Published on: 09/10/2021 • 5 min read

Avidian Report – The Federal Reserve Beige Book and What It Says About the Current Economy

INSIDE THIS EDITION:

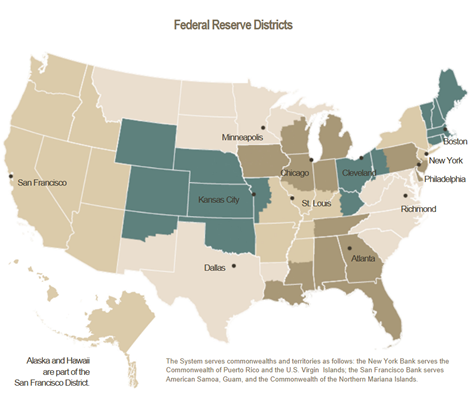

The Beige Book is a report published by the Federal Reserve Bank eight times per year and can be used by investors to determine the economic conditions in each of the 12 Federal Reserve Districts.

This report collects information by conducting outreach activities to bank directors, key business contacts, economists, market experts, and others who have their hand on the pulse of real economic activity in each of the Federal Reserves’ 12 districts. For investors, the Beige Book provides a valuable supplement to other information commonly tracked and released by the Federal Reserve, but more qualitative in nature. The nature of the information might help an investor identify trends in economic activity before those trends appear in the quantitative data. Also, the method of gathering and presenting information in the Beige Book makes it possible to compare economic conditions across major regions of the US more easily.

What is the Beige Book telling us about the national economy?

The Beige Book highlights a slowdown in economic activity from early July to August in the latest release. However, activity does remain relatively healthy, with growth continuing at a moderate pace. What follows are some key takeaways from the Beige Book that investors should be aware of as they assess the state of the economy.

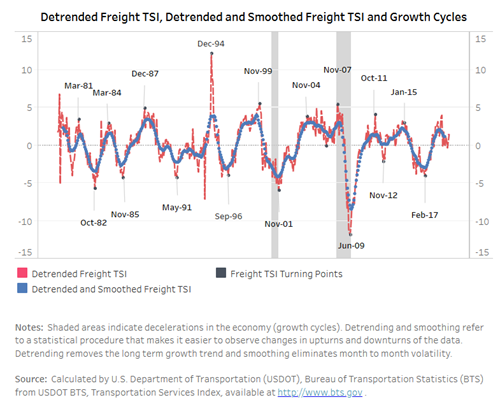

First, current economic growth is supported by strong fundamentals in manufacturing and transportation, the services sector, and residential real estate. Strength in these sectors is far outpacing the downshift of activity in dining, travel, and tourism, which have largely slowed due to lingering fears about the Delta variant of COVID-19. This is expected at this stage of the recovery, although we would prefer to see travel and leisure sectors rebound further.

Manufacturing PMI

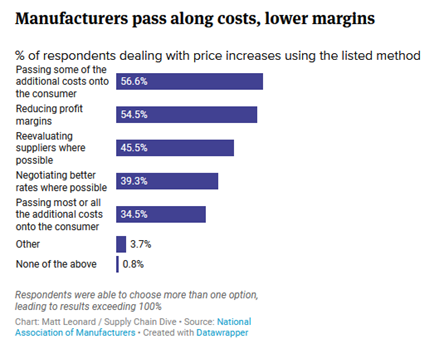

Second, major supply chain disruptions and labor shortages have negatively impacted the economy, as shown in this report’s regional information and overall economic activity. As the chart below indicates, supply chain issues led to weakness in auto sales, especially challenged by chip shortages impacting inventory levels. We think this is temporary but have less clarity about the speed at which these pressures ease.

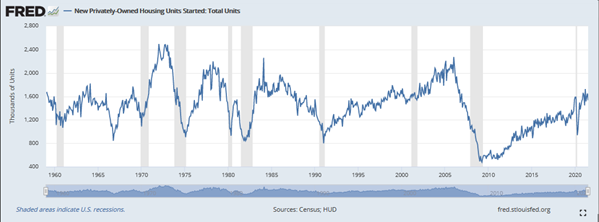

Third, the September Beige Book presents notable data relating to real estate. Namely, steady levels of residential construction continue, and loan volumes across regions are disparate. While residential construction continues to do well for the moment, investors should be keeping a close watch on the supply of residential housing units and the potential impacts that eviction and foreclosure moratorium expirations could have ahead.

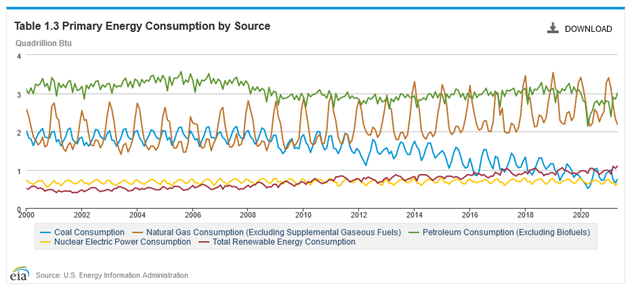

Fourth, both agriculture and energy sectors have shown signs of life as demand recovers off post-pandemic lows. That said, energy-related equities have not recovered in the same magnitude despite the improvement in these sectors. It remains to be seen whether this performance differential will persist or converge as we head into 2022. However, investors should remain vigilant for changes in the energy markets as they can be complex and highly volatile.

Lastly, we highlight what the Beige Book report said about inflation. As discussed many times before in our weekly reports, inflation continues to be a point of disagreement among investors and economists alike. More specifically, some, including the Federal Reserve Board, have communicated that inflation looks more transitory, while others have expressed fears that inflation will be stickier than policymakers are acknowledging. The recent Beige Book highlights input price pressures, rising metals prices, elevated transportation costs, and more importantly, the indication in many districts that businesses plan on raising prices to keep up with higher input prices. Based on this look-through, investors need to be positioned with at least some inflation hedging positions if we see moderately higher inflation. However, to be clear, despite advocating holding inflation hedges in a portfolio, it is improbable that we see a hyperinflationary outcome.

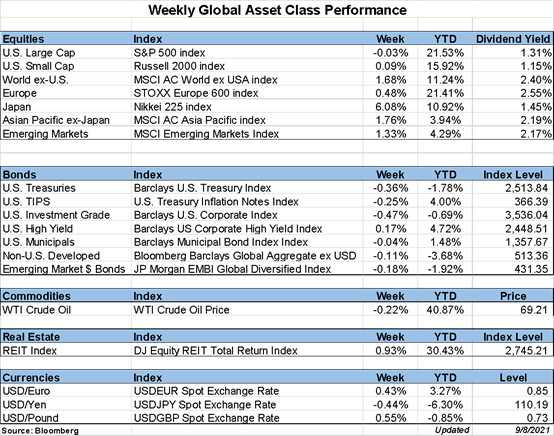

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*