Published on: 08/18/2021 • 7 min read

Tax Update – August 2021 – Democrat Reconciliation Human Infrastructure Deal

For much of 2021, I have been writing on the potential for significant tax changes in the areas of estate planning, income tax planning, investment planning, and retirement planning. Many of those articles are listed at the end of this article for easy reference. The goal of this article is not to be political but rather to focus on tax law changes that you may be facing in 2021, 2022, and beyond.

At the time of writing this article, the Democratic Senate just passed its 92 page “$3.5 Trillion Budget Blueprint” budget reconciliation resolution. The Democrats want to implement significant social policy changes and are trying to find the money (with tax increases) to pay for it. We will leave it to the politicians to debate the merits of these changes (and some of them I think are fascinating policies for discussion – like affordable community college), but below I will focus on the tax changes.

Please note that this is only a blueprint passed by the Senate; no legislation has even been written yet. At this time, there is no assurance that any of these changes will take place, and we don’t know whether they will be effective in 2021, 2022, or further down the road. The Senate plans to have legislation written by September 15, 2021, so stay tuned!

Certain to be included are increases to the top individual ordinary and capital gains rates as well as the corporate rate, changes in the way we tax gifts and death, and a crackdown on carried interest (ending the “Carried Interest Loophole,” the way Warren Buffet pays less tax than his secretary–by taking more of his income as capital gains).

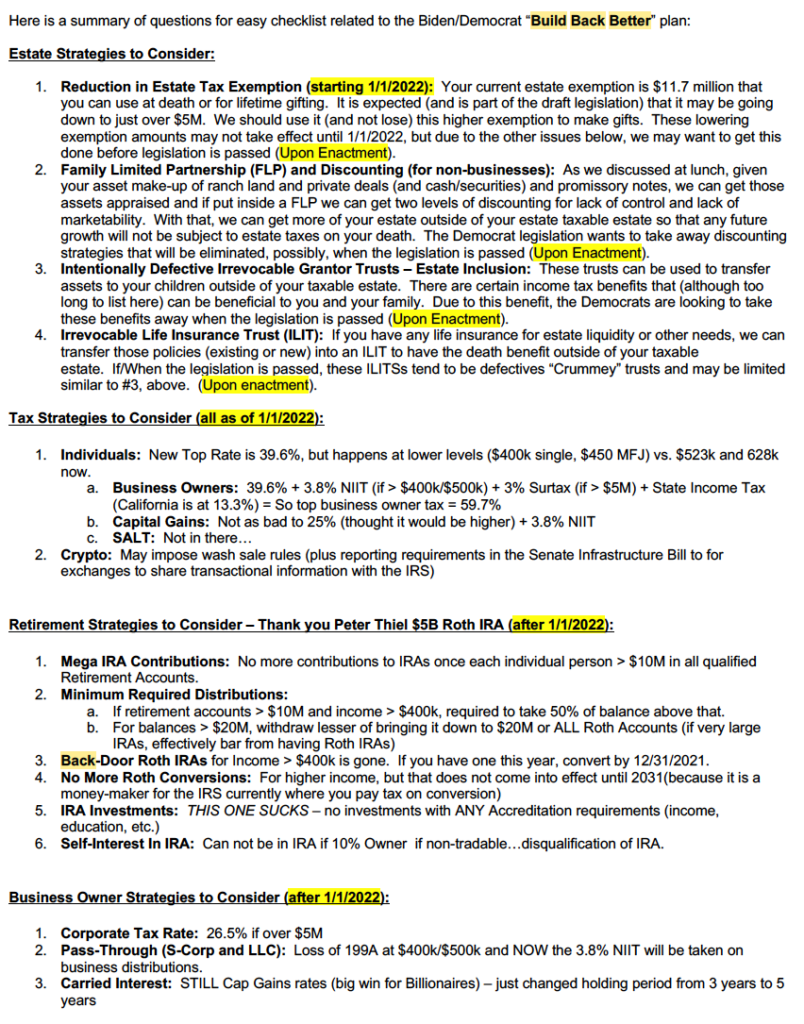

In May 2021, I wrote a one-page summary (see image below) of the changes President Biden was discussing, but now it is starting to take shape. So for today, I will focus on some areas and policies that we at Avidian Wealth will consider how they may impact your financial, estate, business succession, and retirement plans.

Summary of Tax Impacts of $3.5 Trillion Budget Blueprint

Democrats will have to dig deep to raise their intended goal of $3.5 trillion (and I think it will be higher). To put it in perspective, the IRS is expecting to have $3.86 billion in total tax receipts (personal and corporate) for the entire year of 2021. Democrats have promised not to impact those earning under $400,000, but how will they raise $3.5 trillion when those making over $500,000 per year already pay 70% of the taxes? Here is a brief summary of the expected tax increases or “pay for” – note that no specifics were listed in the “blueprint,” so we will have to wait until the legislation is drafted (without amendments) in September.

