Published on: 07/23/2020 • 6 min read

Avidian Report – Is There More Upside Ahead for Equities?

INSIDE THIS EDITION:

Is There More Upside Ahead for Equities?

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

One of the most difficult things to do when markets are in decline or when the economy is faltering is to deploy capital. It tends to be scary and uncomfortable even for the seasoned investor. Our favored approach during the pandemic sell-off and subsequent recovery has been to deploy capital slowly and selectively as we emphasize the importance of balance within portfolios. In hindsight this has been the right approach for limiting performance drag, keeping exposure levels appropriate for the speed and pace of the recovery, and accommodating a wide range of potential outcomes.

[toggle title=’Read More’]

With the markets now back above pre-COVID levels, the STA Investment Committee has been debating whether equity markets have legs to keep running higher. Admittedly, we have gone back and forth about the merits of the bull and bear argument over the last few weeks but now think more upside could be ahead.

Granted, we have seen markets roar back by more than 45% since March 23, 2020 while we grapple with numerous bearish economic datapoints, a combination that tends to support a downward move for risk assets.

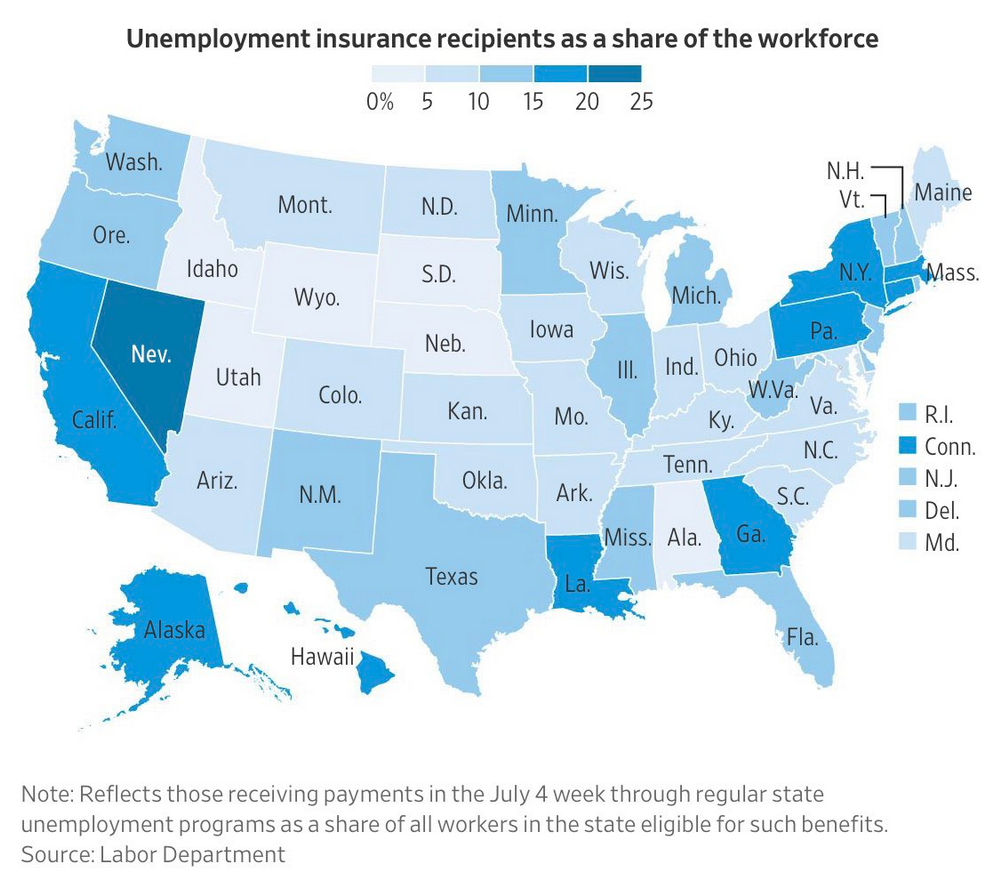

As a quick sample of bearish arguments out there, we can point to the high unemployment rate, rising number of bankruptcy filings across sectors, and sharp rent declines in places like New York.

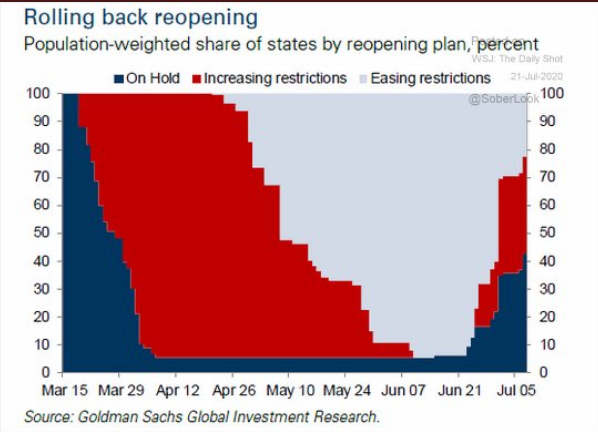

And that is before we consider that some states are being forced to rollback their economic reopening plans which could have additional negative effects on economic activity.

