Published on: 08/21/2020 • 4 min read

Avidian Report – Is It Too Late for Gold?

INSIDE THIS EDITION:

Is It Too Late for Gold?

Coronavirus / COVID-19 Resource Center

The gold rally seems to be the recent mania in financial news. Whether people own gold as a safe-haven for assets, to hedge risk, or simply euphoria. Some investors who were left behind may ask “is it too late for gold?

[toggle title=’Read More’]

Without a firm answer, we review the drivers of the price of gold. Ultimately, it is the momentum of these drivers that determines the future direction of precious metals.

- Real interest rate. Gold has an inverse relationship with the real interest rate, which is the opportunity cost of owning gold vs US Treasury. The Fed’s “whatever it takes” approach depressed real yield sharply in 2020, which is closely followed by the gold price. Can the real yield go even lower? It will be determined by the path of economic recovery and the Fed’s accommodative monetary policy. But at negative 1%, the room of even lower real yield seems to be limited.

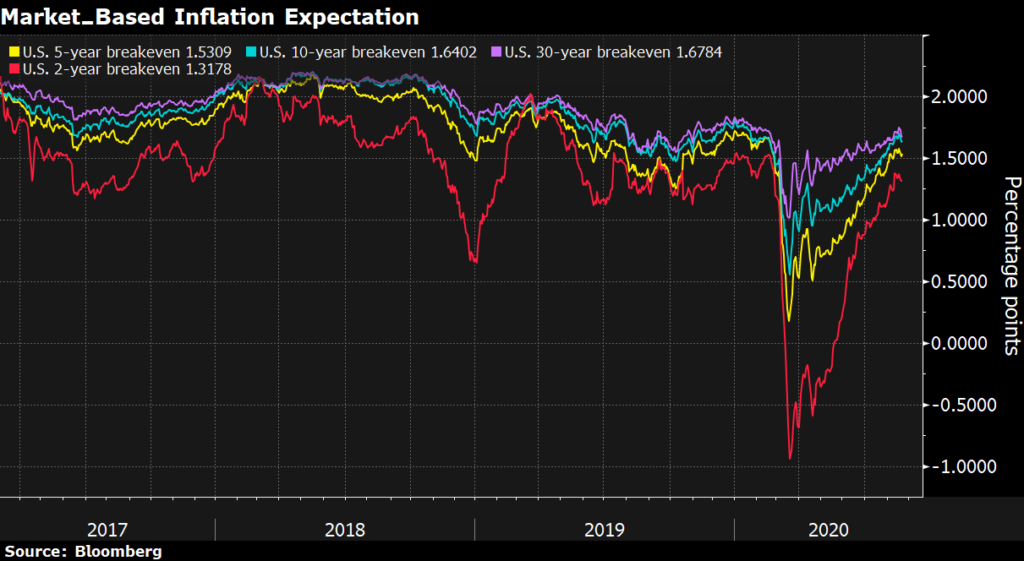

- Inflation expectations. The price of gold tends to have a positive correlation with future inflation expectations. Demand destruction during the COVID crisis has pushed market inflation expectation into a multi-year low at the onset of lockdown. Since March, the inflation expectation has been steadily recovering, which help support a higher gold price. Given extra monetary policy, disruption of global supply, and trade tension, we will not be surprised by higher inflation reading in the following months.

