Published on: 07/02/2021 • 5 min read

Avidian Report – What are Profit Margins, Secondary Offerings, and Valuations Telling Us About Stocks?

INSIDE THIS EDITION:

What are Profit Margins, Secondary Offerings, and Valuations Telling Us About Stocks?

June 2021 Update – FPA Tax and Estate Planning Knowledge Circle

Investors use margins to determine whether a company or business makes money. When a publicly traded company is making money, it is no secret that its stock price tends to rise over time. As a result, at Avidian Wealth Solutions, we track several profitability measures to better understand broad market fundamentals across industry sectors. Doing so can provide some insight into which areas of the market may offer either opportunity or present possible risk.

So what are margins telling us today?

As we observe margins today, they may be starting to show some signs of weakening which could pose a slight risk for the S&P 500’s recent price trend. Consensus margin estimates for 142 companies of the S&P 500 have fallen and appear to have driven some variation we have seen in stock returns recently. Between April and June of this year, drops in margin estimates led to negative price performance, while the companies with the most significant margin gains saw positive price performance. More specifically, we have companies whose declines in their margin expectations fall 251 bps, compared to a gain of 76 bp for the S&P 500 and an increase of 125 bp for companies with increasing margin forecasts.

Research conducted by Bloomberg expanded the analysis by dividing all the constituents of the S&P 500 into quintiles according to operating margin expectations during the period from April and June. They found that the companies that experienced the most considerable stock price drops also experienced the biggest decline in operating margin estimates. At the same time, those companies that experienced the largest price increases had their operating margin forecasts increase by the most. In other words, even under the expanded security set, the results related to the correlation between operating margin estimates and price performance seem to persist.

Interestingly, companies in the technology and healthcare sectors make up only 22.3% and 16.0% respectively of the quintiles of stocks, with the highest expected margin drops moving forward.

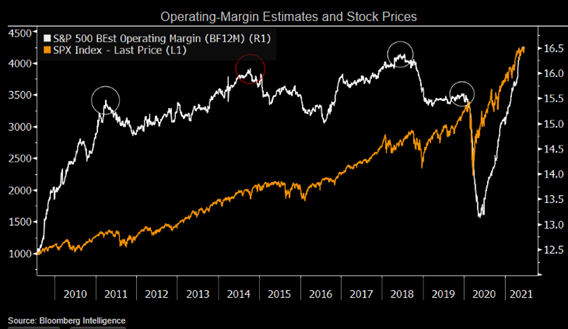

As investors, we should be watching to see if the pattern holds. After all, operating margin estimates are a strong indicator of forward price trends. As discussed above, this margin story has been a major under-the-radar market theme over the past two months. The June headline inflation numbers caused margin forecasts to stagnate and could be one reason why company profitability trends are at risk. And if we follow history, this indicator can predict short- to intermediate-term market peaks. For example, margin forecasts were lower in 2015, 2018, and 2020 right before meaningful S&P 500 declines. However, we have to wait and see what happens with inflation forecasts in the intermediate term before saying whether margin declines are here to stay for a while.

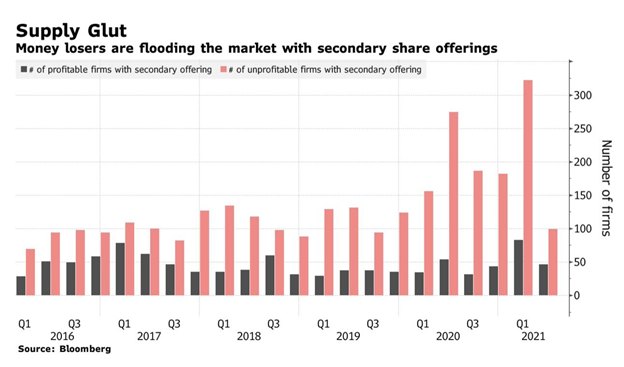

To be clear, we are not necessarily saying that a market decline is guaranteed or imminent. We are merely saying that investors should remain vigilant. Complacency at this stage in the cycle can be dangerous. It may be part of why we see an increasing number of unprofitable companies issue additional shares via secondary offerings as they see an opportunity to raise additional capital into a strong market at high valuation levels. They don’t want to be caught flat-footed should markets enter a corrective phase.

As a result, the playbook should remain to take a balanced view. As mentioned last week, many forces at play might tilt the scales in one direction or another. We continue to advocate for more neutral portfolio positioning blended with some tactical positions that could perform well under various scenarios. This positioning should provide the right balance of return potential and flexibility. An allocation to lower correlation strategies like those found in our liquid alternatives strategy is appropriate in many cases and could help reduce overall portfolio volatility.

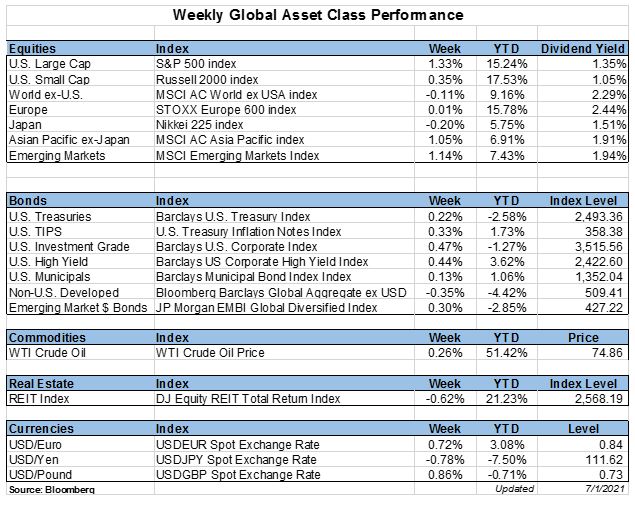

Weekly Global Asset Class Performance

June 2021 Update – FPA Tax and Estate Planning Knowledge Circle

Written by Scott Bishop, MBA, CPA/PFS, CFP®

Since the election last November, I have been talking with experts and writing articles on potential income and estate tax changes under the new Biden Administration and Democratic Congressional majorities. Several of these articles are listed below.

Early in the new year, I wrote an article called Key Estate and Income Tax Planning Takeaways from the “Blue Wave” Democratic Victories based on my interview of and discussions with Marvin Blum, JD/CPA of the Blum Firm.

Click Here to Read the Entire Article

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*