Published on: 12/31/2020 • 7 min read

Avidian Report – Three Important Lessons Markets Taught Investors in 2020, and What They Mean for Portfolios

INSIDE THIS EDITION:

Three Important Lessons Markets Taught Investors in 2020, and What They Mean for Portfolios

Coronavirus / COVID-19 Resource Center

Each year always presents us an opportunity to conduct a post-mortem that can, over time, lead to considerable improvement in how investment decisions are made and executed. In fact, many of the best investors in the world ascribe to a similar process of self-reflection for their long-term success.

[toggle title=’Read More’]

Just because you may not be managing billions of dollars on behalf of clients, does not mean you should shy away from a similar reflection. After all, there is always something new to learn that over time can accumulate and increase the probability of success in the markets.

With the end of the year now merely hours away, we believe now is a good time to pause and reflect on some of what 2020 taught us and perhaps more importantly how investors should think about their portfolios considering these lessons.

Asset prices can be unpredictable, especially in the short-term

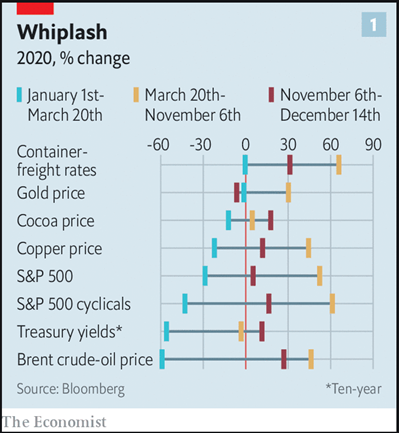

In what may be perhaps the biggest takeaway from 2020, we learned this year no matter how unpredictable market-moving events may be, how asset prices react can be even more unpredictable. Who would have thought that after COVID-19 induced economic-lockdowns led to a swift first quarter sell-off across asset classes, that these major asset classes would still manage to produce an intra-year recovery despite a continuation of COVID-related concerns and economic uncertainty and finish the year positive? Our guess is not very many of us.

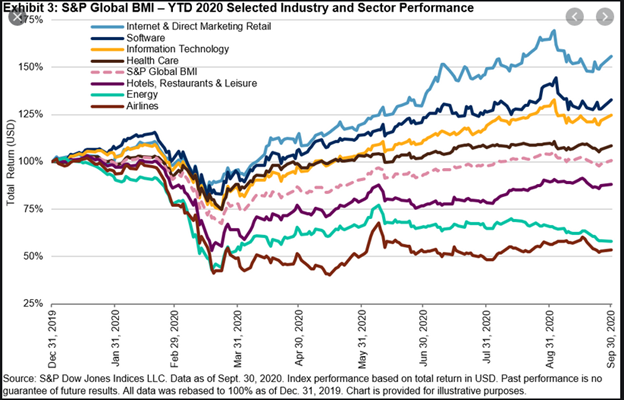

How should investors adjust considering this lesson? Well for one, we believe 2020 makes the case for active management. That means working with an advisor that is monitoring developments in real time, adjusting portfolios along the way to ensure that portfolio positioning might capture opportunities as they occur. Second, we think this lesson also makes the case for diversification. As the chart above demonstrates, at the height of market volatility in the first quarter, some asset classes certainly performed better than others. Through diversification, a portfolio in 2020 had a higher probability to withstand the ups and downs better than a highly concentrated portfolio built for binary outcomes. This truly is the only free lunch in investing and not taking advantage of it can certainly hurt at times of crisis and high volatility.

Markets are driven by psychology and sometimes defy logic

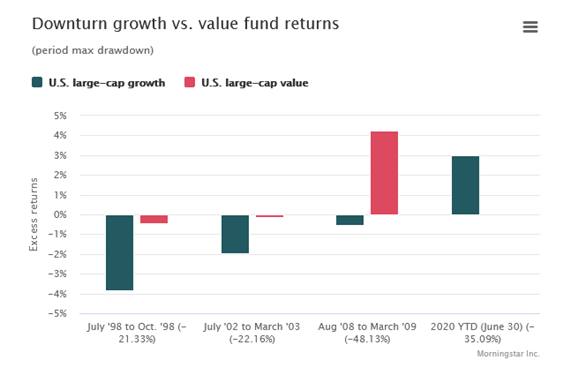

Performance in 2020 was largely driven by growth, as S&P 500 constituents like Apple, Microsoft, Amazon and Alphabet turned in impressive year-to-date performance despite COVID-19.

