Published on: 06/18/2020 • 7 min read

Avidian Report – What a Mixed Bag of Data Means for Investor Positioning

INSIDE THIS EDITION:

What a Mixed Bag of Data Means for Investor Positioning

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

We continue to observe data that provides a very mixed picture of where the economy and markets may be headed. With very compelling bullish and bearish arguments to be made and the unknown effect that central bank stimulus might have in the long-term, we must acknowledge that this is as challenging an investment environment as we have seen in years.

[toggle title=’Read More’]

What makes it even more difficult is that there appear to be a fair number of market distortions that have undefined drivers with uncertain glide paths. In other words, we simply do not know at what point the distortions will give way to more normalized market outcomes or investor behaviors.

Case in point is a study that Man Institute did where they constructed an equal weight portfolio of “garbage” companies that had credit default swaps trading at more than 1,000 basis points as of April 1st. In other words, companies likely under considerable stress. Surprisingly, that portfolio has handily beaten the MSCI World Index since then, in what merely highlights how disconnected the returns have been from reality in some asset classes this year.

Another example is the move higher in the equities of companies that have filed for bankruptcy. In these cases, equity is often worthless, yet investors are bidding these stocks higher. Whether these instances are being driven by speculation on the part of investors looking for something to do while at home on quarantine, or simply a side-effect of Fed-supplied liquidity, we do not see this as healthy nor sustainable.

Possible distortions like this aside, there is a fair amount of data pointing to green shoots as COVID-19 runs its course.

