Published on: 05/01/2020 • 9 min read

Avidian Report – Economy, Stimulus, and COVID-19 Update

INSIDE THIS EDITION:

Economy, Stimulus, and COVID-19 Update

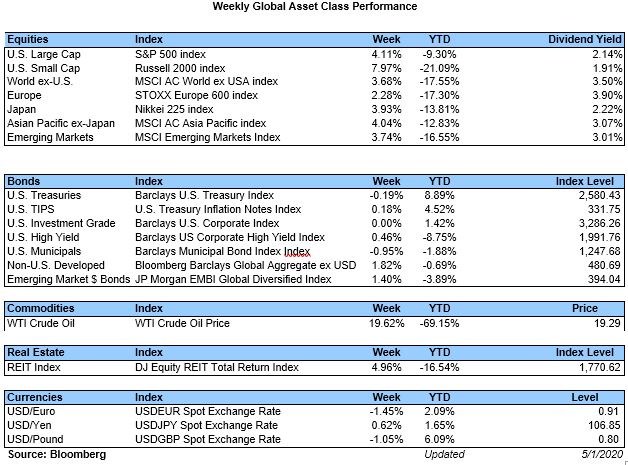

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

Equity markets and the economy have been completely disconnected from one another with the equity markets recovering as the real economy languishes. The S&P 500 is now only down approximately 10% since the beginning of the year while economic activity has collapsed.

[toggle title=’Read More’]

Although it could be that investors have suddenly undergone a paradigm shift and now only look at long-term timeframes and performance, we seriously doubt it. Instead, we believe the dichotomy we are witnessing is symptomatic of Central Bank’s doing all they can to support asset prices long enough for an economic recovery to materialize. If that is the strategy, it is working, at least for now. If it will continue working remains to be seen and we remain concerned about the speed at which an economic recovery will take place due to high unemployment and unknown structural changes that could result from COVID-19. However, we have seen a few positive developments over the last several weeks as it relates to containing the virus.

In this week’s report, we provide an update of the three areas we continue to watch for signals that the environment is becoming more benign for investors – The virus, the economy, and stimulus.

The Virus

Our assessment is that progress on dealing with the virus has been good to date. We have seen a flattening of the infection curve in many geographies around the world and we are encouraged by an intensifying pursuit of a vaccine/treatment for COVID-19. Gilead published results which were cheered by investors earlier this week but we feel investor optimism over the trials of Remdisiver was an overshoot. While promising, information we have seen indicates that the drug comes with significant side effects and its efficacy remains questionable due to the absence of a control group during testing. We will see in the coming weeks whether we get any clarification on those drug trials.

A more encouraging sign on the drug development front is that the Trump administration is reportedly launching Operation Warp Speed. While a formal announcement has not been made, our understanding is that it is a Manhattan-project style effort designed to not only speed the development of a vaccine but also make it widely available by January. Although the project would allegedly be funded by taxpayers rather than participating pharmaceutical companies, we believe this type of effort aligns interests to get a drug developed as fast as possible and if successful could help finally put COVID-19 to rest. We remain cautiously optimistic that a vaccine breakthrough will come about, although we don’t know the exact timing of such a development.

On the flip-side, we do have concerns that the reopening of the economy at this stage does pose large risks not only to human health but also to the speed of economic recovery, particularly if it leads to the need to shut-down the economy again. There are two views about a reopening of the economy and both views can be well-defended. However, learning from history we see that loosening restrictions too early could unleash a stronger second wave of infection. This is what happened with the Spanish Flu in 1918. While we don’t know whether a similar outcome lies ahead, we do believe some caution is warranted and is something investors should watch very closely.

The Economy

As we all know at this point, the country has shut down in a sudden and unprecedented way. Although some states are partially reopening, a large part of the country remains fully shut down. We believe a phased reopening is sound strategy, at least from a virus standpoint, as it allows us to gauge the risk of a spike in new infections. However, even if we assume that the concerns of a second wave are unfounded, we see evidence that a return to business as usual will be slow.

A survey conducted by the Pew Research Center shows that a majority of Americans, regardless of political affiliation, remain concerned that restrictions will be lifted too quickly and this has major implications for the shape of a recovery for the economy. If consumers are slow to return to retail stores, restaurants, travel, and resume normal daily activities, then GDP will continue to suffer beyond the second quarter.

The first quarter GDP number was already dismal as consumer spending fell at a 10.2% annual rate. While this is an ugly print, we believe the second quarter is likely to be even uglier. The question then becomes whether we begin to see GDP start to recover in the second half of the year. Frankly, we believe we see some improvement later in the year, but the magnitude of that improvement remains highly uncertain. The leading reason is the extremely high levels of joblessness in the US since COVID-19 emerged and how that might hinder consumer spending and weigh on sentiment.

As we see it, high unemployment is a monumental challenge for the US economy to overcome, even if all 50 states manage to reopen their economies quickly. After all, how long would it take to re-employ the 30M people that have filed for unemployment benefits over the last 6 weeks? We think the answer is a lot longer than the market seems to be pricing into stocks.