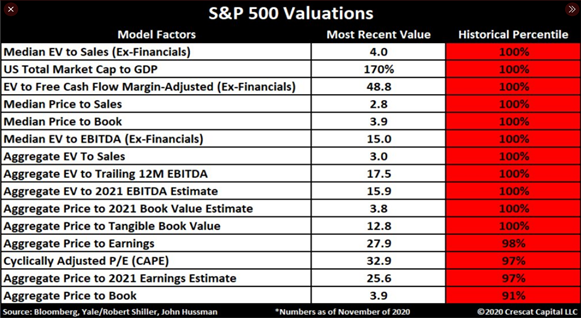

It was this strength in a handful of growth stocks, especially those tied to remote work and e-commerce, that helped propel markets to new highs in the second half of the year. How could they not, when everyone appeared to pile into these stocks while at the same time, they sported high valuations and the expectation of stellar earnings as though the COVID environment would last forever. We know for a fact that nothing lasts forever and so we do have to observe valuations with a critical eye as major indices, like the S&P 500, find themselves near the top of their historical valuations across several valuation metrics.

However, we also must acknowledge that some of the valuation levels may be justified due to stimulus, easy monetary policy, and low interest rates. For investors, we think the lessons here are three-fold. Number one, that prices can at times defy gravity if the right conditions are present. Second, that valuations in the short-term sometimes do not seem to matter. Third, that money flows matter and can build considerable price momentum even at the index level especially if that money is flowing into the heaviest weighted companies in an index which can cloud underlying market dynamics.

For investors holding portfolios in equities, we think the takeaway for the future is that momentum is real but while invested in trending securities, investors must maintain a sober view of where markets are and how similar scenarios have played out throughout history. While the party can certainly continue for a long time, we think investors should be increasingly considering risk exposure the higher we see equity prices rise. In fact, it is why we strongly encourage risk management as part of our discipline.

Don’t fight the Fed

Another lesson from 2020 is that investors should not fight the Fed. In fact, it is the Fed that often tips their hand and provides valuable market information that astute investors can capitalize on.

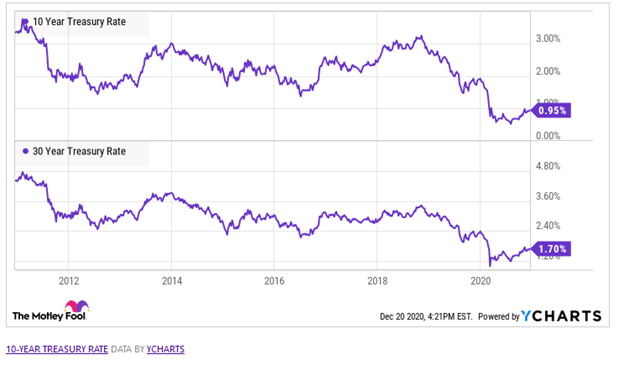

As many investors that lived through the last financial crisis know, it has been a long time since we have seen the market get overheated while inflation picks up. This combination is what typically drives the Federal Reserve to raise short-term interest rates to cool down an overheating economy. With the emergence of COVID-19 early this year, we have seen yet another year go by where the Fed has been stuck at near-zero interest rates.

In fact, going all the way back to the Financial Crisis in 2008-2009, the Federal Reserve has been forced to suppress interest rates as the financial markets and/or economy have proven fragile when a shift in policy has even been hinted at. Further, it is this low interest rate environment that has allowed risk assets to enjoy a prolonged upward trend despite unprecedented uncertainty this year.

In addition to suppressed short-term interest rates, 2020 also saw a return to market intervention by the Fed, as they entered the market to buy some fixed income securities in an effort to ensure the smooth functioning of markets and give investors confidence to keep dollars invested despite a scary economic backdrop.

The key lesson from all this has been that as the Fed outlines and implements their policies as well as signals their intention to keep short-term rates near zero for the foreseeable future, investors might have a high probability of generating outsized returns from equities into next year.

For portfolios, this means that investors should pay extra attention to the Fed as they hold significant power in the financial markets and can impact equity and fixed income returns. For example, if the Fed remains accommodative, recent history has shown that investors might want to be more heavily exposed to equities. At the same time, if the Fed signals tighter monetary policy we might expect more equity volatility. In other words, investors should know by now that the Fed may provide strong signals for how to allocate a multi-asset class portfolio, and that information should never be ignored.

Weekly Global Asset Class Performance

[/toggle]

The team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*