Retail investors are also suffering from fear of missing out and engaging in risky speculation. It is no wonder the Nasdaq Composite Fear-Greed Indicator is showing record high levels of greed, yet another bearish indicator.

But all of this is offset by one thing – stimulus, which we have cited as an overwhelming force in markets today.

Which leads us to an interesting datapoint that could support the case that despite the equity market’s sharp recovery off the lows, it could in fact move higher from here, and potentially meaningfully.

S&P 500/Reserve Balance Ratio

The datapoint we are referring to is the S&P 500/Reserve Balance Ratio. The numerator refers to the price level of the S&P 500 while the denominator tracks the aggregate assets and liabilities of banks within the economy, including the central bank. As you might imagine when the Fed expands its balance sheet, this index balloons higher so we can think of it as a proxy of sorts for the Fed balance sheet.

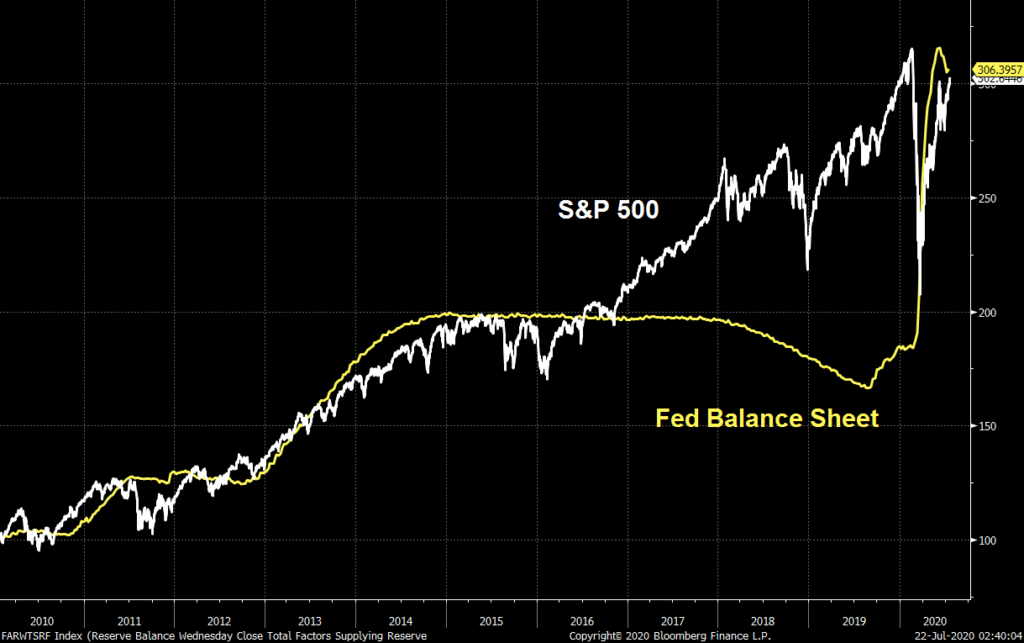

We first started looking at the Fed balance sheet and its correlation to the S&P 500 several years ago to understand the impact that quantitative easing programs were having on equity market performance. As you will see in the chart below, the reserve balance tracked the S&P 500’s price level closely from 2010 to 2016. Then we saw a divergence for a couple of years before the lines once again converged as the steepness in the growth of the Fed balance sheet coincided with the sharp rally off the March lows for the S&P 500.

Where it all comes together is when we take a ratio of these two lines. In other words when we divide the S&P 500 by the Reserve Balance. As you will see on the chart below, the ratio is currently well below where it was between 2016 and 2019.

Investors might interpret this as a measure of the markets level on a Fed balance sheet adjusted metric with the key takeaway being that the market’s recovery off the lows this year may in fact be small and signal two things. First, that perhaps the equity market and economic data is not as disjointed as meets the eye and second, that it is possible that markets have considerable upside still left in them if the S&P 500/Reserve Balance Ratio is to return to pre-COVID levels.

Another factor is that we estimate that every 1% drop in the 10-year Treasury yield should support 2x P/E expansion. If this is true, and earnings recover to pre-crisis high by end of 2021, market could rally another 10% from its all-time high.

Of course, we do not know whether this will come to fruition, yet. Only time will tell. However, the analysis above should serve as a reminder of how important it is for us to challenge our interpretation of data with the opposing view.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*