Published on: 03/27/2020 • 7 min read

Avidian Report – A Fixed Income Playbook for Today

INSIDE THIS EDITION:

A Fixed Income Playbook for Today

KHOU Interview – “How to protect investments amid coronavirus uncertainty on Wall Street“

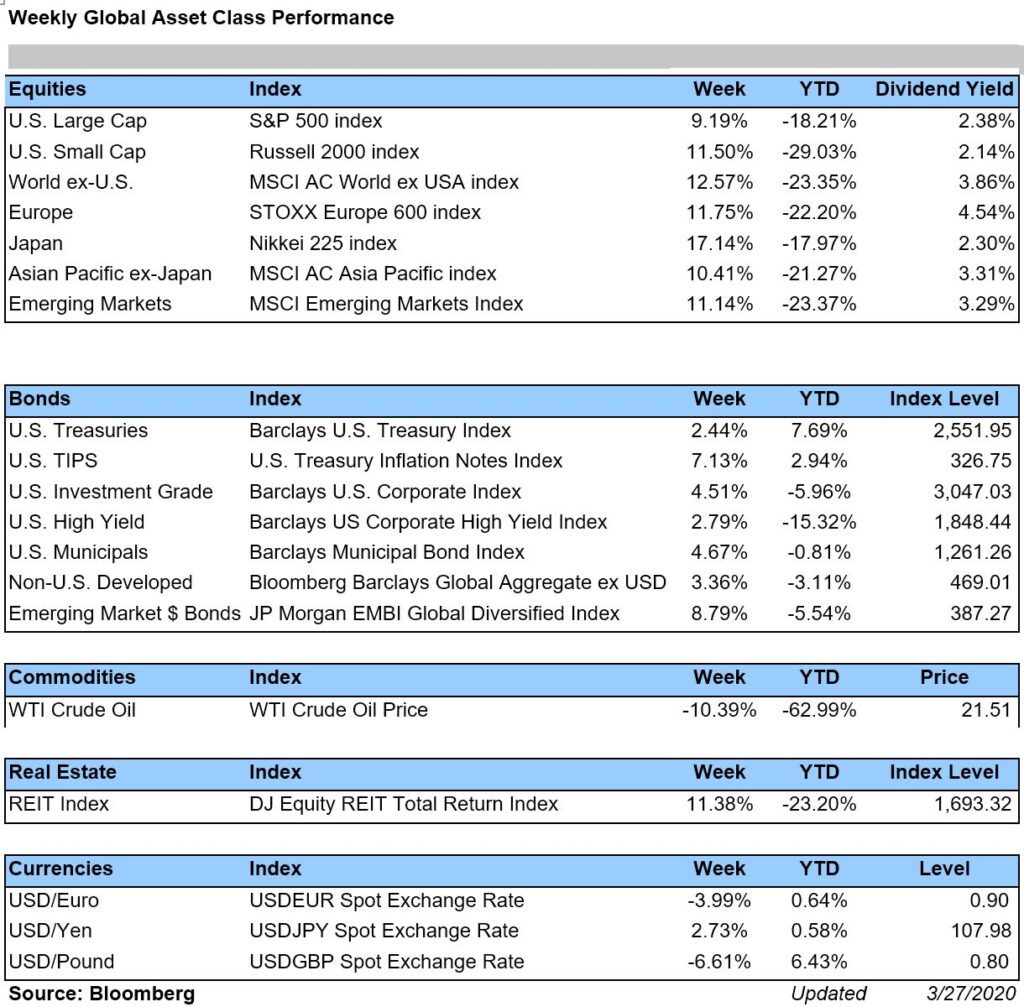

Weekly Global Asset Class Performance