Estate Tax Changes:

- Reducing the Estate Tax Exemption and Tax Rate: Currently, everyone can exempt estate taxes up to $11.7 million of wealth ($23.4 million if married). This may be reduced to $3.5 million to $5 million per person, and the tax rate could increase from 40% to 50% or more.

- Step Up in Basis at Death: Currently, when someone dies, all assets in their name get “marked to market” (up or down from their cost basis). In community property states like Texas, the entire marital estate is stepped up. They are looking to either remove this step-up (allowing for a carry-over of the tax basis) or even imposing a capital gains tax at death.

- Loss of Estate Planning Strategies: In my 25-year career in financial services, I have used many estate planning techniques to reduce my clients’ estate tax liabilities. Many of these strategies related to various gifting and/or discounting strategies (with years of court precedent) may be taken away via legislative changes. Several are reviewed in the summary from May 2021 (below), and many of these “squeeze and freeze” gifting strategies (discussed in the articles below and in this FPA Webinar) may be eliminated as early as the passage of this bill in 2021. So consult your estate and financial planning team soon.

Personal Income Tax Changes:

- Income Tax Rates: Current tax rates are between 10% and 37%. Democrats have promised not to increase taxes on anyone making under $400,000 per year. We do not know how this will impact married vs. single Americans either (i.e. marriage penalty). First, they are looking to increase the 37% top current rate to 39.6%. A married couple exceeds the 37% tax bracket at $628,300 of income. Will they start increasing taxes on those making $400,000 to 39.9% (currently $400,000 is in the 32% tax bracket)? We will wait to see how they rearrange the tax brackets.

- Capital Gains: Currently, long-term capital gains (for assets held more than one year) are taxed at anywhere from 0% to 23.8%. The legislation may increase that to as high as 43.4% (+ state taxes if any). If this occurs, you may want to accelerate any near-term transactions into 2021 (such as stock sales, business sales, real estate sales, etc).

- Repeal of 1031 Exchanges: The legislation may repeal real estate “like-kind” 1031 exchanges that allow you to defer and possibly eliminate (on “step-up in death”) capital gains taxes and recapture of depreciation on real estate sales.

- Carried Interest: While increasing capital gains taxes, they may also be doing away with the tax preference on Carried Interest (making Warren Buffet and others pay full taxation on all income – discussed above). This is a big tax benefit to wealthy hedge fund managers. Currently, many of these individuals can structure much of their incentive compensation to be taxed at the lower capital gains rate.

- Cryptocurrency (Bitcoin, etc): This was in the $1.1 trillion hard infrastructure bill. In that bill, the Senate made it mandatory for more reporting to the IRS from most people on the business. If you have crypto accounts, be aware that although you were already required to report gains and losses on your tax return, the IRS now wants data to ensure you report taxation of those accounts. There are more issues here, but this is where I will leave this point for now (more after the passage of the law). The bill states that it may raise nearly $28 billion in tax revenues.

- SALT (State and Local Tax Exemption): The Trump Tax Cuts and Jobs Act limited the itemized deduction for State and Local Taxes (“SALT”) to $10,000. This angered “blue states” as they have higher overall tax burdens, and they believe (rightfully so, by some) that they were targeted. However, the cost of this repeal to reinstate the full SALT deduction will be expensive and will mostly benefit those that itemize in the top 20% of income earners. Many feel that a full repeal will be difficult when they are trying to raise revenues by $3.5 trillion to pay for this bill.

Business Tax Changes:

- Corporate Tax Rates: Part of the Tax Cuts and Jobs Act reduced the top corporate tax rates from 35% to 21% (C-Corporations – usually larger and publicly traded companies, but not exclusively). This made us more competitive vs. other international tax rates that were much lower than the 35% rate. This legislation may increase those rates to between 25% and 35%.

- Repeal of “Pass Through” Tax Deductions: Part of the Tax Cuts and Jobs Act allowed for a 20% reduction in income subject to taxes (199A) for owners of pass-through businesses (like S-Corps or LLCs). This may be repealed.

- Employee Retention Credit: This will end early on September 30, 2021, vs. December 31, 2021.

Summary from Earlier from September 24, 2021:

Also, please check out these other tax and policy related articles on our website:

- June 2021 Update – FPA Tax and Estate Planning Knowledge Circle

- Estate Tax Law and Strategy Changes are Coming

- 10 Most Asked Tax Questions so Far in 2021

- 2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

- American Rescue Plan

- 2021 Income Tax Update – Alert

- Key Estate and Income Tax Planning Takeaways from the “Blue Wave” Democratic Victories

- Year-End Tax Planning Checklist – 2020

- Secure Act (and the loss of the Lifetime Stretch IRA and Changes in RMDs)

- Qualified Opportunity Zone (Investment Considerations and Tax Benefits)

- Review of Real Estate 1031 Exchanges

- Tax Cuts and Jobs Act (good to know and review if any “repeal”)

- For Individuals

- For Business Owners

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*