Published on: 05/23/2020 • 9 min read

Avidian Report – What is The Data Telling Us About This Market?

INSIDE THIS EDITION:

What is the Data Telling Us About This Market

Weekly Global Asset Class Performance

Memorial Day Miracle!

Coronavirus / COVID-19 Resource Center

Based on what we are seeing, there continues to be a reason to remain cautious, and possibly more so than a few weeks ago. After a strong market rebound, we are seeing signs that investor sentiment may be inflecting bearishly at a time when economic data continues to show breathtaking weakness.

[toggle title=’Read More’]

Since our update last week, we have continued to pour over the data related to the virus, economy and financial markets. At this stage we are short-term cautious but may get more constructive as the reopening of the economy happens gradually. As always, this view is data driven and not an emotional response to an equity market that has rebounded off the March lows and seen volatility as measured by the VIX gradually decline.

Although, we have seen the Conference Board’s US Leading Indicators Index slump, we are now seeing short-term economic indicators tracked by the New York Federal Reserve Bank improve.

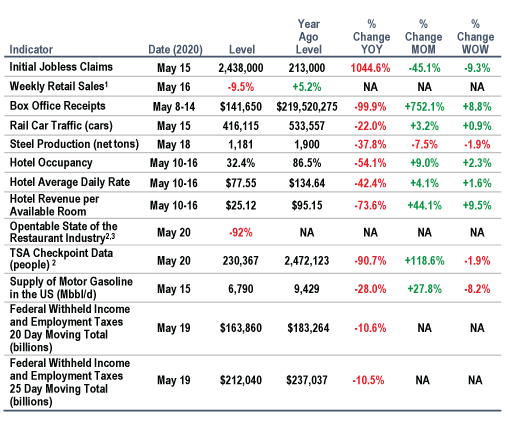

As an example, the data shows us that there has been an increase of 118.6% over the last month of passengers taking flights according to TSA Checkpoint Data. Again, when numbers are down 90%+, it doesn’t take much to show a dramatic improvement on a percentage basis like this. With levels currently only a small fraction of what they were a year ago on most of the short-term indicators we track, large percentage gains in week-over-week and month-over-month numbers are not surprising as certain parts of the economy reopen. Because of this, we believe that investors have already priced in the turn in high frequency economic data.

Rather than focusing on short-term changes to the data, we think as longer-term investors it is far more important to observe the direction of the changes in the data.

Source: New York Federal Reserve Bank, First Trust

From our experience, it is often inflections in the data like what we may be witnessing today, and the coinciding improvement in sentiment that signal a good time to begin investing incremental dollars. However, at the moment we don’t think there is a guarantee that markets will rocket higher. Instead, we think the data is indicating that the short-term market direction could lean slightly positive but contain considerable risks that must be accounted for when making allocation decisions.

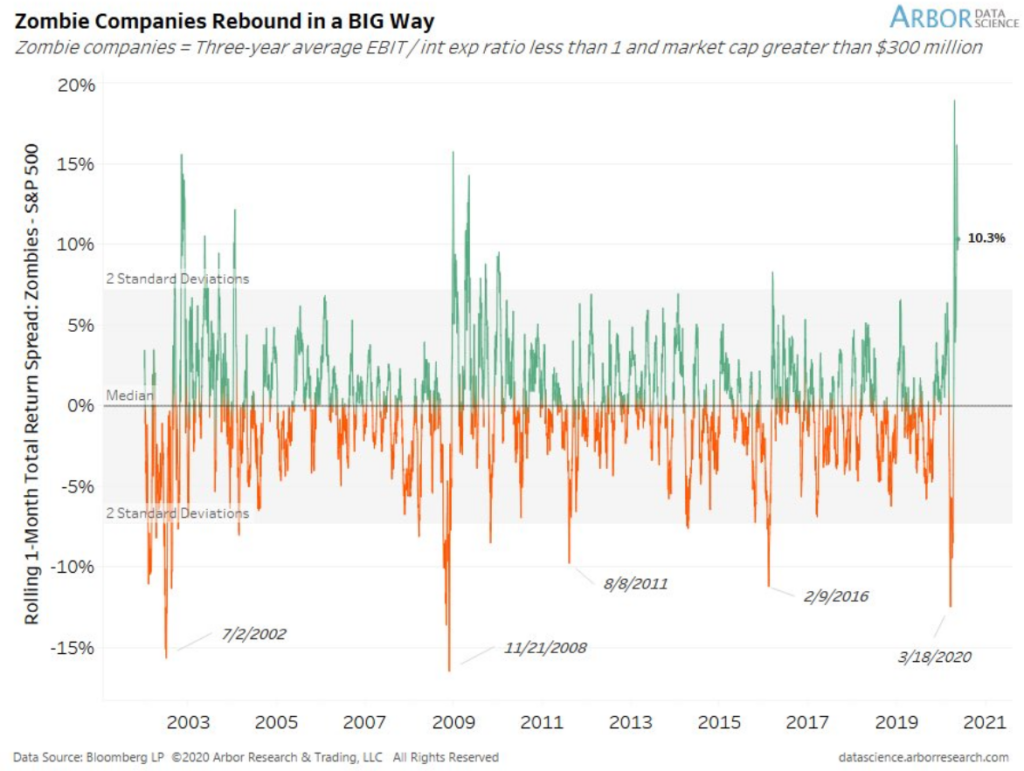

Market Observations

The chart below from Arbor Data Science illustrates strong stock market returns during the recent rebound for companies that have had a low EBIT/Interest expense ratio over the last three years. This ratio is a measure of leverage and truthfully, we have some concerns about the strong performance of highly leveraged companies recently. The reason is that we believe the data signals that investors are making more speculative bets in today’s market for fear of missing out. Fear of missing out can lead to irrational investor behavior and increases overall risks so selectivity in where investors allocate in the short-term appears prudent at this time.