Avidian Wealth Recession Survival Guide

401k Plan Manager

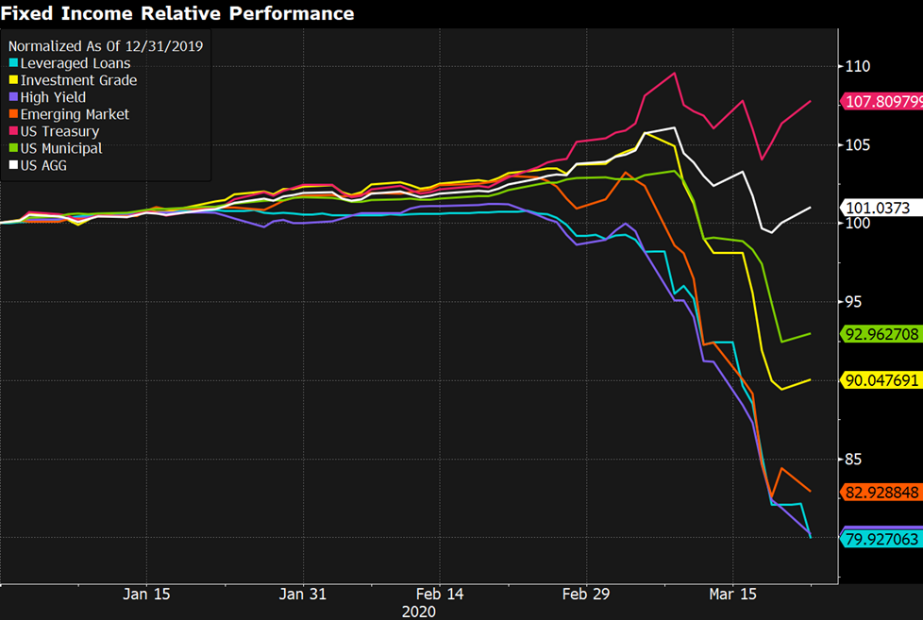

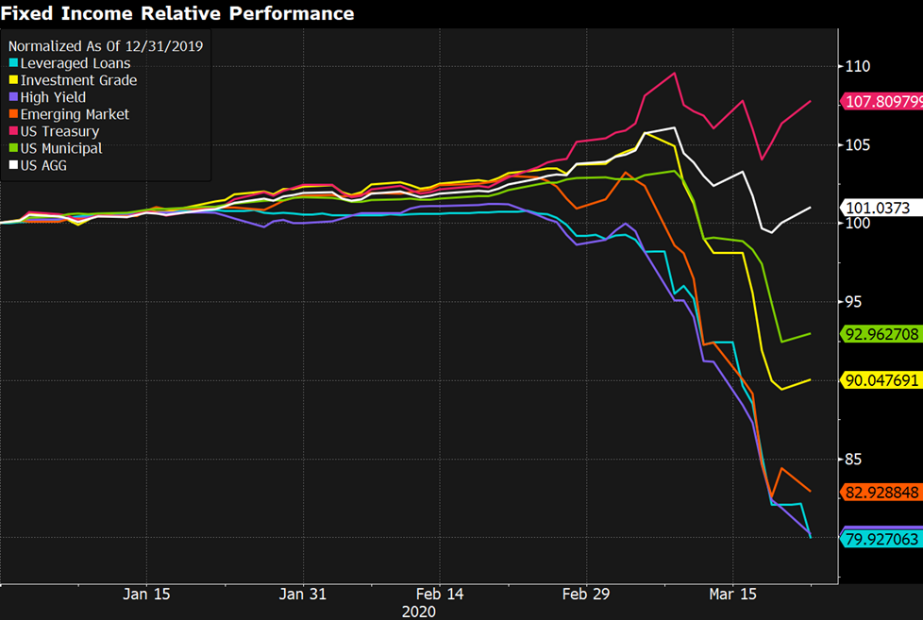

Through March 24, 2020, the returns on most fixed income securities have been negative year-to-date. In fact, leveraged loans, investment-grade bonds, and municipal bonds have all lost money this year.

