Published on: 07/31/2020 • 6 min read

Avidian Report – Where are the Real Estate Sector Opportunities Today?

INSIDE THIS EDITION:

Where are the Real Estate Sector Opportunities Today?

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

The Real Estate sector has been getting a lot of attention as of late due to how sensitive it is to unemployment, interest rates, and the secular changes likely to result from work from home measures.

[toggle title=’Read More’]

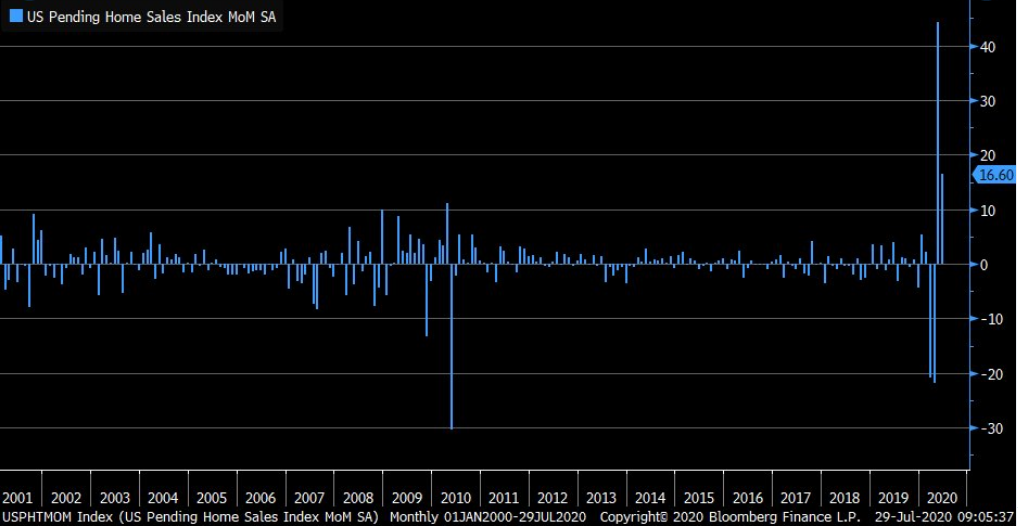

US Pending Homes Sales

Recent US Pending Home Sales data was undoubtedly strong. For the month of June, we saw pending home sales rise 16.6% month over month, which exceeded the estimate of 15%. More impressive was that it also represented a 44.3% increase over the prior month. We think this jump reflects a few things. First, it reflects home buyers jumping to take advantage of record-low mortgage rates. Second, we think it may also reflect an emerging shift away from urban centers to suburban living as people look to get away from crowded metropolitan areas most impacted by COVID-19, a trend that we believe is likely to continue into next year and beyond.

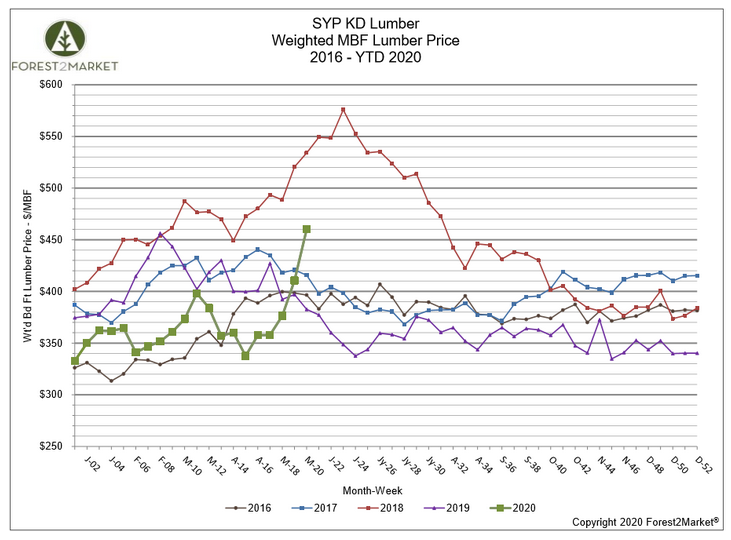

That said, we are seeing a sharp increase in lumber prices, a key raw material for newbuilds that could ultimately flow through to pricing on housing inventory and presents a risk to the robust pending home sales data. While we do not foresee it becoming a problem at present, it is merely something we think investors should monitor closely.