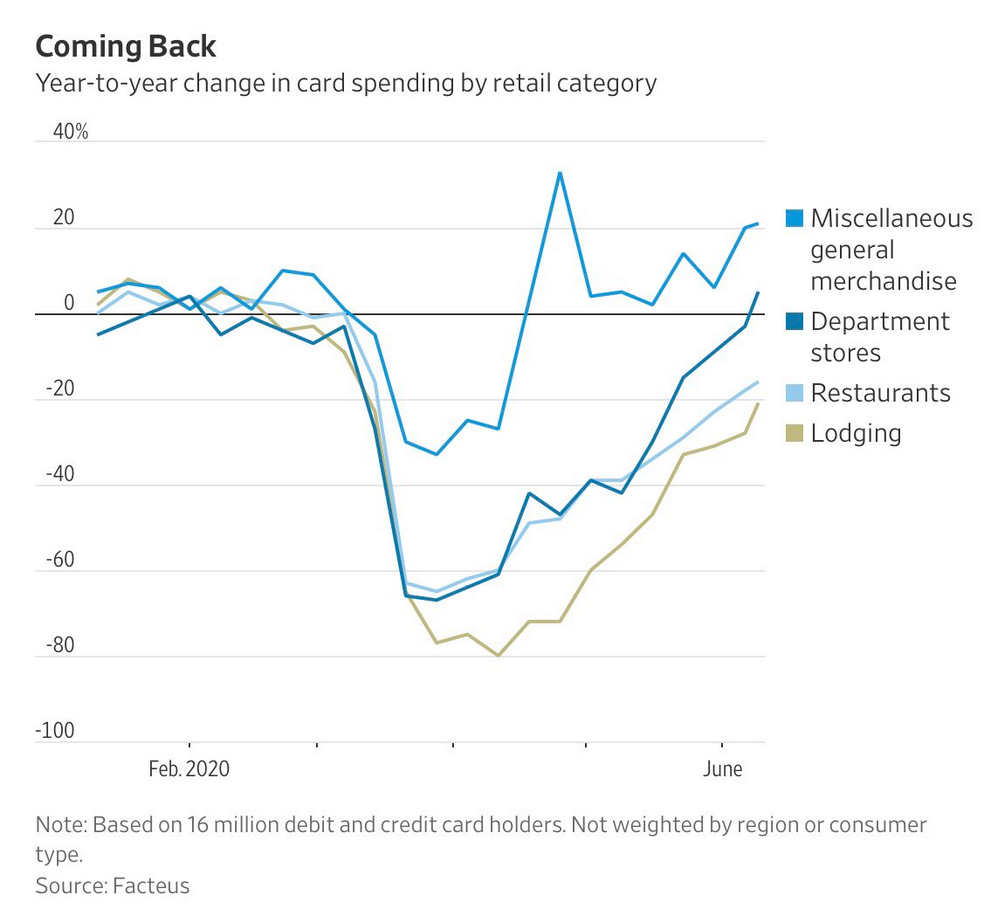

Because so much of the US economy is built on the strength of the consumer, we can start there. What we see is consumer spending picking up after sharp declines, especially in certain categories like miscellaneous general merchandise and department stores. We infer this from the year-to-year change in credit card spending collected by Facteus which shows year-over-year gains in these retail spending categories. Although the data show that card spending at restaurants and lodging is lagging, even those categories are seeing spending trends moving in the right direction.

This has been corroborated in retail sales numbers for May which shows that US retail sales may be in the middle of a V-shaped rebound, although the next retail sales update will be helpful in confirming that view.

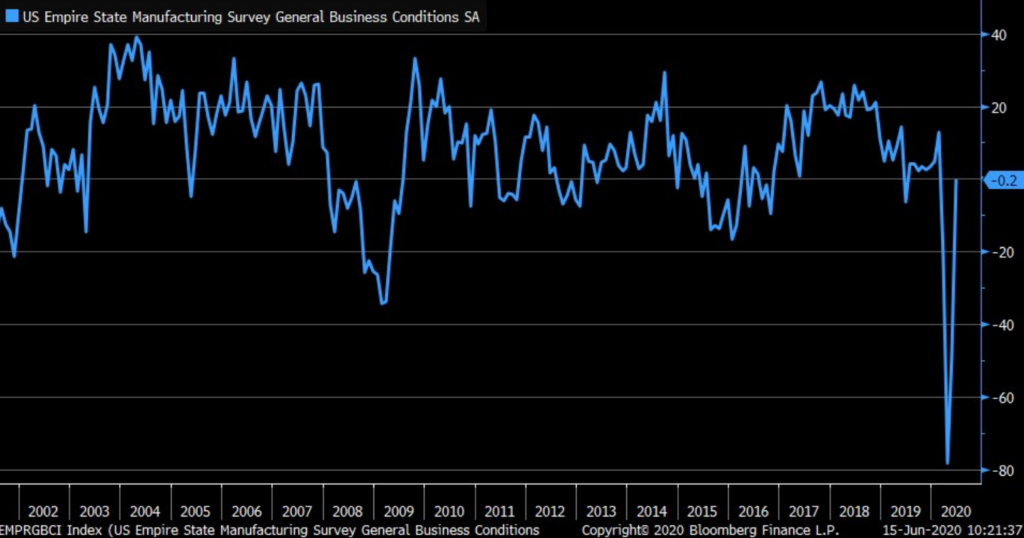

Manufacturing has similarly seen a V-shaped recovery off the lows. The Empire Manufacturing Survey, which provides a measure of general manufacturing conditions, saw a massive 48.3% increase driven by stable new orders, increased shipments, and dramatically improved future expectations.

For investors, the combination of these improvements and growing cash balances in money market assets could certainly bode well for risk assets as further stimulus and economic improvement could give way to more money being taken off the sidelines in favor of risk assets.

Of course, we must balance “green shoots” with the myriad of bearish data we are seeing.

