Published on: 04/01/2021 • 6 min read

Avidian Report – The Case For Including Infrastructure In Your Portfolio

INSIDE THIS EDITION:

The Case For Including Infrastructure In Your Portfolio

American Rescue Plan Act Relief Bill

It is no secret that some of this week’s significant headlines centered around President Biden’s tax plan to finance major investments in the country’s infrastructure. As a result, many investors are wondering whether this presents an opportunity to allocate dollars to publicly traded infrastructure assets that may benefit from increased investment.

Infrastructure is generally an attractive asset class for the income potential it can add to a portfolio and its inflation hedging characteristics that are important in an inflationary environment that can lead to an erosion of purchasing power.

However, now there are even more reasons to allocate dollars to infrastructure. In this week’s commentary, we will touch on a few of those reasons and why investors should be asking their advisors whether they have infrastructure exposure in their portfolios at this point in the market cycle.

Attractive Valuations

Valuations are certainly an important consideration for investors as they look for opportunities. After all, low valuations improve the expected return characteristics for assets. That is why investors generally want to buy low and sell high. Doing so allows investors to invest at low valuations, enjoy strong returns and then sell those investments when valuations are potentially at a premium.

Infrastructure historically has exhibited very favorable characteristics, including predictable revenue streams, equity-like returns with lower volatility levels, steady demand dynamics and an attractive yield profile. It is no wonder that investors typically find infrastructure assets trading at premium valuations. After all, these are desirable assets with both attractive income characteristics and risk-mitigating features.

What’s interesting today is that despite renewed interest in the asset class, the premium valuation that investors are accustomed to is no longer there. In fact, the EV/EBITDA spread between infrastructure and equities has completely vanished. As the chart shows below, before the pandemic, the premium was on average 1.3x but today sits at -0.9x.

This indicates that infrastructure stocks may represent an extremely attractive valuation level that should help an allocation to the space deliver favorable returns going forward.

Not only that, but investors might have a unique opportunity to hedge some inflation risk if they have not already at a healthy discount.

Secular trends highly supportive to infrastructure assets

However, those are not the only reasons to own infrastructure at this point in the market cycle. One of the best reasons to own it is that an investment in infrastructure may position a portfolio to capitalize on important secular trends that might lead to outsized performance.

For example, our 2021 secular trend of increasing reliance on technology drives profitability and efficiency across sectors. Infrastructure is uniquely positioned to facilitate that trend moving forward, especially as increasing amounts of data will require large-scale investments in building out and improving digital infrastructure.

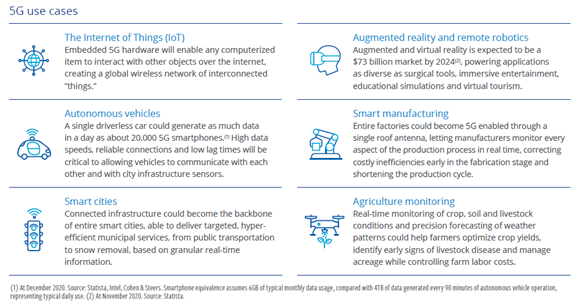

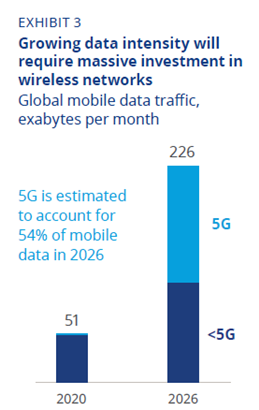

For example, the ongoing investment in 5G technology required to support new applications and use cases for digital information points toward this.

By some estimates, in the next five years, we might see the need for four times the capacity on 5G networks than we have today as more data users require better connectivity and higher transmission speeds. This will lead to tremendous investments to build out this infrastructure and potentially higher profits for companies that facilitate this new driver of growth for the economy.

Increased profitability profile ahead

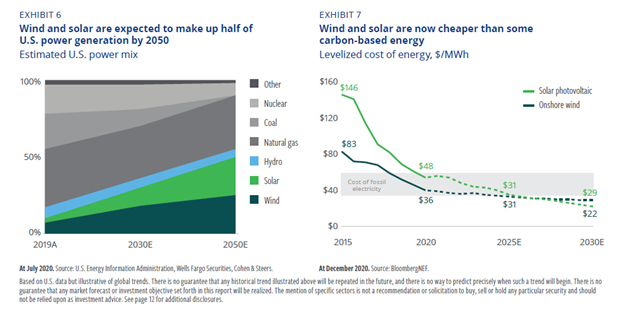

Further, significant themes like the shift to renewable energy sources might also serve as a boon to infrastructure company profitability ahead, especially in the United States, still in the very early stages of a transition to cleaner energy sources.

However, we believe there is growing political, regulatory and shareholder interest in driving the transition forward. Infrastructure will play a defining role in accomplishing that. We now see most US utility companies build out renewable energy infrastructure at increasing speed as a nod to this growing need to adapt to new market forces. Additionally, over the next 30 years, we could see wind and solar power infrastructure carry as much as half of the power needed in the US.

As a result of these investments, some analysts estimate that US electric utilities, which make up part of the infrastructure investment universe, could see as much as a 50% increase in earnings growth from a historical average of close to 4% to around 6%.

Of course, there are always risks associated with an asset class like infrastructure. We could see deflation that might neutralize some of the inflation hedging benefits of the asset class, infrastructure projects might take longer than expected, or be altered, and hurt the overall profitability of the companies within the sector, or yields may decline due to several factors. These are just a few of the risks. However, we believe infrastructure is a unique asset class that should be discussed with your advisor and considered part of a well-diversified portfolio.

Weekly Global Asset Class Performance

American Rescue Plan Act Relief Bill

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Rolando Garcia, JD, CPA

Friday, March 12th, 2021

Congress approved another coronavirus relief bill on March 10, 2021, the American Rescue Plan Act of 2021. The passing of the $1.9 trillion bill comes on the heels of a long and close vote in the Senate last week. The new bill, expected to be signed into law by President Biden on March 12, includes provisions for stimulus payments, extended employment benefits, additional small business funding, and much more.

Read Full Article Here

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*