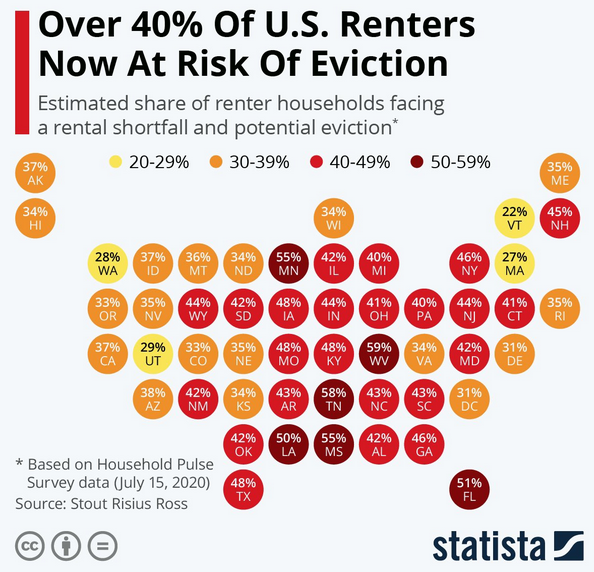

Rental Markets

Speaking of risks, we see a great deal of risk in the rental market for housing across the country. Looking at some of the data, there are over 40% of US renters that are at risk of eviction today. That amounts to over 12 million people expected to face eviction in just the next 4 months. Perhaps more startling is that in some states, like Minnesota, Tennessee, Louisiana, Mississippi, and Florida, the percentage of tenants facing eviction far exceeds 50%. To date, we have been fortunate that many of these households have been given a reprieve through rent deferrals and a federal eviction moratorium. However, we think it would be unreasonable to expect that this will continue indefinitely. In fact, the eviction moratorium already expired earlier this week with evictions possible beginning August 24th. At some point, we believe the deferrals will run their course as well and these households will have to find another way to make their landlords whole or renegotiate the terms of lease agreements if possible.

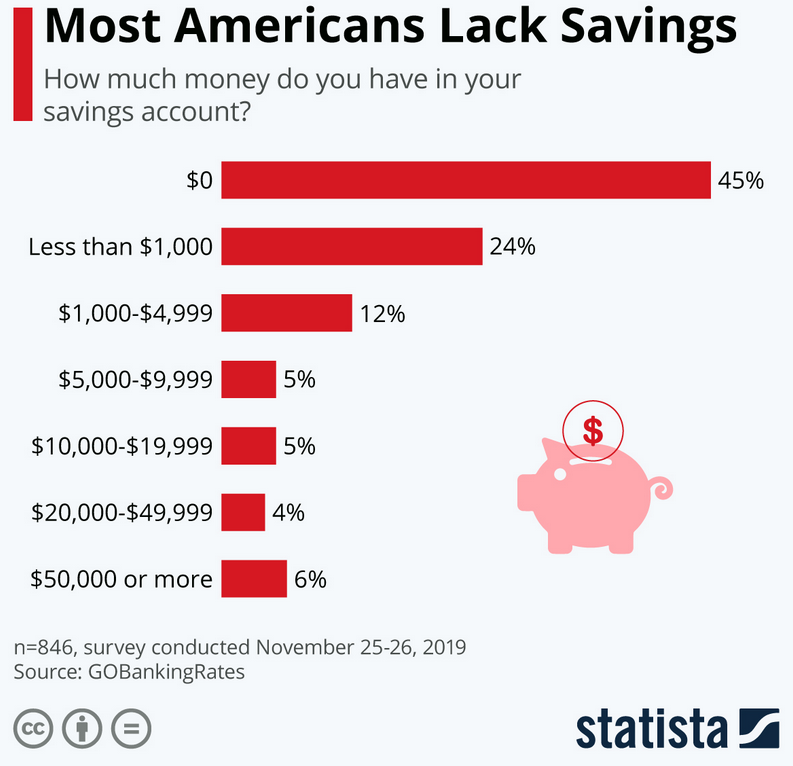

Unfortunately, that is no easy task with the unemployment rate where it is, and the sheer lack of savings held by most Americans, which would normally help stave off pending evictions.