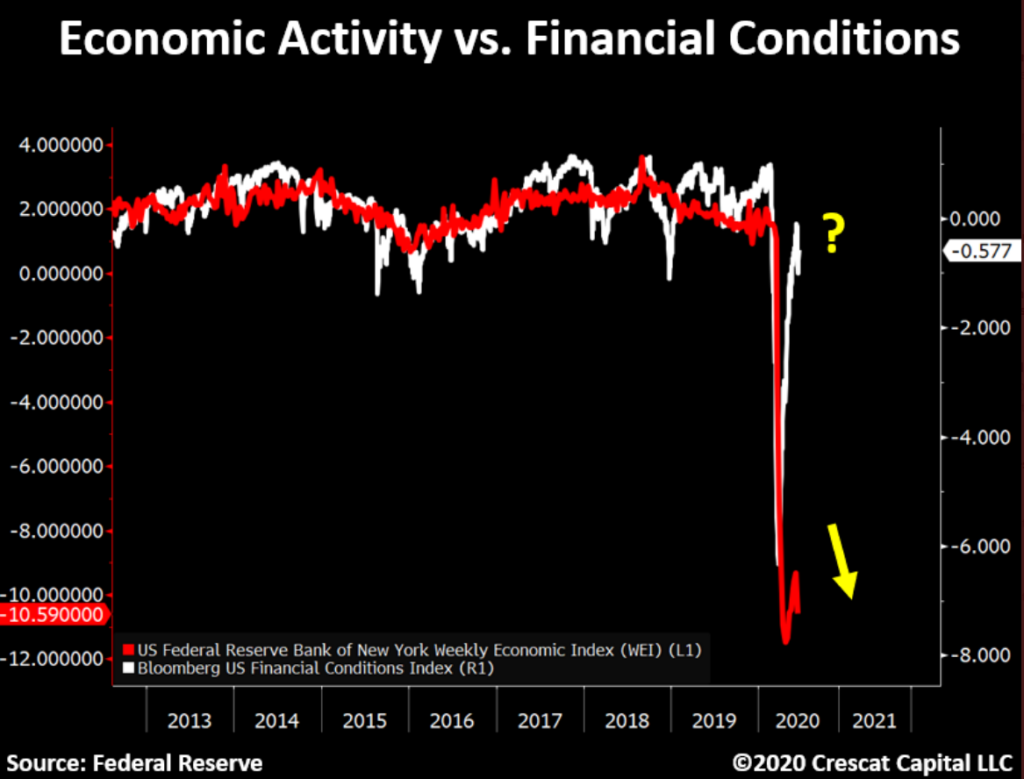

For starters, the NY Fed’s Weekly Economic Index (WEI) which we have been closely tracking has taken another dip recently. This is a bit of a surprise because we have frankly expected it to continue improving, albeit at a slower pace than we saw immediately off the bottom. More concerning is that the dip is not factoring in a reintroduction of restrictions to combat a potential second wave of COVID-19. While we do not expect these restrictions to be as wide sweeping as the first round, they are certainly possible in select regions. Should that happen, we would expect economic activity to slow considerably from today’s levels and set the stage for more of a W-shaped recovery. While not our base case, investors would be wise to include it in their range of potential recovery scenarios.

