Published on: 04/24/2020 • 6 min read

Avidian Report – Do Oil Markets Offer Opportunity?

INSIDE THIS EDITION:

Do Oil Markets Offer Opportunity?

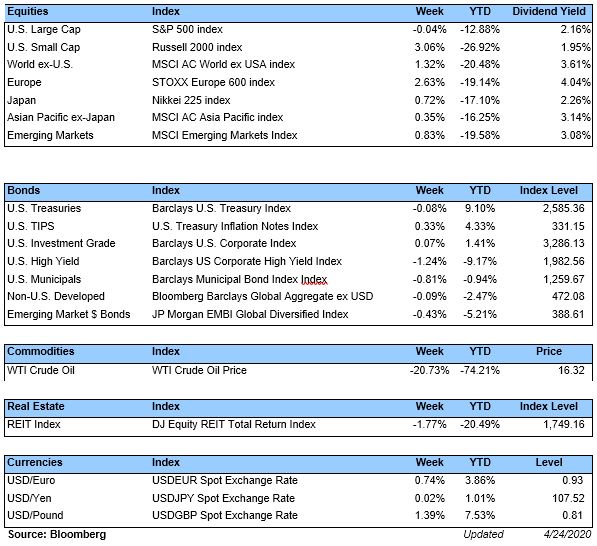

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

There are currently an equal number of arguments for why an investor might be bullish as there are to be bearish in today’s market. This signals the need to take a balanced view, and not allow one or two days of negative or positive market performance cause knee-jerk reactions to de-risk or re-risk portfolios.

[toggle title=’Read More’]

The truth is that the current environment remains extremely uncertain and knee-jerk reactions can take investors away from their discipline. Instead, it is far more productive to have a plan for increasing and/or decreasing exposure and then adhering to that plan. However, we must also acknowledge that economic data and markets are changing rapidly. For that reasons, we also believe that having an ability to be tactical is of increasing importance. That means having levers we can pull to position portfolios to take advantage of opportunities as they present themselves.

Along these lines, we are beginning to see investors ask whether oil markets at the current juncture present an opportunity. Frankly, we think investors that are asking this question are thinking about markets the right way – using volatility in the near term to capture opportunity in the long term in beaten down sectors. That said, we caution investors who think about opportunity in beaten-down sectors to beware trying to catch a falling knife. After all, price and value are two different things — just because a stock has dropped in price does not mean that it is cheap. It could merely mean that something has changed and made the value of that stock decline considerably. With that said, we can now explore what we are seeing in oil markets.

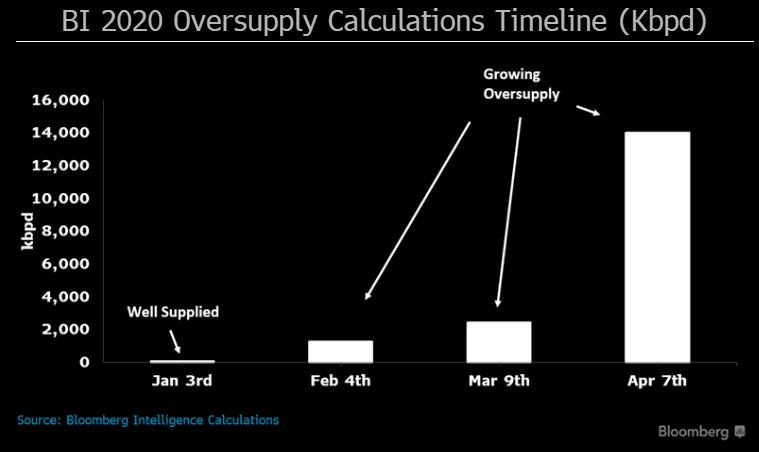

On the back of COVID-19, we have seen a breathtaking hit to demand. This is not surprising considering that many parts of the world have gone into lockdown as governments and health officials attempt to squash the spread of the virus. At the same time, we have seen many parts of the world increase production, virtually flooding the market with oil, which has caused an increasingly serious oversupply scenario. In fact, by some estimates, oversupply of oil may average 14 million barrels a day this year. Unsurprisingly, this imbalance has shocked oil markets and caused a ripple effect throughout the industry.

