Published on: 04/09/2021 • 6 min read

2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

Scott Bishop was on Barron’s Live Podcast (part of MarketWatch) with Andrew Keshner on April 7th. The topic was about “Make the Best out of our Complicated Tax Season”. A link to the webinar can be found below. Also, a summary of some of our discussion items can be found following the link.

Webinar Recording: Making the Best Out of Our Complicated Tax Season

Note: Additional Tax and Estate Planning article Links are listed at the end of this article.

- What the extension does/doesn’t mean (filing returns, paying taxes owed) per IRS :

a. Everyone will have until May 17th to file (June 15th in Texas, Oklahoma and Louisiana due to freeze/natural disaster).

b. That means you can also do certain things like do Roth IRA or Traditional IRA contributions.

c. That will be the time to file and/or file an extension to get you to September 15th (some businesses) and October 15th (personal returns)

d. This extension is only for Federal Returns – see your states for any extensions from them. - What about estimated payments? (deadlines and who pays them)

a. April 15th Estimated tax payments are still due on April 15th for those that need to pay estimated (or June 15th for LA, TX, OK – Considering May 17th for others…stay tuned)

b. Mostly for those that have large investment income (dividends/taxable interest/capital gains) or those with personal or business income that is not salary (thus not withheld). - What about IRAs/HSA contributions?

a. You have until May 17th to make those contributions (or June 15th for LA, TX, OK) - What about the mid-season $10,200 exclusion on UI benefits – and what to do if I already filed my taxes?

a. Fully excludable on your Federal Tax Return

b. As of the end of March, 13 states didn’t give the tax break on state income tax returns (but most have).

• Not: CO, GA, HI, ID, KY, MA, MN, MS, NC, NY, RI, SC, WV - Maybe a question about cryptocurrency and that prominent question on the top of the 1040 on whether a person sold, spent, exchanged or acquired cryptos.

a. IRS is gathering information (don’t assume they won’t find out…UBS had to give info on US Citizens with swiss bank accounts back in 2009 or be not allowed to do US business)

b. Currently any transaction is taxed as long-term or short-term capital gains (subject to change under the Biden-Harris plan)

c. Note: If long-term gain, could be good for charitable giving (vs. cash) and/or to a Donor Advised Fund - The summer rollout for the advance payments on the Child Tax Credit (when we will know more about the specifics on how this works, who’s eligible, etc)

a. $3k credit for Children OK if age 17 at end of year (larger to $3,600 if under 6 years old)

• Phase out for $200k income of single and $400k income of joint

b. If close to threshold, be careful of capital gains, use 401k and avoid Roth Conversions and if self-employed consider SOLO 401k, SIMPLE or SEP for 2020 or 2021.

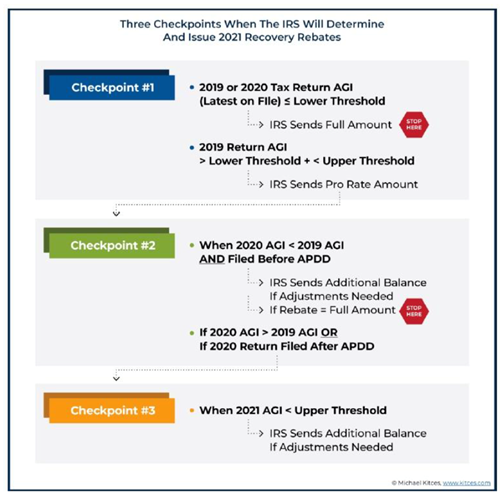

c. See below…with thresholds and no “claw-backs” – it IS truly based on your 2021 return, but:

• If 2019 is under threshold (hold off on 2020)

• If 2020 is below threshold…file ASAP (possibly due to COVID job reduction or layoff)

• If 2021 qualifies (even if not for 2019 or 2020), you can claim it when you file your 2021 return before April 15, 2022. - Looking ahead potential corporate tax increases & high-income earners

a. Income Tax Changes Bing Considered:

• Top Tax rate from 37% to 39.6% (but at what level…as low as $400k married?)

• Higher portfolio income tax (see below)

• For “upper income” (not yet defined) phasing out again of itemized deductions of up to a loss of 80% of deductions (but what about SALT and Charity?)

• Uncapping Social Security Tax – keeping 12.4% tax on income in excess of $400k (currently capped at $142.8k) – but no more benefits – this is on top of income tax and they will be much more difficult on business pass through income?

• Loss of 199A business income 20% reduction for taxes

• Higher corporate taxes from 21% to 28% (and also minimum tax of 21% of foreign subsidiaries).

• Unsure of SALT (State and Local Tax) – many Democrats want that deduction re-enacted (but doesn’t that help very wealthy?)

b. Possible Wealth Tax (but at what level?) – maybe at 3% (most recently by Elizabeth Warren and Bernie Sanders).

• How will compliance be done via IRS?

• 2% for $50 Million to $1 Billion, 3% above $1 Billlion

• Done Annually?

• Possible “mark to market” to force gains at year-end even if no sales?

c. Limiting size of growth of IRAs or other retirement accents (Mitt Romney Rule – my term).

d. Loss of 1031 Tax-Free Exchanges for Real Estate “like kind” transactions

e. Possible reduction in benefits for capital gains reductions in Qualified Opportunity Zones.

f. 99.5 Percent Act (Estate Tax) – Bernie Sanders

• Reduces Gift Tax Exemption to $1M and GST/Estate Taxes from $11.7M to 3.5M with taxes at up from 40% to 45%-55%, with 65% for very large estates.

• Possibly loss of stepped-up basis at death (more taxes for heirs)

• SECURE Act – loss of beneficiary lifetime IRA stretch

• Reduces ability for estate tax strategies (for discounting and many trusts like GRATs, CLATs and IDGTs won’t be as helpful)

g. Other Estate/Gift Changes:

• Capping annual exclusion gifting (the $15k per year gift) to somewhere between $20k to $50k for ALL heirs/donees. - How would each potentially affect me (perhaps in my investment portfolio, but also tax planning)

a. Higher taxes on Capital Gains (up to 43.4% Federally + State Income Tax – long term gains taxed at 28% + 3.8% NIIT/Obamacare 3.8% tax)

b. Higher Taxation on Dividends (may be higher than 15% for qualified gains – may also be at 28% + 3.8% NIIT)

c. Timing of recognition of income in 2021 vs. 2022 when would new tax law be effective (most think it will not be retroactive.

Also, please check out these other tax and policy related articles on our website:

- American Rescue Plan

- 2021 Income Tax Update – Alert

- Key Estate and Income Tax Planning Takeaways from the “Blue Wave” Democratic Victories

- Year-End Tax Planning Checklist – 2020

- Secure Act (and the loss of the Lifetime Stretch IRA and Changes in RMDs)

- Qualified Opportunity Zone (Investment Considerations and Tax Benefits)

- Review of Real Estate 1031 Exchanges

- Tax Cuts and Jobs Act (good to know and review if any “repeal”)

- For Individuals

- For Business Owner

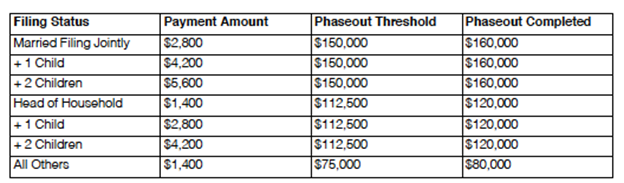

Note on Filing for the $1,400 Credit (and filing of 2020 return) “check ins” + no “Clawback”:

Income Thresholds:

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*