Published on: 12/30/2021 • 5 min read

Avidian Report – The Good Times Keep Rolling

INSIDE THIS EDITION:

The Good Times Keep Rolling

Year-End Tax Planning Checklist 2021

Money Hour Radio Show Announcement

The Good Times Keep Rolling

This stock market boom over the last couple of years has pushed investors to feel increasingly confident as stimulus continued to pour into the system. Further, it has pushed some investors to take unreasonable amounts of risk and margin debt in the belief that this is the ticket to fully capitalize on the current boom. However, we caution investors against this type of speculative behavior and believe instead that a balanced approach to risk and reward is perhaps better suited for long-term capital appreciation during up markets and capital preservation during the down years.

Of course, many investors today have stopped considering risk as they look around and see major indices touch new highs. It has also driven consumers to spend and fuel a strong post-COVID economic recovery, though continues to wrangle with Omicron.

This year’s holiday season is a perfect example of how good investors and consumers are feeling as we close out the year. After all, sales rose 8.5% during the holiday season over last year according to Mastercard’s Spending Pulse Indicator in what is a follow-through to strong retail sales numbers we saw reported by the US Census in September.

Source: US Census Bureau

However, we do believe investors must do their best to retain a sober view of markets. After all, every great party eventually ends. The truth is that investors typically oscillate between extreme optimism and extreme pessimism which is reflected in asset prices. For this reason, we believe the prudent investor should work hard to distinguish which of the extremes may be at play during any given period. Unfortunately, this may be the investor’s biggest challenge today.

And while we do not think the market is in a period of euphoria, we do think we could be gradually entering a phase where more awareness of risk is warranted, especially in certain areas of the market which have been driven to pricier levels as liquidity has flooded the system.

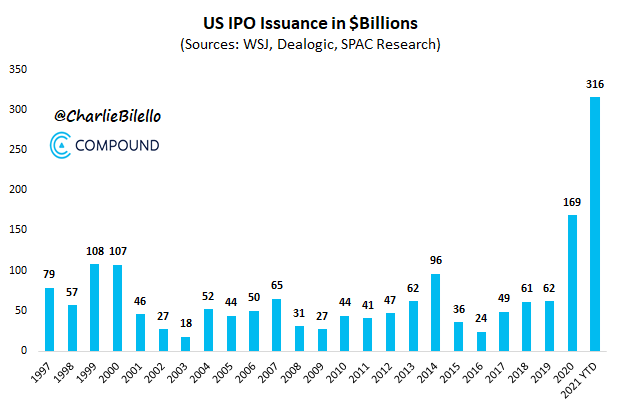

One data point which we believe supports this view is the IPO market. This year saw one of the more active IPO markets that we have seen in years and serves as a sign that corporate management teams may be viewing the current environment as a window of opportunity to raise capital when valuation levels are elevated, and hot money chases the next big thing.

Source: Twitter @CharlieBilello

As we head into 2022 then, we have a few things for investors to consider. First, investors must ask themselves whether Fed support for asset prices may slowly begin to thin and lead to more volatility. We might already be seeing signs of this in lower quality tech stocks as the chart below shows.

Second, investors should consider that lofty valuation could be brought down to earth if the Federal Reserve moves aggressively to hike interest rates in the next 12 months and whether they are positioned with sufficient diversification across asset classes and sectors to weather potential drawdowns.

And lastly, investors should be asking themselves whether their positioning is designed to keep up with their neighbors who may be taking undue risk for their returns, or whether their positioning is right for reaching their financial goals and objectives. If these questions give you pause, then perhaps a rethink of portfolio risks and positioning is in order as we head into the new year.

Weekly Global Asset Class Performance

MONEY HOUR RADIO SHOW ANNOUNCEMENT

As our firm grows and becomes more dynamic, our desire is to always find more ways to enhance your experience in working with our firm. After much deliberation, we want to announce we will be wrapping up our daily radio show, The Money Hour. The last airing was Friday, December 17th, 2021. We greatly appreciate all of you who have listened to the show for many years.

In place of the Show, we are planning to do a monthly podcast starting in 2022. Moving forward, we will be using podcasting and video to bring you new and helpful content from our executives, advisors, and other members of the Avidian Wealth team. Our podcasts will be available on all major platforms, as well as our YouTube channel here https://www.youtube.com/channel/UCo90q2IcXGvfUc4ptnr3uWA.

The Money Hour Show, December 17, 2021

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*