Published on: 12/18/2020 • 8 min read

Avidian Report – Why The Rise of Asia Is An Important Unstoppable Secular Trend

INSIDE THIS EDITION:

Why The Rise of Asia Is An Important Unstoppable Secular Trend

Interview with Matt Hougan from BitWise

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Coronavirus / COVID-19 Resource Center

This week’s commentary will be the 4th installment discussing five major trends that we believe investors should be watching as we move into 2021. As we have said before, we believe having an awareness of these trends may help investors position their portfolios from a strategic asset allocation standpoint as we move into next year and beyond.

[toggle title=’Read More’]

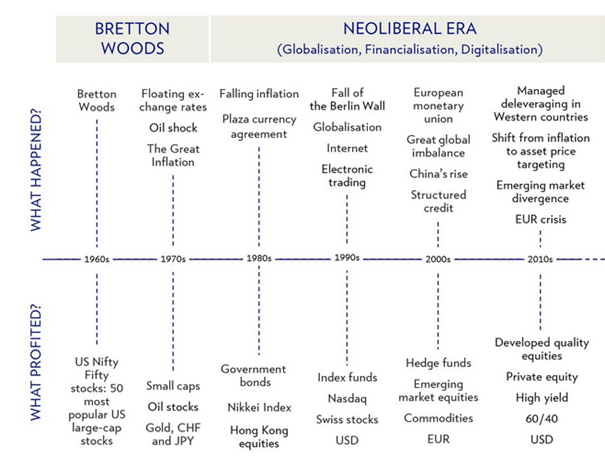

For investors’ financial outcomes, we believe being exposed to the correct long-term secular trends can determine long-term success for portfolios. Last week we shared the chart below because it does a pretty good job laying out longer-term regimes and the asset classes that performed well.

That backdrop once again informs our discussion of the fourth trend we will discuss in this series: The Rise of Asia will create strategic competition between dual economic growth engines — the United States and China.

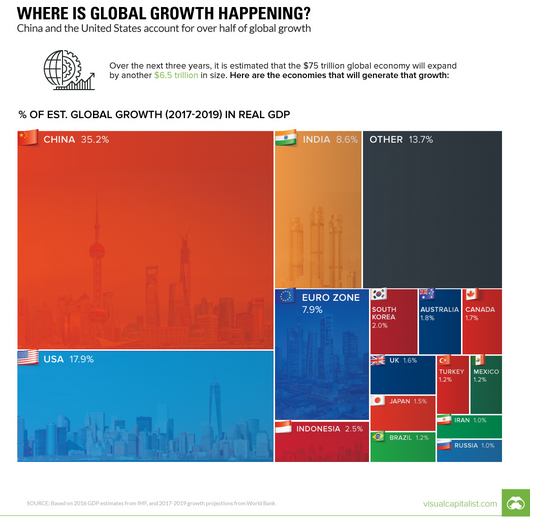

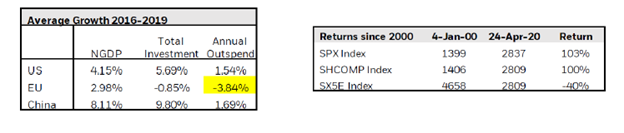

This dynamic really does pose a bit of a problem for the world economy. If you look at the contribution to global growth, China and the United States combine to contribute more than 50% of global growth. As the chart below also indicates, China accounted for more than 35% of global growth in real GDP terms between 2017 and 2019, a number that was more than twice that of the United States at just above 17%. Thus, highlighting the rise of Asia, especially when adding contributions by countries like India.

What is more, is that China and the United States are undoubtedly the most important engines of global growth and are the most highly integrated countries with global trade and global supply chains. What this really means for the world economy is that any type of disengagement from either China or the United States stands to provide a major headwind to global economic growth. While we have seen trade-tensions heightened during the Trump administration between these superpowers, it appears unlikely that these tensions will dissipate with a new Biden-led administration. In fact, tensions may even intensify in a high stakes game that holds important strategic importance for both China and the US.