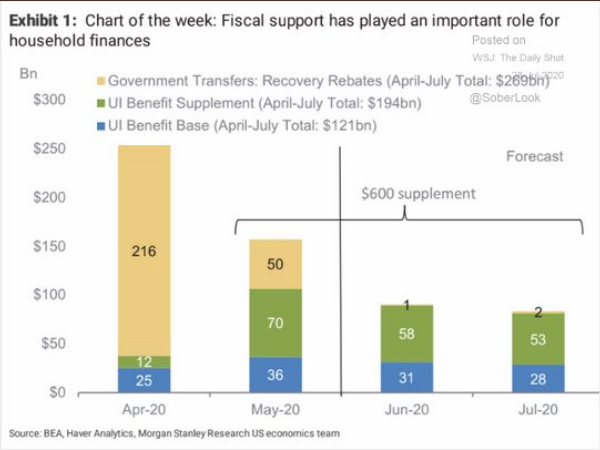

Further complicating the situation is that unemployment benefits are also on the verge of running out unless some other action is taken by the government.

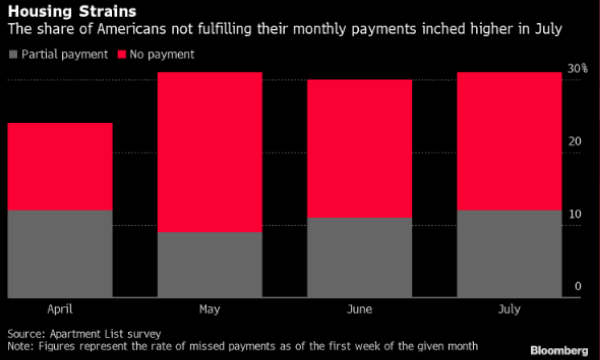

Granted, those programs have helped, but they are only a stop-gap measure because even with these programs in place the strain has continued building. As the chart below shows, from June to July the share of Americans missing their monthly payments ticked higher.

Clearly, the decision is difficult for policymakers. On one hand, large swaths of their constituencies are insolvent but at the same time not lifting the Federal Eviction Moratorium puts a massive strain on property owners that depend on rent payments. It really does look like a Catch-22 without some creative policymaking.

We admit that these dynamics are both challenging and in many cases disheartening. However, not everything is bad in the real estate sector. In fact, our research shows that some real estate investments coming out of times of crisis perform very well on a relative basis. As such, there are some areas that are positioned to perform well from an investment perspective.

Places to look for opportunity

As we see it, tailwinds for industrial properties have been reaffirmed. Suburban residential properties are more desirable in a post-COVID world and the environment is ripe for private equity and real estate managers that target distressed assets to find compelling value. As far as public REITs go, we think there are still opportunities in more stable US REIT sub-sectors like data centers and last-mile industrial property, especially for investors that are seeking to generate yield. However, as we have said before, selectivity at this stage of the economic cycle is important, within real estate subsectors as well as in more broadly diversified portfolios. The good news is that now is a good time as ever to make sure you and your advisors are following solid investment principles, conducting thorough analysis, and are keeping a watchful eye toward risk. These things can be invaluable for avoiding value traps and helping investors meet their investment objectives.

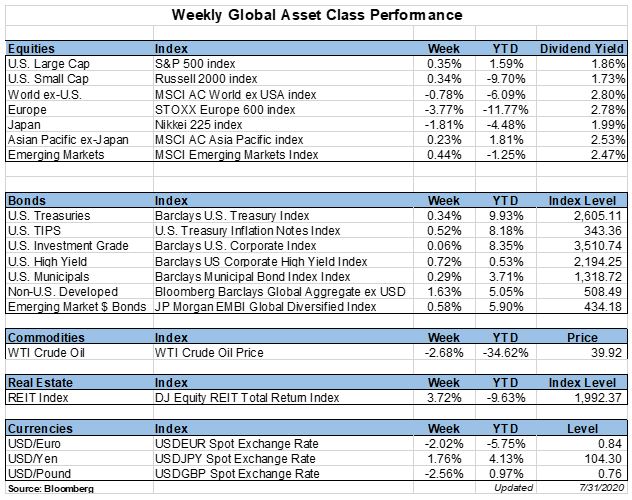

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*