Published on: 04/03/2020 • 6 min read

Avidian Report – The Earnings Impact of COVID-19

INSIDE THIS EDITION:

The Earnings Impact of COVID-19

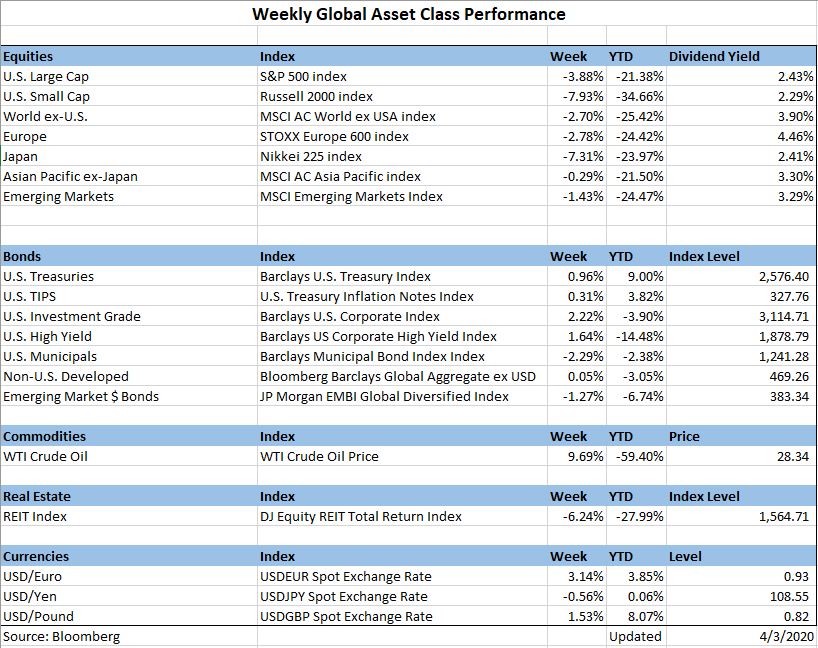

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

We already know that COVID-19 has had a major impact on markets over the last 8 weeks. Volatility has been elevated, stocks across most industries are down sharply, and investors are on edge as the economic impact of the virus remain uncertain.

[toggle title=’Read More’]

Thus far, we have seen major adjustments to how we live our lives as citizens of the United States are forced to comply with stay at home orders as governments attempt to slow the spread of the virus.

Security markets and regulators have similarly adjusted to the current reality. The SEC recently issued guidance for public companies that recognizes the difficulty in assessing or predicting with precision the effects of COVID-19 on industries or individual companies. However, they are recommending that listed companies provide COVID-19 related disclosures within their filings anyway. This is likely because they recognize that the impacts from COVID-19 and the shutdown of economic activity across the globe are going to be large and far-reaching.

That leaves investors with a lot of unanswered questions, especially as many companies have suspended earnings guidance for the remainder of the year. And those that haven’t suspended guidance in many instances have issued earnings warnings as they attempt to manage investor expectations. In fact, as of March 11, 2020, 150 companies had already issued earnings-related warnings due to COVID-19 from all sectors of the economy. Additionally, of the 150 largest global companies, 100% mentioned either Coronavirus or COVID-19 in their quarterly earnings reports or earnings calls.

Based on what we are seeing, none of them will be as hard hit as retail, airlines, and hospitality companies.

Sampling of Negative guidance by sector

Retail

Abercrombie & Fitch (ANF) said sales would be lower by as much as $50 million during its first quarter and $80 lower for the year.

Best Buy (BBY) took a different approach and did not quantify the magnitude of lower guidance. However, they did say that supply chain disruptions would have an impact and that it was too difficult to predict how consumer behavior would change following COVID-19.

Gap (GPS) said it would be difficult to qualify the impact of COVID-19 at the moment, but that it expects at the very least to see a sales reduction of $100 million dollars. This type of sales decline will likely shave more than $0.10 during the first quarter from Asia and Europe alone.

Of course, these are largely traditional retailers. Online retail has bucked the trend and has actually seen an improvement in sales based on early data. This makes sense as online sales have benefited from people spending on essential items.

At the moment, many people are spending money to stockpile essential items, which may temporarily divert funds from more discretionary purchases.

Airlines

Jet Blue (JBLU) pulled earnings guidance as its outlook became unclear. They did this for both the first quarter as well as the full year 2020.

United Airways (UAL) also withdrew all guidance for 2020 in late February as the duration and spread of coronavirus increased uncertainty over travel demand. They did say that they believe they will be able to deliver earnings growth in 2021.

Southwest Airlines (LUV) warned that operating revenue would take up to a $300 million haircut. It expects first-quarter revenue per available seat mile to be -2% to +1% which is down compared to the previous estimate of +3.5% to +5.5%.

Hospitality

Marriott International (MAR) said that it expects a $25 million reduction to its monthly fee revenue due to COVID-19 uncertainty. Additionally, they said that 2020 new room inventory might be delayed due to the outbreak.

Wyndham Hotels & Resorts (WH) said they expect operations to suffer for up to 6 months as the market recovers from travel disruptions and expects to lose $5M of its first-quarter adjusted earnings. For the year, the loss to earnings could be anywhere between $8M and $12M.

We would not be surprised to see even more of these warnings issued or adjustments to these guidance numbers. That is why we believe investors need to exercise great care before investing in these sectors. While the large price declines can certainly get your attention, many of these businesses could face additional risks that are difficult to predict. As a result, tread carefully.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*