We also continue to observe the departure of stock performance for the S&P from the economic reality. More specifically, we are seeing a breakdown in correlations between S&P performance and earnings estimates. The chart that follows highlights that over the last 20-years there has been a positive 0.90 correlation between the S&P 500 and earnings estimates. However, during this recovery, that relationship has inverted (correlation of -0.90). In other words, since March 23, 2020 we have seen poor earnings estimates correlate with a rising S&P 500. This disconnect presents risk for the short-term as correlations are known to break down and then revert. Should that reversion happen, one of two things would have to occur — either S&P 500 earnings estimates would need to rise sharply or the S&P 500 would need to decline. It is our opinion that in the intermediate-term this dichotomy gets resolved but does present some short-term risk of a pull-back.

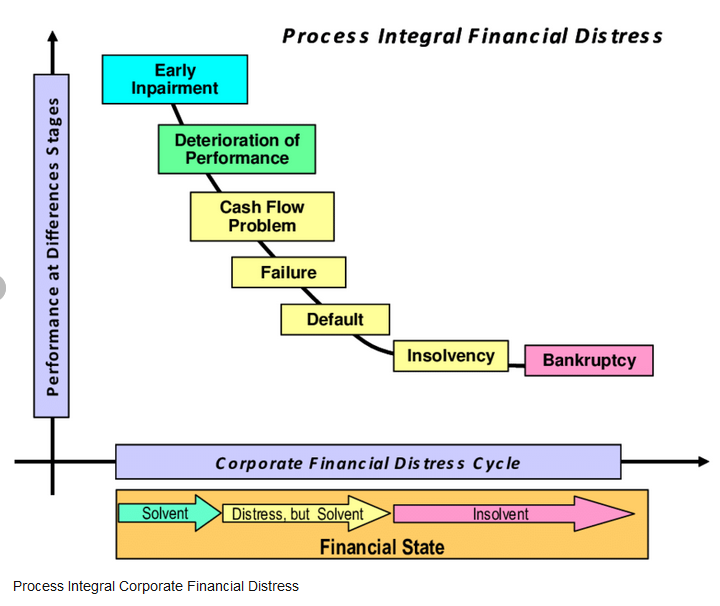

Finally, some of the data we are seeing indicates that even if the reopening of the economy goes without a hitch, we may be in the early stages of a distress cycle in several industries, as is typical during economic downturns (see 2001 and 2009 in the table below).

Although we are currently seeing some companies access their lines of credit and issuing equity to stave off more serious stages of distress (i.e. defaults, insolvency, and bankruptcy), we think there is a risk that many won’t be able to tap into these funding sources and avoid failure.

Source: The Dynamics of Corporate Financial Distress in Emerging Market Economy: Empirical Evidence from the Indonesian Stock Exchange 2004-2008

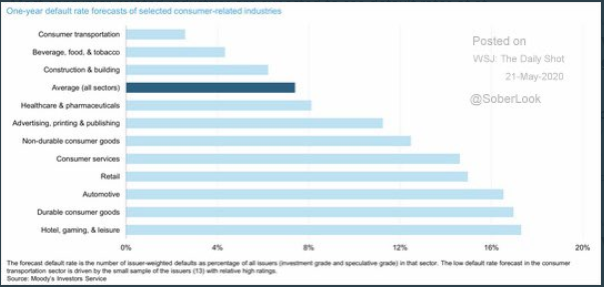

This is especially true in consumer-related industries as a spike in joblessness takes a toll on the US consumer and starts to hurt both the top and bottom line for many of these companies. Just consider for one moment what happens when we have millions of American’s stop making their credit card and car payments due to financial hardship, and the delinquency rate on US home loans surge. The risk is that these dynamics lead to distress at the household level and potentially for the businesses that those consumers transact with. We aren’t alone in thinking this as Moody’s Investor Services now expects most consumer-related industries to see default rates of greater than 10% this year. In the short-term investors should watch whether a distress cycle gains momentum.

Although we are currently seeing some companies access their lines of credit and issuing equity to stave off more serious stages of distress (i.e. defaults, insolvency, and bankruptcy), we think there is a risk that many won’t be able to tap into these funding sources and avoid failure.

This is especially true in consumer-related industries as a spike in joblessness takes a toll on the US consumer and starts to hurt both the top and bottom line for many of these companies. Just consider for one moment what happens when we have millions of American’s stop making their credit card and car payments due to financial hardship, and the delinquency rate on US home loans surge. The risk is that these dynamics lead to distress at the household level and potentially for the businesses that those consumers transact with. We aren’t alone in thinking this as Moody’s Investor Services now expects most consumer-related industries to see default rates of greater than 10% this year. In the short-term investors should watch whether a distress cycle gains momentum.

What this means for investors, is that they must exercise more care in selecting their exposures and makes a compelling case for why they should work with an experienced advisor with access to an in-house investment team that can navigate a more difficult environment. Secondarily, it makes another case for remaining balanced with an eye toward risk mitigation, despite an equity market that has recovered much of this year’s maximum drawdown.

Weekly Global Asset Class Performance

[/toggle]

Memorial Day Miracle

A Story of Hope

“We as Americans honor active Military every day as we should, on Veterans Day we honor the Veterans who have served in the armed forces, and Memorial Day is when we honor the fallen. This story could have been a combination of Veterans Days and Memorial Day but it has an interesting twist to it.” – Max Gains, Executive Producer, The STA Money Hour

We invite you to listen to this incredible Memorial Day Miracle story. Click the link below to hear the story.

Memorial Day Miracle

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*