Published on: 09/18/2020 • 6 min read

Avidian Report – The Fed Framework & Implications For Your Portfolio

INSIDE THIS EDITION:

The Fed Framework & Implications For Your Portfolio

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

The fed funds rate is the target interest rate set by the Federal Open Market Committee (FOMC) at which commercial banks borrow and lend their excess reserves to each other and can have a meaningful impact on short-term rates on things like consumer loans. The Federal Reserve just concluded their September meeting earlier this week and decided they would leave the fed funds rate unchanged after a series of decisive actions taken to respond to the Coronavirus outbreak earlier this year.

[toggle title=’Read More’]

An unchanged Fed funds rate target is what we and most of Wall Street was expecting considering still challenging economic conditions.

After all, the GDP growth projection the Federal Reserve laid out in the Summary of Economic Projections showed a decline of 3.7% in the fourth quarter this year compared to the fourth quarter last year. Less encouraging was the downward revision to GDP projections for 2021 and 2022 but partially offset by a more encouraging projection on the unemployment rate, with a faster decline in unemployment expected for 2022 and 2023. Nonetheless, a still challenging economic backdrop and outlook.

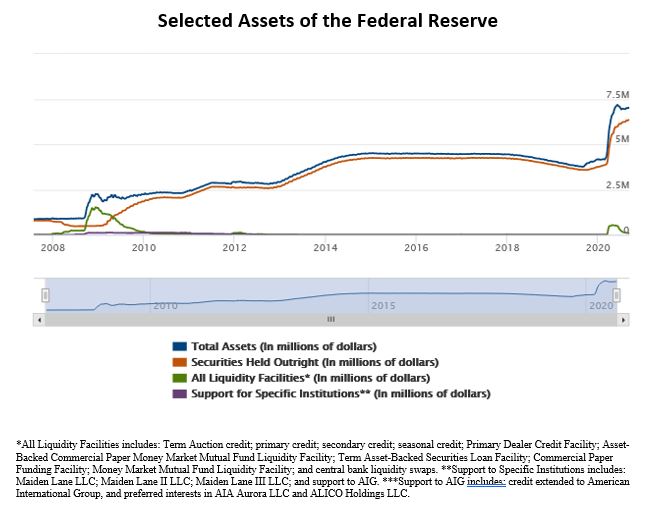

Now, back to the Fed. In addition to leaving the Fed funds rate unchanged, the Fed also determined that making any changes to their asset purchase program at this juncture is premature. In fact, the Fed confirmed that the asset purchase activity they have engaged in for months now would continue at a similar pace for the foreseeable future. Part of the communication this week included that the same assets would comprise the asset purchase program currently in place, so investors thinking the program should be expanded to other asset classes have to wait to see if that changes at any point ahead.

To us, these decisions signal two things. First, that the Fed remains committed to ensuring that financial conditions remain accommodative; and second, that there is an extremely low probability of any shift in that stance unless we see a massive change to economic conditions or a reemergence of any dysfunction in securities markets.

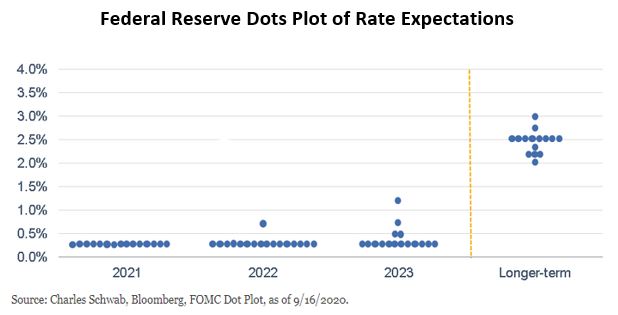

The most interesting part of this week’s meeting comments and communications, and perhaps the most important for investors going forward, was that there was an increase in the number of committee participants projecting one rate hike over the forecasting period (now 4 committee members think a rate hike may be appropriate sometime before 2023) and an official adjustment to the Fed framework for making the rate-hiking decisions, which had been previously discussed in a speech by Fed Chairman Jerome Powell a few weeks ago in Jackson Hole, Wyoming.

In short, the Federal Open Market Committee has officially decided that they will adopt outcome-based criteria for lifting the fed funds rate. Under this new framework, the current policy target range will remain unchanged until two criteria are met – when the labor market reaches what the committee deems to be maximum employment and when inflation rises to 2% and is on track to exceed 2 percent for some time. In essence, the big change in the framework is that now for the Fed Funds rate to be increased, the Fed will look for inflation to overshoot the 2% target level. This is an interesting shift for the Fed which for a very long time has explicitly targeted a 2% inflation rate. In our view this means, the Fed recognizes not only the absence of meaningful inflation at present but also shows the Fed’s willingness to adjust to the new economic reality, even though a hotter than 2% inflation target could pose some inflationary risks.

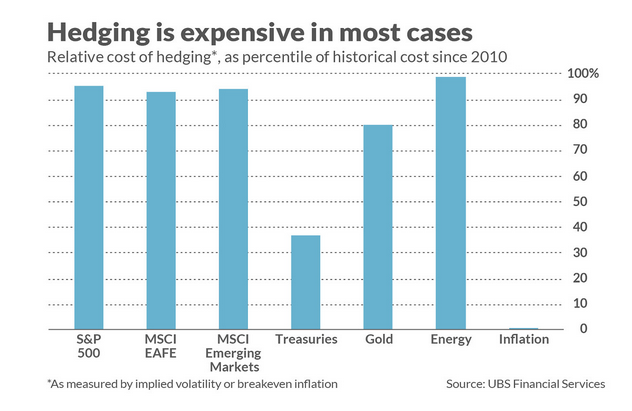

For investors, we believe this means that portfolios should be positioned for bumps to inflation by including a small allocation to inflation hedging securities. While a spike in inflation in the very near term is a low probability event, considering exposure to securities like TIPS on the fixed income side of the portfolio and real assets like real estate, infrastructure, and commodities makes sense to us from a portfolio construction standpoint.

As the chart below shows, commodities and REITs have historically provided solid inflation protection with total returns running above inflation in nearly 70% of high inflation periods, defined in this case as 6 month periods when inflation runs ahead of the long-term median.

For investors not currently holding these inflation hedging asset classes, there is an upshot. Namely, that putting on the exposure today remains very inexpensive relative to the cost of hedging other risks a portfolio may face over a full economic cycle. While these positions may not perform immediately, history has shown that they can effectively protect purchasing power and help ensure that financial plans remain on track.

If your advisor is not including some of these asset classes in your portfolio, you should be asking why. After all, for investors to be successful over time, they must hold portfolios built not for the present, but for the wide range of possible outcomes in the future.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*