Published on: 05/29/2020 • 6 min read

Avidian Report – A Fed-Fueled Rally Marches On

INSIDE THIS EDITION:

A Fed-Fueled Rally Marches On

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

Over the last several weeks animal spirits have been firmly in control of domestic equity markets as stimulus measures in the US encouraged risk-taking on the part of equity investors. With each new round of stimulus from the Fed, we have seen the S&P move higher. Frankly, we think newly announced stimulus measures from Europe and Japan may further support the appetite for risk assets.

[toggle title=’Read More’]

However, we also recognize that despite all the policy stimulus and a recovering stock market, economic data still looks poor compared to pre-COVID-19 levels. That said, as we mentioned last week, there are some initial signs that things are improving, albeit slightly, off extremely depressed levels. While the inflection in the data is encouraging, we believe investors should closely watch for possible breakdowns in improving trends. Especially considering the wide gap in sentiment between equity investors and consumers, which has widened to levels not seen in the last 40 years.

As we monitor market movements, we note that major indices have not reacted much to upside economic surprises. Instead, equity market moves after upside prints have been somewhat muted. We have given this feature of today’s equity market considerable thought and are gaining conviction that it is signaling that the economic recovery we are seeing as states loosen restrictions has been largely priced in. As a result, in the near-term, and absent any major COVID-19 treatment or vaccine, it may become more difficult for the equity markets to move higher in a powerful way. Instead, we think there is a higher probability that equity markets march upward at a slow pace as things improve further, with occasional, and potentially short-lived, bouts of volatility.

What leads us to this conclusion is that bad news and other uncertainties that would have historically unleashed wild volatility (Hong Kong power grab, China/US trade, Libya tensions, domestic unrest in several major US cities, and a looming US election), simply have not done so as of late. Instead, there have been very brief episodes of mild volatility followed by relative calm in the markets. We think this is symptomatic of central bank intervention that has in some ways been focused on suppressing volatility after an initial push to ensure the functioning of markets.

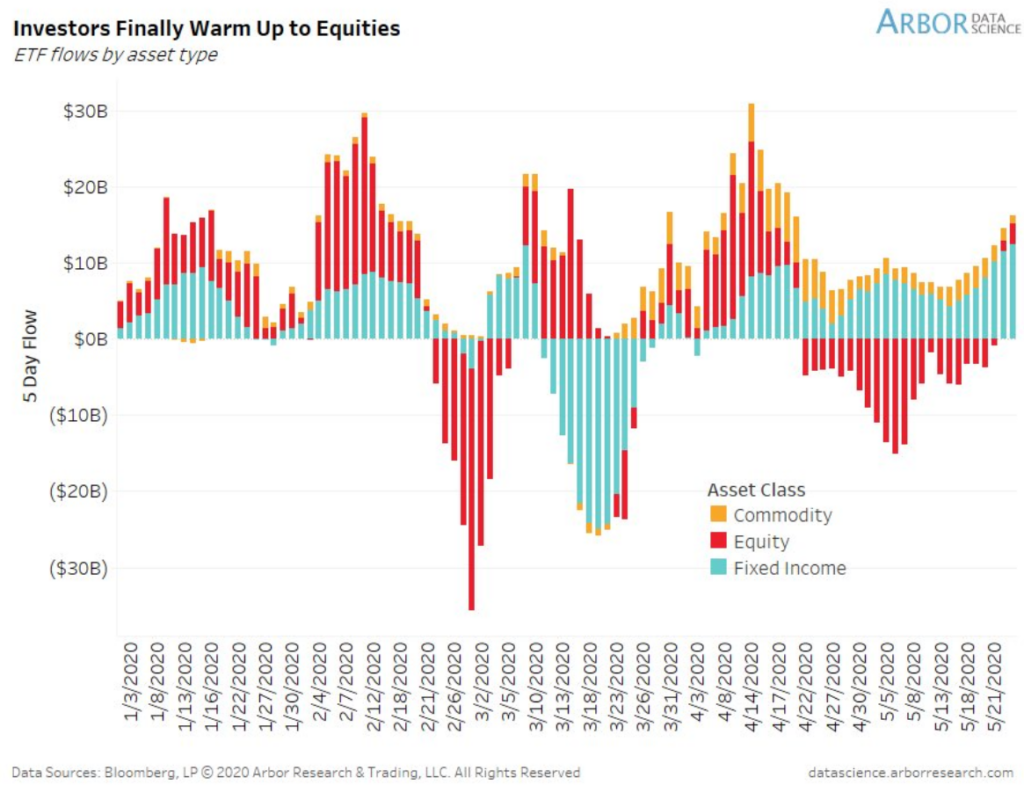

Looking at ETF inflow and outflow data we observe increasing flows into equity ETF’s which previously saw large outflows. We think this reflects two things. First, that as economies open, albeit very slowly, investors are leaning hard into the idea that the COVID-19 recovery will be swift and without challenges (as the chart below shows there are still concerns surrounding a reopening of businesses, however).

Second, we think risk-taking indicates a belief that the world’s central banks will move swiftly to save the day if things don’t go as planned. We believe there is a willingness from policy-makers to go to great lengths to keep the economy, and markets, afloat.

While we don’t necessarily believe the economic recovery will play out without some equity market volatility due to risks outside of COVID-19, we do believe there are reasons to gradually and selectively add exposure to equities within portfolios. However, investors should take great care to be sure that they are compensated for the risks taken.

That requires being selective with exposures and waiting for moments when the odds are firmly in their favor. We believe the inflection in high frequency economic data we have seen over the last couple of weeks, the gradual reopening of the economy across states, and improvement in technical indicators are worth watching closely.

We have now witnessed approximately 96% of S&P 500 stocks cross above their 50-day moving averages. This is the highest reading of the 21st century and is certainly a bullish sign. However, we must temper that bullishness by factoring in that more than 50% of those stocks are yet to trade above their 200-day averages.

As we have stressed in many of our weekly commentaries over the last month, it is why we urge investors to think objectively about the data and remain balanced in their views and analysis. If this market has proven one thing it is that at the drop of a hat, things can change.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*