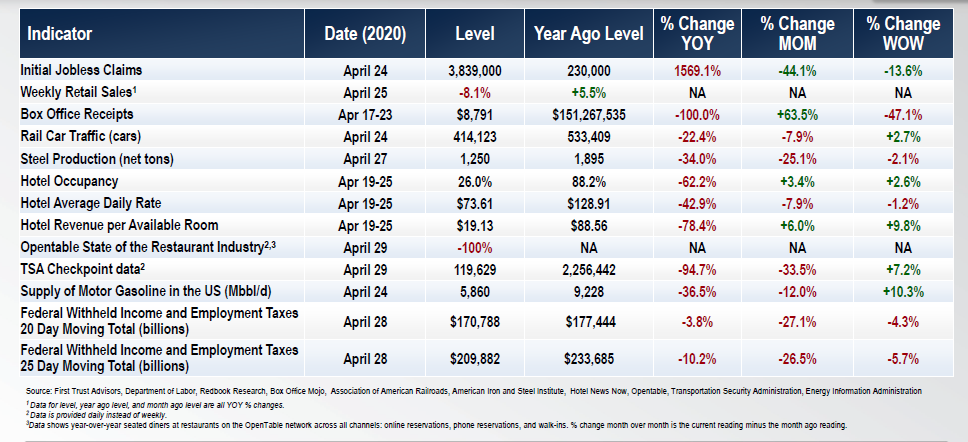

Yesterday, we got updated high frequency indicators. You may recall that we first mentioned them in our weekly report a few weeks ago. As a reminder, the indicators in the table below are measured on a weekly basis and are one of the few windows that we have into how the economy is doing in real time.

The picture painted by the high frequency economic data is truly a mixed bag. However, we can use it two ways. First, to see shorter-term economic trends and second, to glean insights into how some industry groups might be faring through COVID-19.

Some things we want to highlight are the improvement in TSA Checkpoint data this week compared to last week. This tells us that people are slowly beginning to fly. However, we must remember that year over year, TSA Checkpoint data is down 94.7%. It doesn’t really take a lot to see an improvement off of such terrible numbers. The same can be said about hotel revenue per available room which is up on the week, but still well below where it was one year ago. While many investors may want to take advantage of lower stock prices in the hotel and hospitality sector or in the airline sector, we urge caution as many of these stocks are merely sporting lower stock prices because their earnings have been impaired. Adding exposure to these areas requires selectivity as there will be both winners and losers.

Stimulus

Not much has changed as it relates to stimulus over the last couple of weeks. We continue to see a willingness of central banks to support the economy and we would not expect that to change anytime soon.

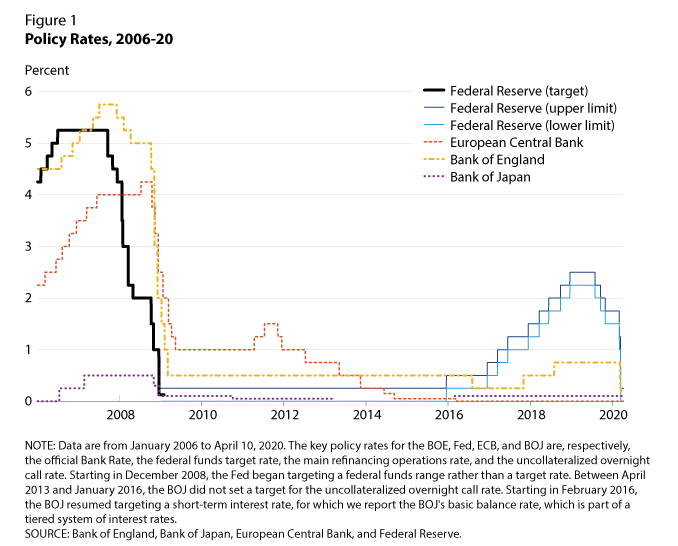

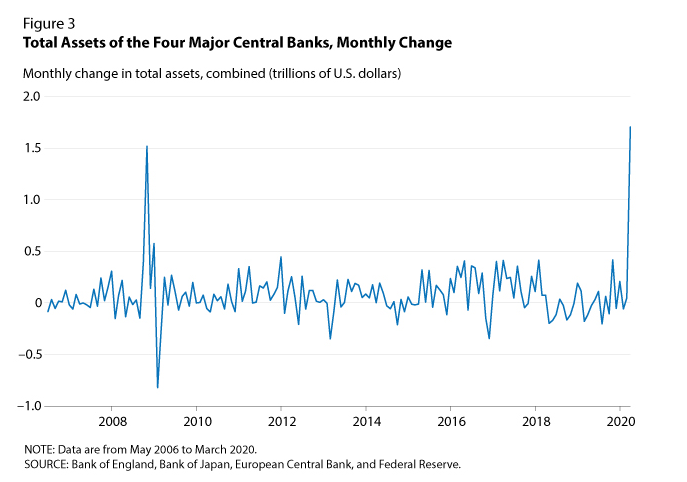

That said, we do think it is worthwhile to provide a few charts that highlight central bank policy rate cuts, asset purchases that continue to provide asset price and liquidity support across the globe, and the rapid expansion of central bank balance sheets. We believe these measures have largely helped to support the rally in risk assets over the last month. If markets begin to move lower once again, and economic data does not stabilize, there may be even more policy action to come.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*