Published on: 07/28/2023 • 6 min read

What Are the Benefits of a 529 Plan?

529 plans have become increasingly popular as a tax-advantaged savings vehicle for education expenses, but what are the benefits of a 529 plan in Texas, and are they right for your family? While 529 plans in Texas offer several benefits, we know that high-net-worth families all have unique financial needs to be considered when making any decision about where to invest their hard-earned money.

Avidian Wealth Solutions offers financial planning in Houston and Austin for high-net-worth individuals, families, and executives looking to optimize their financial life. If you have any questions about how a 529 plan might benefit your family (and your estate), schedule an appointment with one of our fiduciary financial advisors today.

What is a 529 plan?

529 plans are tax-advantaged investment accounts used specifically for paying for qualified education expenses like tuition, books, and room and board. Each state sponsors at least one 529 plan, offering a range of investment options and tax advantages.

Texas has three state-sponsored 529 plans: the Texas College Savings Plan (TCSP), the Lonestar 529 Plan (LS529), and the Texas Tuition Promise Fund (TTPF). The major difference between the three is that the TTPF allows families to pay for future education expenses at current rates, while the TCSP and the LS529 allow families to contribute to portfolios to be accessed at a later date.

Can you buy an out-of-state 529 plan? You may be able to contribute to an out-of-state 529 plan, which could have lower fees and more tax benefits as compared to the above Texas plan. Before investing in any 529 plan though, you’ll want to make sure you consult your estate planning advisors before making such a decision.

What are the advantages and disadvantages of 529 plans?

529 plans are a way for high-net-worth families to benefit from tax advantages at the federal and state level with little to no hassle. While this doesn’t mean that 529 college savings plans will be right for every family, it does mean that your family should consider it if you plan on sending future generations to college and want to save.

What is the advantage of a 529 plan?

The benefits of 529 plans will change from state to state and plan type to plan type, but some of the common benefits of a 529 plan in Texas include:

- Tax benefits* — Because earnings accumulate tax-free and qualified withdrawals are federally tax-free, the tax benefits of a 529 plan can be vast and rewarding.

- Estate planning options — 529 plans for grandchildren can be a powerful estate planning tool because of the gift tax exclusion.

- Control and flexibility — The account remains in your control and you can change the beneficiary of the plan as needed.

- Ability to convert to a Roth IRA after 15 years — see more on this below.

*Continue reading: Are 529 contributions tax deductible?