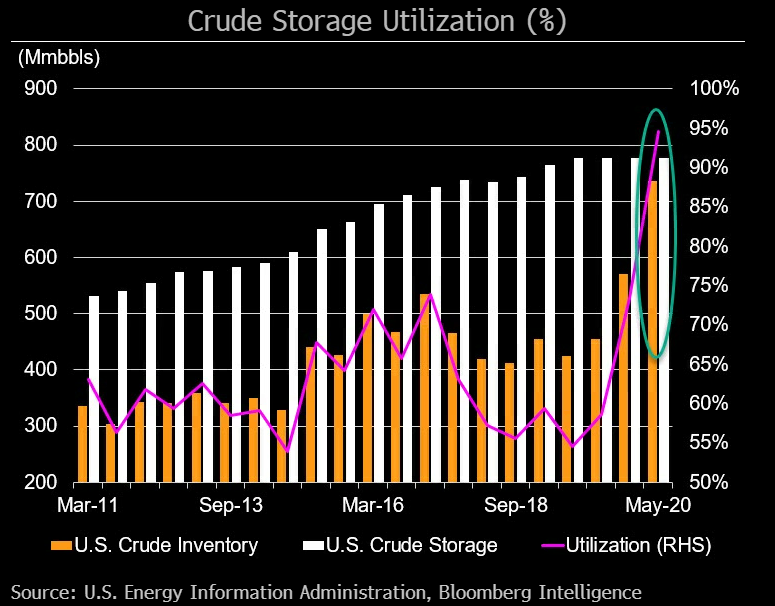

The effects have ranged from a collapse in oil prices, to a widening of contango in oil futures contracts, and a looming shortage of crude oil storage. By some estimates, US storage capacity may be 95% full by next month. In fact, it is the combination of reduced storage capacity and dramatic oversupply that we believe led the May contract of WTI to trade negative earlier this week. While it has not occurred yet, we do believe that there is a high likelihood that Brent Crude Oil contracts will be similarly affected as floating storage fills up. Unfortunately, we don’t know when the storage crunch will end as markets currently have little visibility into when oil demand will come back and begin working off the excess.

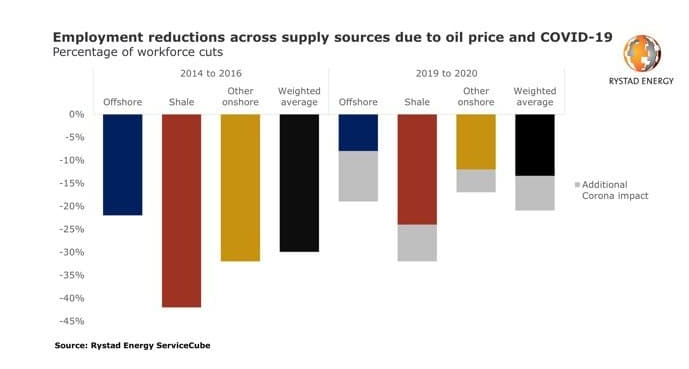

However, we do believe that the current oversupply and skyrocketing storage costs due to waning capacity are likely to keep oil markets under pressure for some time, barring something extraordinary. Exploration & Production companies are certainly feeling the pressure. Lower crude prices are poised to hurt profitability and reduce cash flows which will shrink energy sector budgets. Additionally, we would not be surprised to see dividend cuts and layoffs as companies do all they can to survive the current environment.

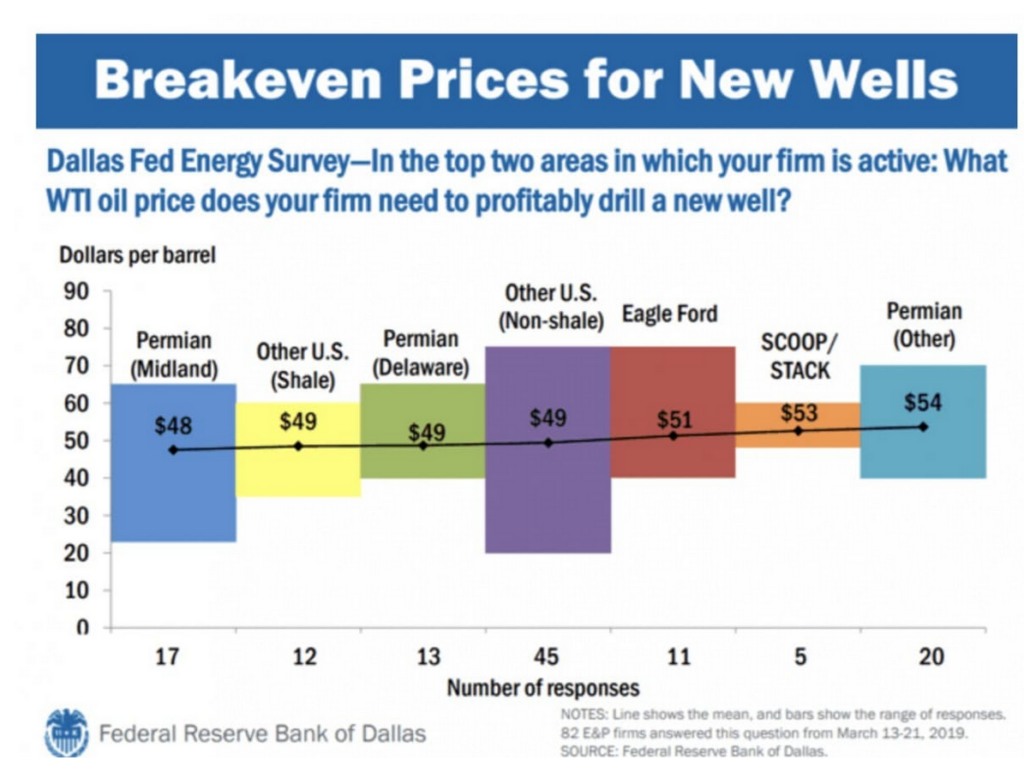

This is especially true for shale oil. The biggest issue is that breakeven prices are much higher than where oil trades today. As the chart below shows, shale oil breakeven prices are well above where crude is trading today and spells forced shut downs to production and potential distress in the shale patch. The Presidential administration sees the situation and has begun weighing whether to provide a lending facility for oil companies struggling in the current environment.

We don’t know that bailouts are the best antidote in this situation. As painful as it could be perhaps a hard reset might be healthier in the long term. However, we do know that with all the moving parts involved, it may be much too early to start looking for opportunities amid the distress within energy. However, we do believe the time to do so will come. In the meantime, we think investors are best served having discipline, tactical flexibility, and access to cash that can be used to invest opportunistically.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*