Published on: 05/08/2020 • 5 min read

Avidian Report – US-China Trade Deal Talks Re-emerge

INSIDE THIS EDITION:

US-China Trade Deal Talks Re-emerge

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

U.S. President Donald Trump met Chinese President Xi Jinping in Beijing during 2017, as part of a 12-day trip to Asia. The meeting of the two superpowers had been dominated by discussions about trade policy and North Korea, which stood to make a meaningful impact on the world’s trade, economy, geopolitics, and ultimately, market performance.

[toggle title=’Read More’]

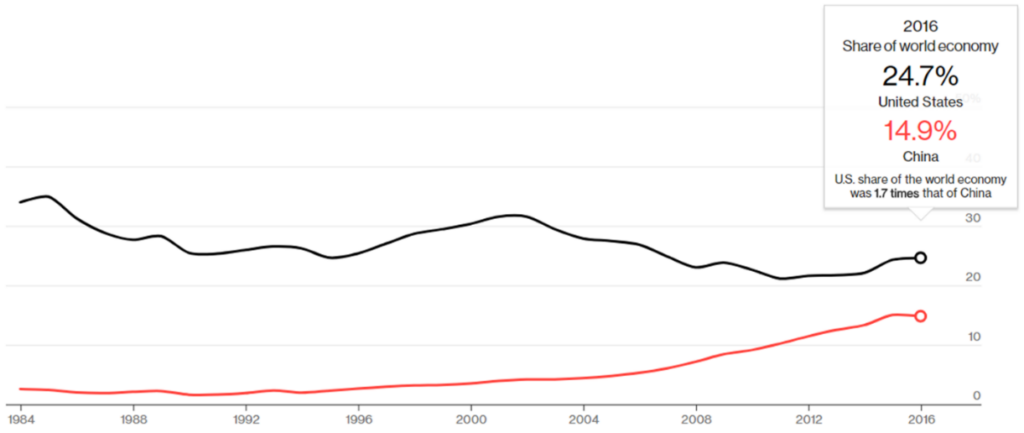

At the time, it was a meeting between two economic powerhouses, China and the U.S. which made up almost 40 percent of the world’s economic output at that time. In fact, they were and continue to be the world’s top trading nations and have had a bilateral economic relationship that has historically been mutually beneficial.

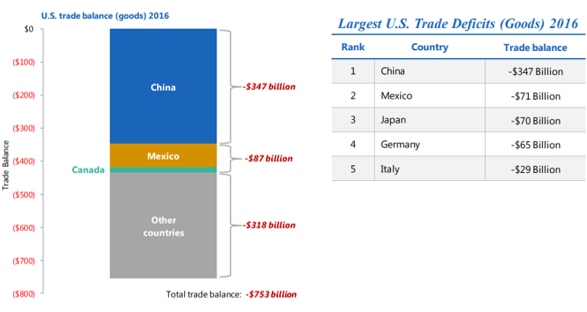

However, that doesn’t mean that it has always been equal. In fact, trade between the U.S. and China had been somewhat imbalanced with the U.S. trade deficit with China rising to $347billion in 2016. At the time, this accounted for 46 percent of the US’s total trade deficit.

You may recall that a key centerpiece of President Trump’s campaign strategy was highlighting his preference for more trade protectionism. This helped him gain the support of blue-collar manufacturing workers in the American heartland. Since being in office, the tune has not changed much with the Trump administration taking a series of actions, ranging from withdrawing from the Trans-Pacific Partnership (TPP), renegotiating the North American Free Trade Agreement (NAFTA) with Canada and Mexico, pressuring Japan on open trade and threatening to withdrawal from the South Korean Free Trade Agreement. Taking a stance against China on trade was the next step to these precursors.

While President Trump talked tough on China during his campaign by blaming them for unfair trade and currency manipulation, he went through a period where he changed his approach. Instead of blaming China, President Trump instead spoke of seeking a collaborative approach to narrowing the trade gap.

After it was said and done, President Trump’s 2017 China visit concluded with several commercial deals valued at as much as $250 billion, though some were already in the pipeline. These deals suggested that the US and China were more likely to collaborate to narrow the trade deficit. Back then, we thought it would likely drag out for quite some time despite the stock market reacting positively to the occasionally encouraging news on the trade front. We also thought that investors and the administration obsessing over the balance of trade with a single country was a distraction from emerging threats including automations’ impact on employment.

Little did anyone know that a bigger threat would emerge as a potential game changer for the world economy, in the form of COVID-19. Not only that, but the virus’ impact to trade negotiations now appears to be bigger than ever as dealing with the virus has rightfully become the top priority.

That said, we have seen some progress on US-China trade. China has lifted restrictions on some US agricultural imports, eliminated foreign ownership limits in the financial sector, and provided better guidance on intellectual property. We recognize that if the virus continues wreaking havoc on the world, we are unlikely to move beyond phase one of the negotiation anytime soon. However, these positive developments are a bit of good news at a time when good news may be hard to find. Unfortunately, investors may not care as unemployment rises and the economy tries to find its footing.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*