. What we believe investors should be watching more carefully is whether employment in the chart below closes the large gap that the economic shutdown created as this could say a lot about the economy’s ability to get back to pre-COVID conditions.

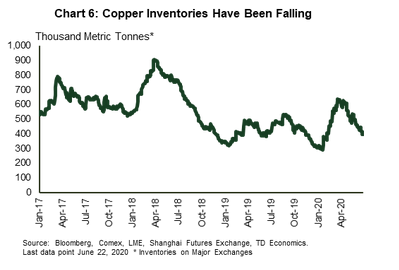

China shows a demand recovery: This is pretty encouraging in our view. China was the initial epicenter of COVID-19 and they are now seeing a pickup of industrial demand. This suggests that it is possible that once COVID-19 has been dealt with either through a drug breakthrough or adherence to strict safety standards that allow people to resume normal daily activity, that the path to pre-COVID demand levels could be speedy. In China, for example, we are seeing increased demand for raw materials and manufactured goods. For illustration purposes, the chart below shows the falling inventories of copper, a key industrial metal, as demand increases in China.

Reasons to be bearish

Infection rates and Permanent Job Losses rising: Let us start with the biggest overhang the economy faces — the COVID-19 infection rate. It has continued rising in the United States and has led to a scaling back of reopening plans in several states. While markets have not priced in the worst of scenarios, investors should be cognizant of the rise in permanent unemployment. Permanent job losses could start to negatively affect spending, saving, housing prices, and a slew of other economic drivers.

Retail Traffic is Slowing Once Again: As COVID-19 cases rise, we are seeing retail traffic declining once again. This, after a sharp rebound off the lows at the beginning of April. Investors should be concerned as this trend, if it continues, could put many more retailers at risk of financial distress than what we have already seen (many retailers have filed for bankruptcy protection in the last several months).

However, investors must temper this bearish argument some, by acknowledging that reduced traffic does not necessarily mean the consumer is not consuming. Instead, it could simply be indicative of the secular shift toward e-commerce. As the chart below shows, the share of retail sales that E-commerce now holds has gone parabolic during COVID-19, and as we see it is unlikely to fully reverse, even when the pandemic has run its course.

S&P Profit margins and Price Level Experience Divergence: As we wrote several weeks ago, the markets and economic reality were looking detached from one another. Unfortunately, this has not corrected and has in fact gotten worse. Especially when we look at profit margins and compare them to the S&P 500 price level. Throughout the 2000’s up until the start of this year, S&P price level behaved as one might expect, with the profit margins being earned by index constituents closely tracked by index price level. Now, however, we have a complete departure from the norm, which presents a scenario we believe must reverse, either through the drastic improvement of margins, a decline in the S&P 500, or a combination of both. With COVID-19 making it difficult to look too far ahead, we think investors would be wise to keep an eye on this relationship.

Domestic stocks are not inexpensive: Valuations are not inexpensive in domestic markets. Sure, we have extremely low-interest rates that help support higher multiples and monetary policy that does the same. However, investors must keep in mind that high valuation levels constrain future returns. Developed international and emerging market stocks, by contrast, look more favorably valued in a broad sense. This is why we continue to be proponents of a high degree of selectivity when selecting investments in the current environment.

As may be evident the current environment is unprecedented in many ways. For example, we don’t know the limits of central bank stimulus or what the secondary and tertiary effects might be. However, despite the challenges, investors should continue to look for opportunities to capitalize on secular changes COVID-19 is likely to leave behind and remain balanced in their approach to risk and return.

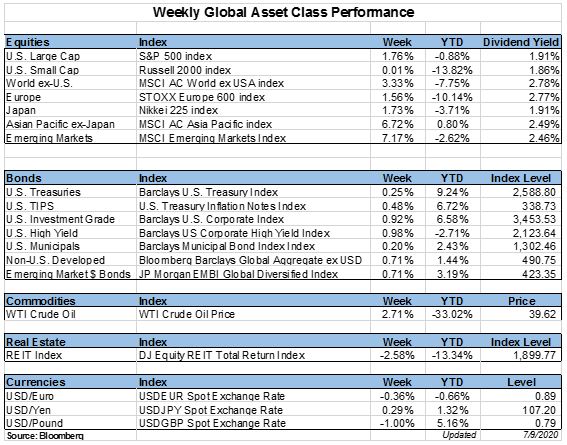

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*