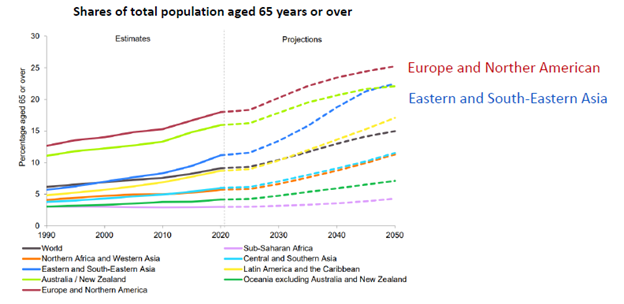

This rise of Asia also ties into what we are seeing in world demographics, the first of the key secular trends we are highlighting in this series. As we touched on several weeks ago, it is a well-known fact that older populations in Europe and North America are trending higher. In other words, as a percentage of the population, people 65 and over are growing in these continents. In Asia and China especially, the situation is even more stunning thanks in large part to their one-child policy. In short, China’s population will age as we are seeing in Europe and North America but will do so at a much faster rate.

The implication of this, of course, is that it will very quickly lose the economic dividends paid by having a younger working-age population they have enjoyed over the last thirty years. And, further will cause China to fight these negative impacts by trying to move up on the value chain.

While many investors believe the main issue between the US and China trades, we believe that is secondary to the technological competition occurring between nations as this is a means to capture more value from the economic value chain.

As an example, back in 2008, China and the United States also ran a large trade deficit. In the sale of an iPhone back then China was capturing approximately $40 of value from the sale of an iPhone in the US. Fast forward to today, and China now captures nearly $250 dollars of value from the sale of the same iPhone.

As you might imagine, that has a major market impact. For the last decade, if you compare the US, Europe, and China, you can see that in the US and China, total investment has outpaced GDP growth. In other words, the US and China have overinvested in their economies. Europe on the other hand has underinvested relative to their GDP and has led to significant underperformance relative to the US and China over the last 20 years. But, as the chart shows below, this is far more relevant for investments in technology research and development which have moved higher by a significant amount and are really a bet on the strategic importance of technology going forward.

For investors, this secular trend is likely to intensify and gain importance for how portfolios are positioned. Namely, we believe having exposure to global assets, especially those that include exposure to the growth engines discussed above will grow in importance. Second, technology is likely to continue playing an important role in future economic growth not only in China and the United States, but for the entire world. And how much a particular economy invests in these areas could potentially be a key driver for how a particular country’s stock market performs over longer time frames.

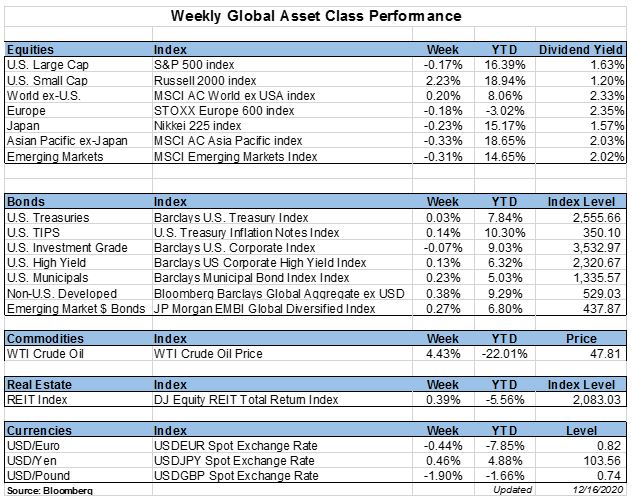

Weekly Global Asset Class Performance

[/toggle]

Mike Smith interviews Matt Hougan on The Money Hour. This was a follow-up to our last conversation with Matt. In the six months since that program aired, the changes to the cryptocurrency sector have been amazing to watch. Doug and Mike dig into the numbers and discuss where crypto is headed and who is buying. Doug Hougan is excellent at making a very complex subject easy to understand.

Matt Hougan is the Chief Investment Officer at Bitwise Asset Management. Founded in 2017, Bitwise Asset Management pioneered the first cryptocurrency index fund and is the leading provider of rules-based exposure to the crypto asset space. Think of Bitwise as being like the S&P 500 for crypto. Shares of the Bitwise 10 Crypto Index Fund (the “Fund”) began public quotation on OTCQX® on December 9, 2020, under the ticker symbol “BITW.”

Click Here To Listen To The Full Interview

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

There is no question that 2020 has been a year that everyone just wants to put behind them and hope for a brighter 2021. But before you start thinking about 2021, do not forget about your 2020 year-end tax and financial planning because there are still opportunities and strategies to consider, at least from a planning perspective, to take advantage of before year-end.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*