Published on: 09/25/2020 • 8 min read

Avidian Report – Could Dividend and Buyback Activity in Banks be Signaling a Bank Stock Recovery?

INSIDE THIS EDITION:

Could Dividend and Buyback Activity in Banks be Signaling a Bank Stock Recovery?

Weekly Global Asset Class Performance

Trump vs. Biden Tax Policy Proposals

Coronavirus / COVID-19 Resource Center

Companies have different ways to return cash to shareholders. Cash dividends and stock buybacks are two of the most popular ways. Over the last two years, companies have increasingly relied on buybacks to reward their shareholders. However, COVID-19 and the economic uncertainty it caused led to a bit of a pull back in the amount of corporate cash used to buy back shares.

[toggle title=’Read More’]

The chart below shows the last 8 quarters and both dividend and buyback activity for the S&P 500. The all-time high for quarterly dividends was seen in the first quarter of the year when the aggreagate payout among S&P 500 companies was $127B. Buybacks for those firms on the other hand, dropped 55.4% in the 2Q, down to $88.7B. This massive decline in buyback activity marked the lowest buyback amount since 2012. It was not just the amount of dollars spent on buybacks that declined. It was also the number of S&P 500 companies that executed buybacks. After the first quarter, which saw 79% of S&P 500 constituents execute buybacks, the second quarter saw only 49% of S&P 500 companies do the same. This is a direct sign of the influence a highly uncertain economic and earnings environment can have on capital allocation decisions for companies. What is also worth noting is that dividend cuts during the second quarter were far smaller than the cut in buybacks, with only an $8B reduction compared to the first quarter. This makes sense to us because management teams often resist cutting dividends as it can erode the shareholder base and cause sharp share price declines.

Following the second quarter buyback decline, we are seeing signs that buybacks may be rebounding, especially in certain sectors.

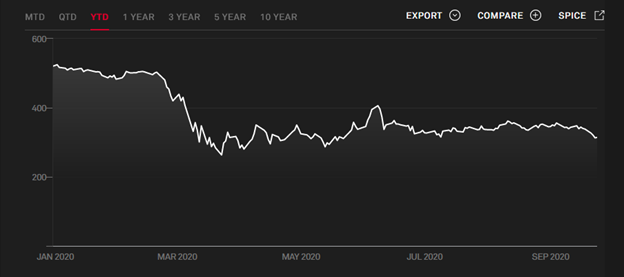

Take the banking sector for example. For banks, share buybacks took a pause in the front half of the year, mirroring what we saw in the broad S&P 500. However, it looked to us that this was less about fundamentals and solvency concerns. Instead, it was attributed to pressure from regulators as they looked to ensure that the banks would remain solvent healthy as the economic impact from COVID-19 looked both uncertain but also potentially dire. In response, the Dow Jones U.S. Banks Index has produced a year-to-date total return of -39.65% through the end of September 24, 2020.

DOW JONES U.S. BANKS INDEX YTD TOTAL RETURN

However, it is our opinion that the second quarter buyback suspensions may be set to reverse strongly in the coming quarters. Banks, especially regional banks, have been moving to reinstate their repurchase programs and we have seen a rising number of banks already reinstate their buyback programs or authorize new share buybacks over the last three weeks.

This leads us to believe that the return pressure we have seen for some bank shares for quite some time may be primed to finally relent. However, whether this will lead to a reversal in returns remains to be seen. If we were to look at the buyback story in isolation, we might be more sanguine.

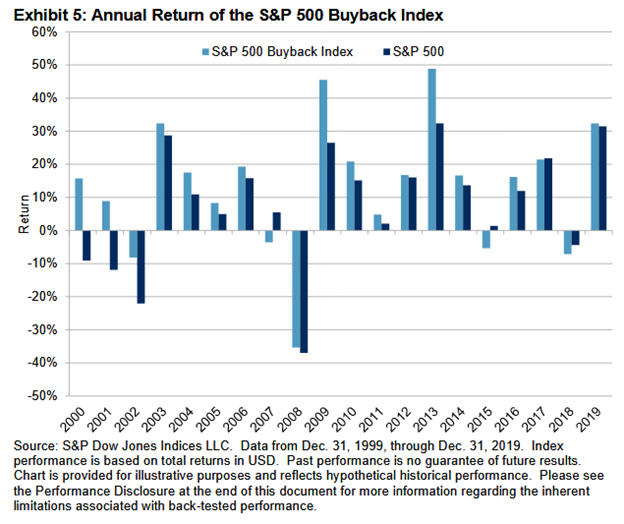

Afterall, history tells us is that buybacks tend to be a reasonable proxy for determining future returns. Take for example the S&P 500 buyback index performance over the last 10 years. That index tracks the equal weighted performance of 100 companies of the S&P 500 that also have the highest buyback ratios. Over that time this index outperformed the market cap weighted S&P 500 by more than 200bps annualized.

While at face value it does not seem like a lot, a 2% return differential is huge over long holding periods. As an example, a $100,000 portfolio growing at 7% for 25 years with no additional investments would be worth $175,404. That same $100,000 portfolio growing at 9% for 25 years with no additional investments would be worth $340,217 which amounts to 93% more money at the end of the 25 years.

Unfortunately, the investment landscape is complex and this very compelling buyback story for financials may be partially offset by the continued low interest rate environment that in some ways impedes the ability of lending institutions to generate higher profits.

That said, with many banks trading at or below their book value, it may not be a bad sector to look for opportunities. However, it is our view that for this out-of-favor sector to truly inflect, we would need a more hawkish Fed and a meaningful economic recovery post-COVID-19.

Weekly Global Asset Class Performance

[/toggle]

Trump vs. Biden Tax Policy Proposals

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Chris Masters, CPA

With less than two months away until the presidential election, President Donald Trump, the Republicans’ choice for another term, and Former Vice President Joe Biden, the Democratic nominee, are in the home stretch of making their cases to voters. Come Nov. 3, 2020, changes may be on the horizon based on each candidate’s differing views on popular tax policies. I have been working with the CPA Firm Doeren Mayhew’s tax advisors break down each policy, equipping you with the tax information you need to know before casting your ballot on voting day.

View our comprehensive side-by-side candidate tax policy infographic

Stay Informed and We’ll Keep You updated

Depending on the candidate elected for the presidency, there may be tax repercussions for both individuals and businesses. Before you cast your vote on Nov. 3, be sure to evaluate the candidates’ tax policies to learn how you and your business could be affected. If you have questions about President Trump or Former Vice President Biden’s proposed tax policies’ potential impacts on your unique situation, please feel free to contact your financial advisor at Avidian Wealth or a member of the CPA and advisory team at Doeren Mayhew

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

This is for informational purposes. The information was prepared by Avidian Wealth Management and Doeren Mayhew CPA’s and Advisors this information has not been independently verified by a third party. Avidian Wealth Management LLC is not an affiliate of Doeren Mayhew CPAs and Advisors, their offerings, nor their management team.

Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security or product.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*