Published on: 06/26/2020 • 7 min read

Avidian Report – Growth and Value Divergence to Continue?

INSIDE THIS EDITION:

Growth and Value Divergence to Continue?

Weekly Global Asset Class Performance

Mike Smith Interview with Dr. Vikram Mansharamani

Coronavirus / COVID-19 Resource Center

The equity market has returned to a familiar pattern where growth outperforms value. Although the markets have been choppy with some intraday volatility, we believe growth’s outperformance over value reflects the growing concern over the second wave of COVID-19 and the accompanying impact that could have on consumer behavior.

[toggle title=’Read More’]

The equity market has returned to a familiar pattern where growth outperforms value. Although the markets have been choppy with some intraday volatility, we believe growth’s outperformance over value reflects the growing concern over a second wave of COVID-19 and the accompanying impact that could have on consumer behavior.

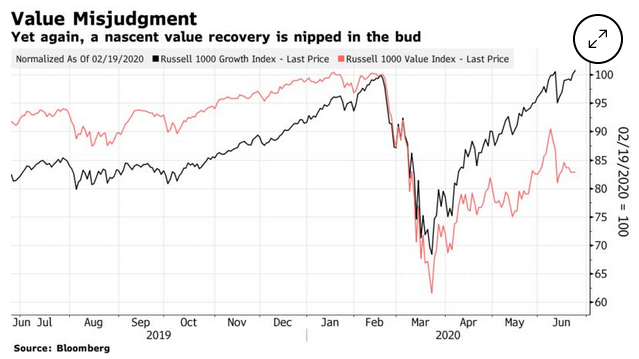

If we look at the Russell 1000 Growth Index and compare it to the Russell 1000 Value Index, we see that growth has fully recovered its intra-year losses while value still has considerable ground to make up to merely get back to even.

In some ways growth’s strength relative to value mirrors what we saw 20 years ago (1999-2000) when growth shares pushed the markets to new highs before the dot-com bubble burst. In fact, the growth/value ratio is so similar today to what we saw during the dot-com era, that it has some investors wondering if this is a repeat of history.

As we look at the data in front of us, we think it is possible that divergent performance between growth and value continues on the back of two forces – the growing importance of technology and this week’s announcement that the Fed will impose caps on the dividend payouts of banks while also barring bank stock buybacks at least until September. We think this announcement has the potential to hurt the performance of large banks in the near-term and as a result make value underperform growth even more.

Why technology and financials factor so greatly in the relative performance of growth and value is that technology is strongly represented in growth indices while financials are a large component of the value indices.

To be clear, we have started in some ways to view technology as an indispensable consumer staple. With the reliance on technology intensifying as more people work from home, shop online, and use technology to maintain social connections during COVID-19, the tech sector is more defensive than it has ever been.

However, that does not mean it is immune to drawdowns. It is also not prevented from contributing to a broad market drawdown. In fact, if the technology sector falls, the broad markets are likely to follow. This is due to the high weighting to technology within the major indexes.

Further, we also have a handful of technology companies driving a big part of index returns. Take for example, the S&P 500. Since the start of 2018, the 5 largest stocks (Microsoft, Apple, Amazon, Facebook, and Alphabet) in the S&P 500 have outpaced the performance of the index. Combined strong performance in these technology names have resulted in substantially positive returns for the index over that time period.

Granted there are some technology names that have likely run-up too fast off the March 23rd bottom in our view. In fact, there are currently 18 listed companies in the United States with market capitalizations above $10B that have also returned more than 100% year-to-date.

Additionally, we have a median EV/Sales multiple for these firms of 20x. Yet, this valuation multiple is not necessarily a sign of froth for the broad domestic equity market. Especially not with interest rates at near zero, tremendous liquidity being provided by central bank stimulus, and the narrow leadership we see in major market indices.

But, nonetheless we currently believe there are risks investors need to keep an eye on. For one, the world economy is certainly experiencing a contraction. This week, the International Monetary Fund has adjusted growth projections for the world economy as they project both a deeper recession and slower recovery than expected just a couple of months ago. Currently they expect the global economy to contract -4.9% while the expectation is that US GDP will contract -8% compared to the prior estimate of -5.9%.