[toggle title=’Read More’]

The only bright spot from a return perspective has been US Treasuries which garnered investor attention as they sought safety amid the equity market sell-off. The good news is that over the last couple of weeks, we have seen interest rates rebound slightly as the Federal Reserve has made multiple announcements regarding fiscal policy intended to instill investor confidence and provide support to the economy.

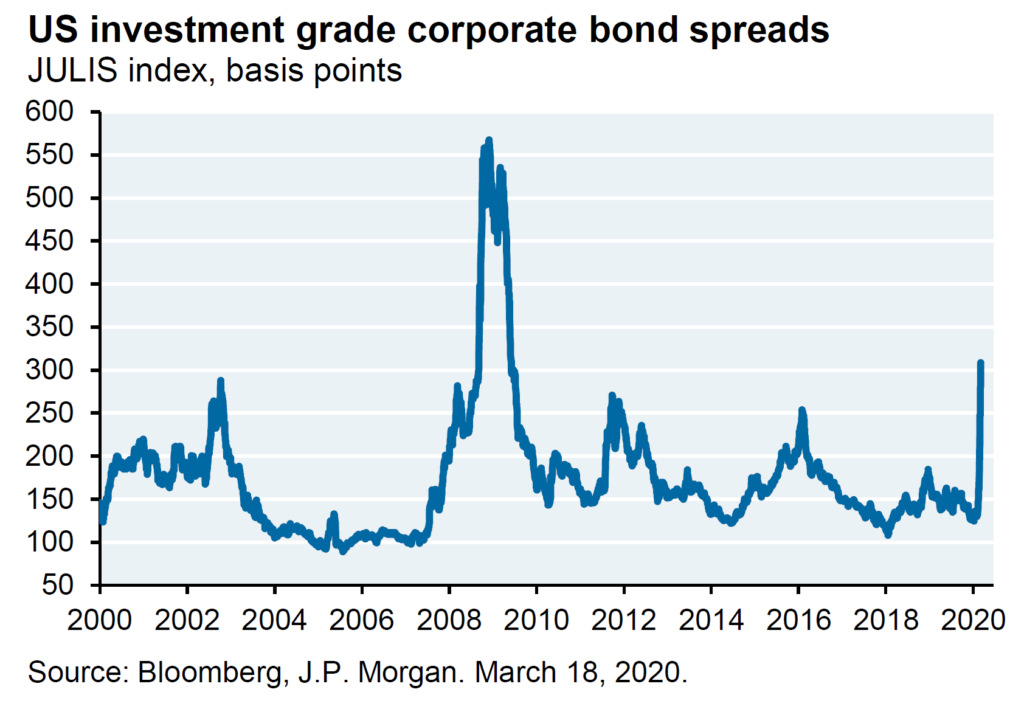

At the same time, mortgage- and corporate-bonds which initially benefited from falling yields in treasuries have been recently hurt by sharply widening credit spreads. Widening credit spreads like we have seen recently, highlight concerns that investors have about the ability of lower credit-quality corporations to pay off their debt. This has been reflected in corporate bond yields as they have spiked over the last two weeks, indicating that investors are requiring higher compensation to take on the risk of buying corporate bonds, particularly from lower-quality issuers. As the chart below demonstrates, year-to-date total returns (through March 24, 2020) for higher-rated A, AA, and AAA bonds have outperformed lower-quality BBB-rated bonds.

What we have noticed, perhaps unsurprisingly, is that the spike we have seen in yields and spreads coincides with the COVID-19 infection rate. In other words, as the infection rate has increased in the US, yields, and spreads have increased, reflecting a higher risk of default by bond issuers as many are forced to shutter their businesses. Of course, on a sector basis, spread performance has not been homogenous. The Energy sector, in particular, has been hardest hit as COVID-19 challenges have only been made worse by a collapse in the price of crude oil that is likely to impact energy company income statements, balance sheets and ultimately the ability of many issuers to service their debt.