Understanding 529 rollover to a Roth IRA

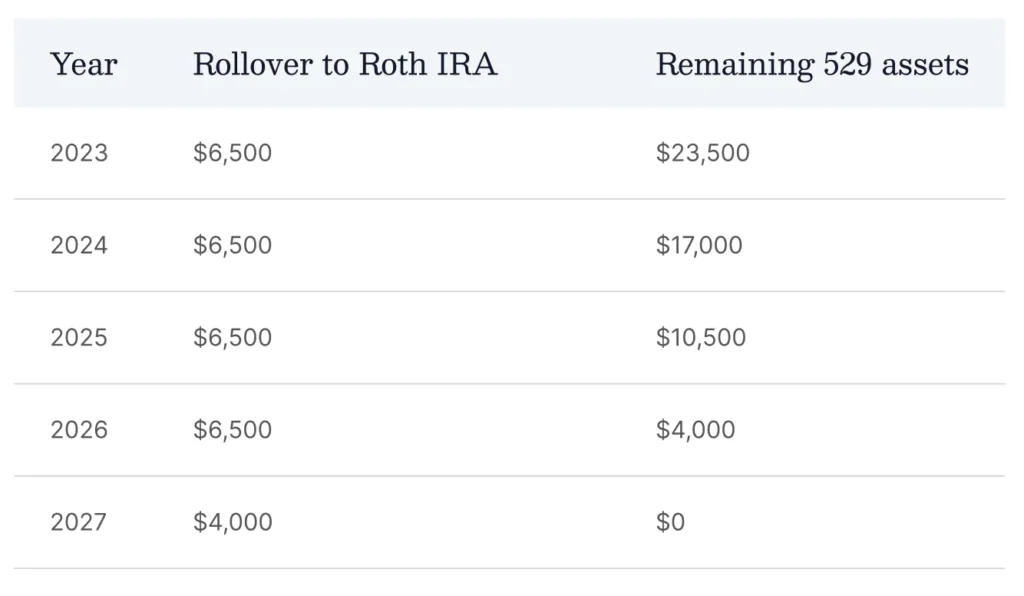

As per Secure 2.0, beneficiaries can convert up to a lifetime maximum of $35,000 from their 529 to a Roth IRA starting in 2024. Keep in mind that the annual contribution cannot exceed the annual Roth IRA contribution limits and the 529 account funds converted to a Roth IRA may not exceed the aggregate amount contributed to the 529 plan account (including earnings on those contributions) in the 5 years prior to the Roth IRA conversion distribution date.

Here’s an example. Carol has already finished college and has started her career but has remaining funds in her 529. Carol’s parents can convert the excess assets (up to a lifetime limit of $35,000) into a Roth IRA for Carol tax-free. Due to annual contribution limits, this strategy would take multiple years to fully transfer the remaining 529 plan assets, refer to the chart below to see how this would play out.

What are the disadvantages of a 529 plan?

What happens to 529 if a child doesn’t go to college? Do all states offer tax credits or deductions on 529 plans? The following are a few scenarios in which you may not want to invest in a 529 plan:

- You’re not sure if your children will attend college. Because 529 funds must be used to pay for qualified educational expenses, it is easy to trigger tax penalties if the money isn’t spent on qualified expenses.

- You’re sure your child will receive federal aid. If you’re expecting or counting on federal aid or scholarship for your children, the 529 plan funds will likely count against them.

- You live in Wyoming, the only state that doesn’t offer a state-sponsored tuition plan.

Because Texas does not have a state income tax, all of the tax benefits of investing in a 529 plan come from investing in the account itself, but this does not mean that a 529 plan is not a worthwhile investment to explore for high-net-worth families in Texas.

In order to make a more informed decision, you should always contact an experienced financial and tax advisor before deciding to invest.

How much does a 529 plan save in taxes?

529 tax benefits in Texas are similar to those of 529 plans in many other states in that they mirror federal tax benefits and do not come with any state-specific income tax benefits (because Texas does not have a state income tax). However, they still come with plenty of other tax incentives. Some of the 529 tax benefits in Texas include:

- Eligibility for up to $17,000 gift tax exclusion.

- Eligibility for contributions beyond the gift tax for 5-year gift tax averaging, allowing lump sum contributions up to $85,000 before incurring gift taxes.

- Tax-deferred earnings accumulation.

- Distributions for qualified education spending are entirely tax-free.

Although 529 plan contributions are not deductible because of the lack of income tax in Texas, 529 plans can still save quite a bit in taxes for high-net-worth families looking to save for future generations.

Continue reading: What happens to your tax liability with proper financial planning?

Take advantage of the benefits of a 529 plan with Avidian Wealth Solutions

The benefits of a 529 plan can often outweigh the disadvantages for families looking to invest in their future and potentially reap tax advantages while they do it — but you’ll never know until you ask a financial advisor from Avidian Wealth Solutions what a 529 plan can do for you.

Avidian Wealth Solutions offers a boutique family office experience to those looking for financial planning in Austin, Houston, or Texas at large. Our approach to financial planning aims to help you optimize your existing wealth and your life. Our team of multidisciplinary professionals collaborates on various areas of your wealth with the goal of helping you work toward reaching your financial goals.

More Helpful Articles by Avidian:

- Are Bonds a Good Investment Right Now?

- Debt Ceiling Concerns Surface as X-date Looms Near

- How To Protect Assets for Your Aging Parents

- How To Talk to Your Advisor About Asset Allocation Strategies

- Investing in Bullish vs. Bearish Markets

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*