Published on: 01/15/2021 • 6 min read

Avidian Report – Is the Fed Policy Framework Working?

INSIDE THIS EDITION:

Is the Fed Policy Framework Working?

Key Estate and Income Tax Planning Takeaways from “Blue Wave” Democratic Victory

Coronavirus / COVID-19 Resource Center

On Thursday, January 14, 2021, Federal Reserve Chairman Jerome Powell held an online discussion open to the public with Markus Brunnermeier who is the director of the Bendheim Center for Finance at Princeton University.

As is customary, we paid close attention to Mr. Powell’s comments as they have in the past provided insights on how the Fed is thinking about the economy and policy decisions moving forward. Not only that, but markets often react to his comments as they did on January 29, 2020.

The web conference today is notable because it represents the last time we will hear directly from Jerome Powell before the Fed holds its next policy meeting thanks to a media blackout that begins on Friday. Although there are a couple of other public speaking engagements scheduled with Fed Presidents before the blackout begins, it is unlikely those speeches will hold as much information regarding a monetary policy decision before it is announced toward the end of January.

We were especially interested in seeing if Mr. Powell would provide any hint of potential tapering because, in the past, any hint of tapering has led to market volatility. Further, and perhaps of special interest to bond investors, is that with fear of tapering, treasury yields might rise. Of course, the reaction might be short-lived, especially as other factors might come into play surrounding the existing bond-buying program in place which is seeing the Fed buy approximately $120B of bonds each month in its effort to get closer to full employment and its attempt to drum up inflation, which has been nearly impossible to get since before the financial crisis.

Based on Mr. Powell’s comments today, it remains clear that an increase in yields is not his primary concern. He appeared to reason that with the improvement in growth they expect, and a slightly more buoyant inflation forecast, that the uptick in yields may in fact be justified.

For some context, we are now above 1.1% on the 10-year treasury yield and are seeing extremely easy financial conditions. Easy financial conditions indicate higher potential growth and low output volatility as we continue to see post-COVID economic improvement. But more importantly these loose financial conditions might inform monetary policy, especially under the Fed’s recently updated average-inflation targeting framework.

For investors, we have seen this new inflation framework keep yields low relative to other markets. We can see an example of this when we see cyclical stock performance and implied yields and compare them to the yields on the 10-year. On a relative basis, the gap between cyclical stock yields and the 10-year is as wide as it has been in well over a decade. What this indicates to us is that the Fed’s new framework may be quite effective at achieving the goal of keeping yields low while at the same time pushing inflation marginally higher.

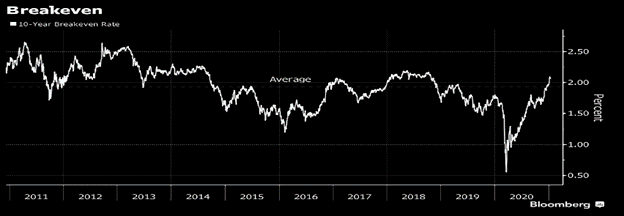

As investors have seen this early success, they have improved their expectations for inflation. For instance, the 10-year break-even rate for inflation is now trading above 2%. Although we have seen this happen previously, as recently as 2018 in fact, it is certainly encouraging in the face of a global pandemic. However, we want to see breakeven inflation of better than 2% as that would get the Fed to hit its target for average inflation of 2%.

Of course, some investors and economists worry that this new approach coupled with significant stimulus might be inflating an asset bubble. Especially as P/E ratios have moved to levels last seen during the dot com bubble. Mr. Powell however has made the point more than once that he disagrees. Instead, he sees that stocks are not as overvalued today as they were in 2001, thanks in large measure to bond yields remaining suppressed. We tend to agree, especially once we factor in an expected earnings improvement compared to 2020, and as we see S&P earnings yield relative to the 10-year treasury yield at just about its 20-year average.

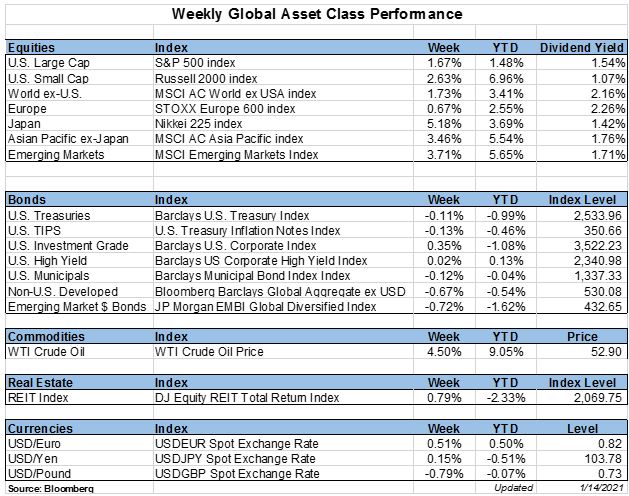

Weekly Global Asset Class Performance

Key Estate and Income Tax Planning Takeaways from “Blue Wave” Democratic Victory

As we discussed many times heading into the election, there were many differences between the Tax Plans and Policy Proposals of Donald Trump and Joe Biden. Even after the election, there was stimulus relief, (including changes related to small business owners and the tax-deductibility of PPP loan proceeds).

Click Here to Read The Full Article

The team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*