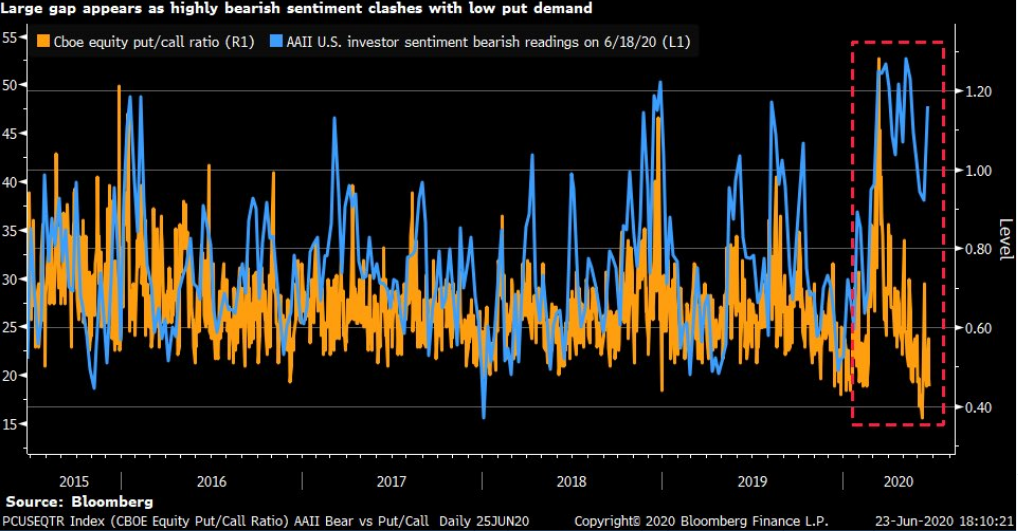

Naturally this downbeat forecast has caused bearish sentiment to persist at elevated levels. However, with the put/call ratio continuing to trend lower, it still looks like portfolio positioning is not yet reflecting investor bearishness and could be an indicator of investors commitment to chasing returns.

This is a bit concerning because we are also seeing many stocks still not trading above their 200-day moving averages, even in the tech-heavy NASDAQ. Again, this supports the notion that the rally, even in technology shares, remains fairly narrow.

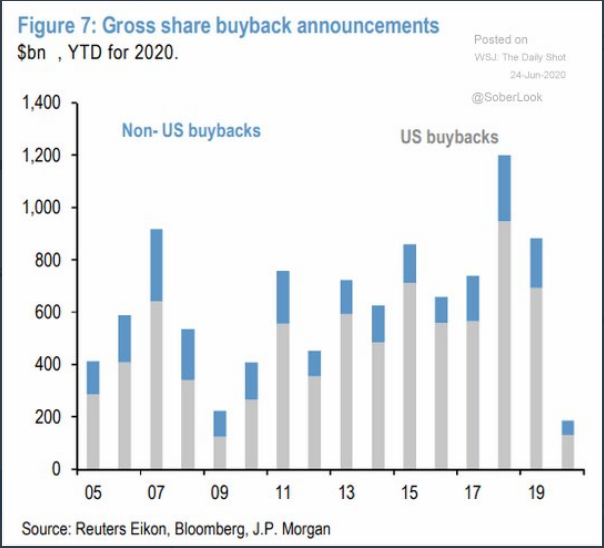

Moreover, we have gross share buyback announcements falling to their lowest levels in over 15 years. This is before the move by the Fed to suspend stock buybacks from financial institutions in a move that will make the Gross buybacks dry up further.

Outside of financials, we think the reduction in stock buybacks shows management teams caution as they navigate through the COVID-19 environment. Second, a potential sign of concern over the disconnect that appears to exist between equity performance and economic fundamentals.

As we move ahead, holding cash in portfolios can serve as a buffer against potential volatility and corrections. This can also provide dry powder to deploy as opportunities to add equity exposure at attractive valuation levels arise.

[/toggle]

Mike Smith interviewed Dr. Vikram Mansharamani

on The STA Money Hour.

Mike Smith interviewed Dr. Vikram Mansharamani on The STA Money Hour. The analysis of uncertainty. As we’ve become more reliant on data and technology, our focus has become more narrow and specific. Which is another way of saying “a broad and wider ignoring”. This concept about individual perception and perspective is what Vikram’s new book is about.

Click Here to Listen to the Full Interview

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*