In a historical context, the 300bps spread seen earlier this week in US investment-grade bonds was lower than the 550bps spread seen in March 2009. However, the magnitude of the widening has been dramatic as spreads have widened by more than 150bps, thus putting them at levels rarely seen.

So what has driven the spread widening? First, increasing default risk as issuers try to navigate a hard stop on economic activity in many areas of the world. Second, a lack of liquidity as investors seek to hold cash. Third, strategic rebalancing that often occurs in response to large moves in the prices of equities and fixed income like we have had. This time around, we are likely seeing investors sell down fixed income to allocate to equities and US Treasuries which leads to more supply of bonds.

In plain language, what we are saying is that over the last couple of weeks we have faced major liquidity issues in bonds that the Federal Reserve had to address through emergency action. This has been an effort to maintain a sense of order in bond markets.

So far, they have announced several policy actions aimed at shoring up liquidity. First, they announced market purchases of assets all along the yield curve. Second, they cut the Fed Funds policy rate and narrowed bank borrowing costs to 0.25% while committing $700B to quantitative easing. This was not enough for the market to respond positively so they finally removed the cap on assets to be purchased in what some are hailing QE infinity. These operations commenced this week with some success.

However, investors question how much the Fed can truly alleviate market stresses. The big concerns are that they already have limited balance sheet capacity with primary dealers already stretched and the scope and scale of the damage done by COVID-19 on economic activity are in many ways unprecedented. This is in many ways uncharted territory.

That said, we do expect these actions by the Fed and other of the world’s central banks to help improve liquidity over time. Additionally, we see a Fed funds rate that is lower than normal for the foreseeable future. At some point, the Fed is likely to try to unwind these support mechanisms as they once again try to normalize interest-rates like they did following the Great Financial Crisis. The result may ultimately be a steeper yield curve. As a result, investors should be at least thinking about how to position their portfolios for that possible shift, if and when it happens.

We currently believe bond investors should focus on three major themes. First, put a focus on high-quality bonds from issuers likely to weather the current economic environment. Second, investors should be prepared with a buy-list to take advantage of the price dislocations that may be caused by indiscriminate selling over the coming weeks and months. There may be good opportunities in fixed income to choose from. Lastly, for tax-sensitive investors, they should look at municipal bonds. We are currently seeing an interesting municipal market that might offer nice opportunities to pick up quality bonds with low default risk.

To summarize, the recent drawdown in fixed income markets reflects a liquidity crisis, rather than a solvency crisis, as fundamentals for higher credit quality bonds remain healthy. These changes largely depend on the duration of the economic lockdown that has gradually taken hold around the globe and the world’s ability to halt the spread of Covid-19. However, the world’s central banks are doing all they can to help support fixed income markets in the interim. The Fed has explicitly stated they will be purchasing assets in the treasury and mortgage banked security markets as they try to stabilize markets and prevent the liquidity crisis from worsening. While the coming weeks and months will tell us about the success of their efforts, Avidian Wealth Management plans to stick to our discipline. Leading up to the recent volatility, our discipline led us to shorten the duration and improve the credit quality of our clients’ fixed income portfolios. As investors, it is important to examine individual bonds to make sure the default risk is low, especially in the current environment. More importantly, if your advisor is not helping you look at fixed income through a more nuanced lens, you should ask why.

[/toggle]

KHOU 11 News Interview: Coronavirus: Have a plan to protect your investments

“An Avidian Wealth Management financial adviser said the unknown is fueling the roller coaster we’re seeing on the stock market.”

Published: 10:09 PM CDT March 12, 2020

Click Here to Watch the Full Interview Featuring Luke Patterson, CEO of Avidian Wealth Management

Written by Scott Bishop, MBA, CPA/PFS, CFP®

Over the years, I have written many articles on financial planning. Several of those have been “guides” to help readers through different stages of their life or lifecycle events. Two of those were the Retirement Survival Guide and Layoff Survival Guide.

Click Here to Read our Full Recession Survival Guide Article

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*