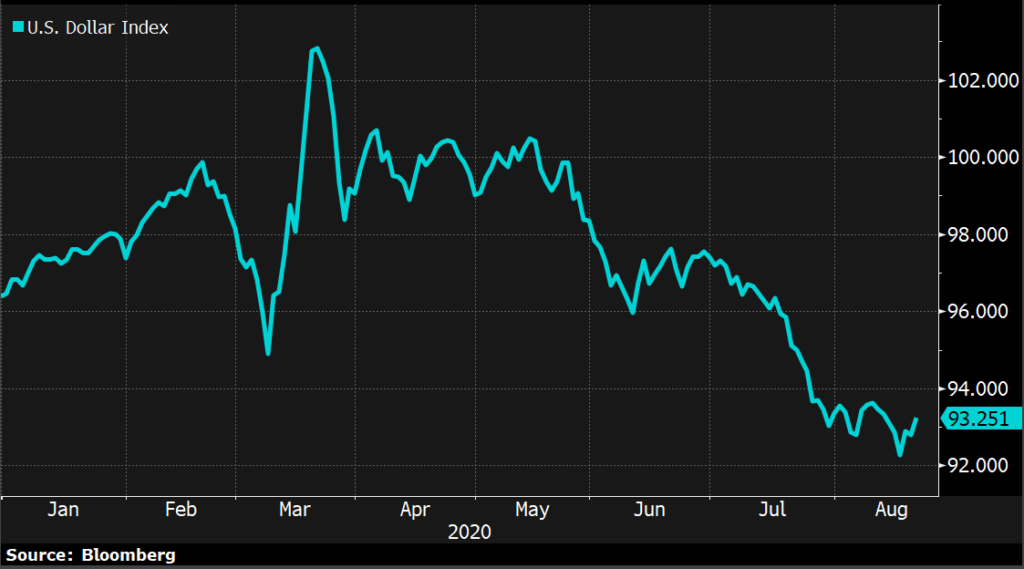

- US Dollar. Because commodities are denominated in US dollars. The 10% decline of U.S. Dollar from its March peak has fueled the gold rally. The continuous weakness of the US dollar would require more dovish Fed or slower-than-expected recovery of the U.S. economy, relative to the rest of the world.

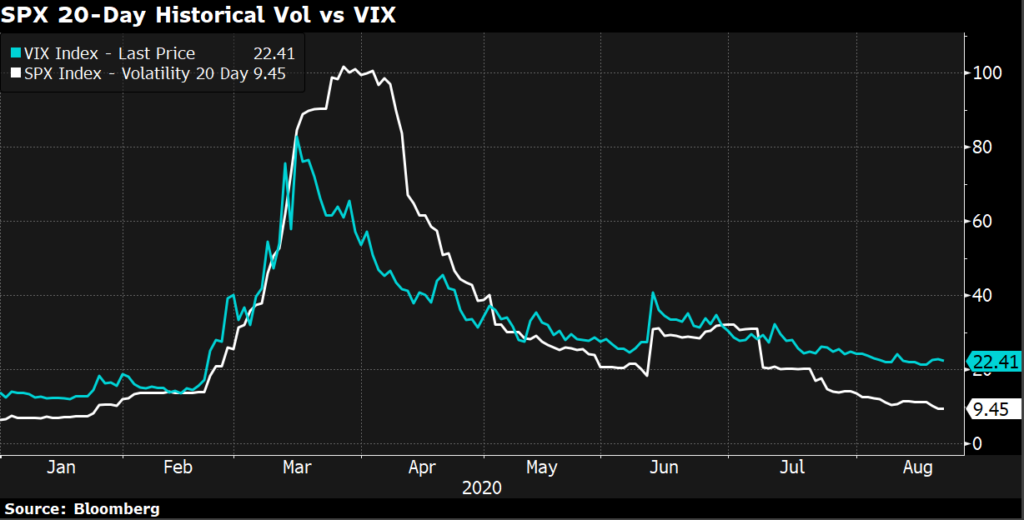

- Market volatility. Although March Madness is behind us, a great number of uncertainties related to the virus, the fiscal policy, the US election, and US-China tension will keep market volatility elevated above its historical norm, which supports the current valuation of gold. However, we do expect volatility to continue trending lower as uncertainties unfold themselves over time.

Given gold price is determined by multiple factors, thus it is difficult to predict the exact price movement. However, we do know, as a commodity, gold is highly volatile. A significant price correction can happen in a short period of time. For investors who view gold as safe-haven assets and plan to take unreasonably large exposure, this may well be a reason to take a pause.

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*