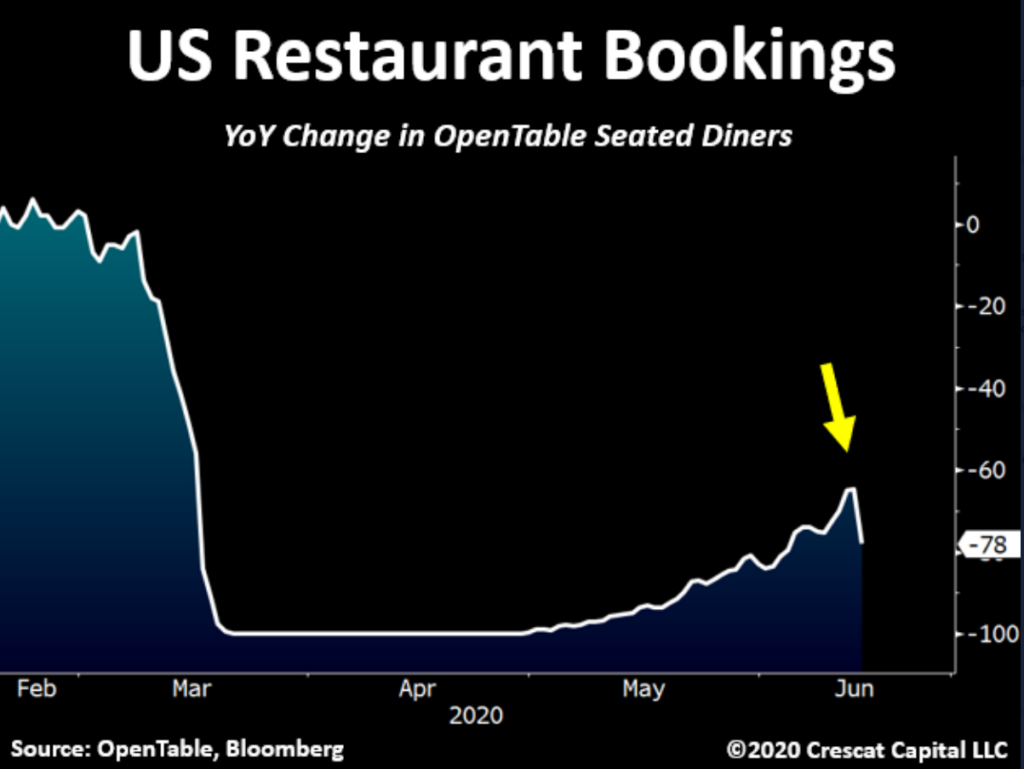

As some investors know, US Restaurant bookings are a component of the WEI measured above, and there we are seeing a bit of a pull back. All of this after showing a respectable rebound when the economy started to re-open. In our view this reflects mounting COVID-19 cases across the country and rising caution among restaurant patrons.

Another case for bearishness which we have mentioned before are rising bankruptcy filings in consumer and energy sectors. If the incidence of distress increases from here, we could see a negative effect on sentiment, which could unnerve investors and lead to more volatility, especially as equities are thought by many institutional investors to be overvalued.

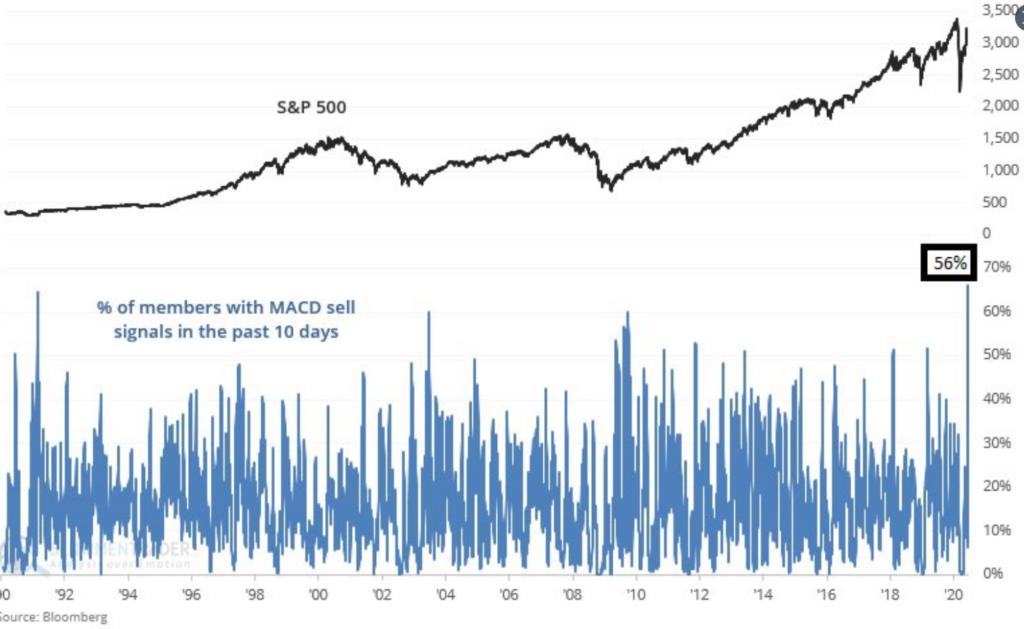

A compelling short-term headwind we also see supporting a bear thesis is the number of MACD sell signals across S&P 500 constituents. Where we stand today, 56% of S&P 500 stocks have seen a MACD sell signal over the last 10 days. This is the highest percentage going back to 1990 and certainly indicates some technical deterioration in domestic equities.

So what does all this mean for investors?

Our view is that despite the presence of positive data points there are certainly risks that support taking a very measured approach to risk. More specifically, it means investors should pay close attention to three things.

First, it means being well-diversified across asset classes and geographies. While there are times where correlations may converge, over the long-term, it has been shown that diversification is the only free lunch in investing, and we advocate a fair amount of it at this time. Second, it means adding selective tactical exposure where investors have a conviction that a favorable risk/reward exists. Lastly, and perhaps most importantly, is following discipline to both raise and deploy cash. This should let the emotions that often plague investors from clouding judgment.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*