Published on: 10/09/2020 • 9 min read

Avidian Report – Third-Quarter Recap and What The Fourth-Quarter Could Bring

INSIDE THIS EDITION:

Third-Quarter Recap and What The Fourth-Quarter Could Bring

Year-End Tax Planning Checklist 2020

Is ESG Investing Another Bull-Market Craze or Here to Stay?

Medicare Open Enrollment Begins October 15th

Coronavirus / COVID-19 Resource Center

The third quarter was marked by 2 steps forward and one step back with July and August seeing positive total returns for the S&P 500. Then in September, we saw a healthy 10% correction. We think this is progress and far better than 1 step forward and 2 steps back.

[toggle title=’Read More’]

With COVID-19 losing headline value over the last several weeks, and the economy starting to slowly reopen in a phased manner across the globe, investors have turned their attention to the real economic recovery, corporate fundamentals, and the US election, at least in the near-term.

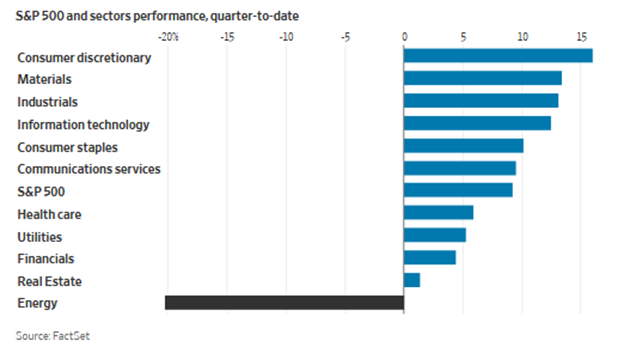

As we recap the third quarter, we saw an equity market that continued to march higher and produce positive returns across most major sectors. Through the end of the quarter, it was the consumer discretionary sector that led the way followed by materials and industrials. That said, the technology sector kept pace despite a torrid 2Q performance as investors flocked to companies primed to do well in a social distancing world. This further solidified our view that in many respects, the technology sector has truly become the new consumer staples sector with both growth- and defensive- characteristics. The one sector that finished the quarter with a negative return was energy as COVID-19 demand destruction continued to weigh on equity performance. In the end, we had 10 of the 11 S&P 500 sectors finish the third quarter in positive territory.

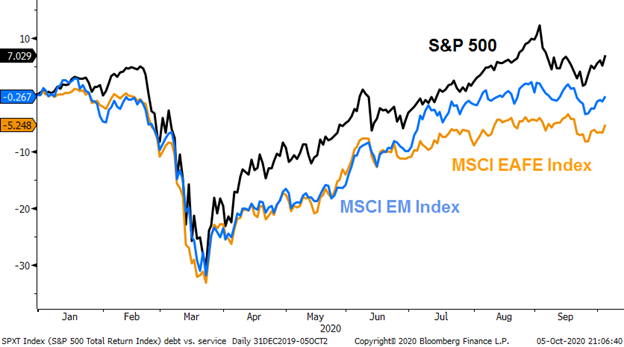

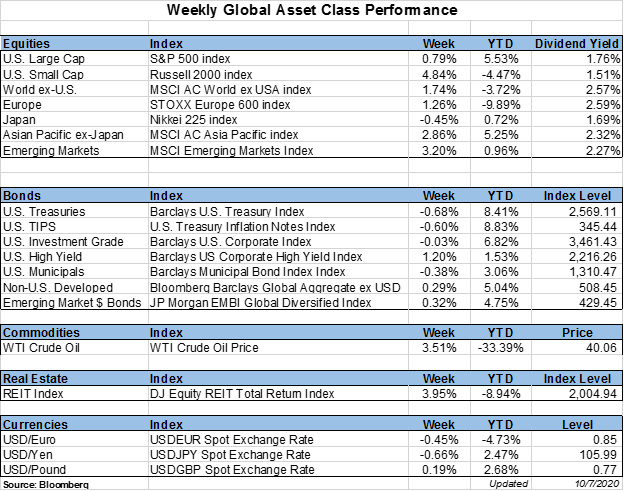

For the broad indices, we had year-to-date performance through October 5, 2020 for the S&P 500 of +7.03%, the MSCI EAFE Index -5.25%, and the MSCI EM Index -0.27% on a total return basis.

BROAD INDEX YEAR-TO-DATE TOTAL RETURNS

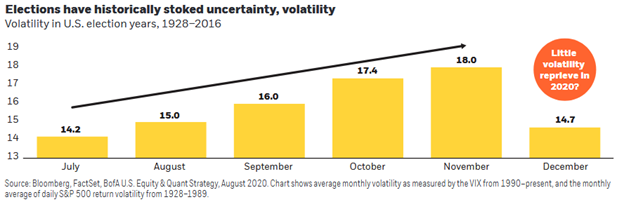

As we look ahead, we do think a shift is in the process of occurring. Namely, the focus on COVID-19 is waning while the focus investors are placing on fundamentals, both corporate and economic, is likely to increase. However, first, we have the issue of the November election to contend with. We have touched on this a couple of times over the last few months but as we get closer to the November 3rd election, we do believe there is a risk that equity market volatility may increase. It certainly has done so throughout history leading up to an election.

The chart you see below shows the monthly average volatility leading up to and then through the end of an election year dating back to 1928.

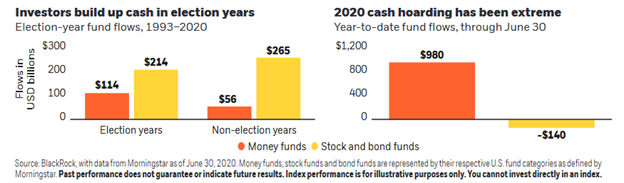

What we note, is the gradually increasing volatility in each month through November before calm has returned in the December months. While it is certainly possible we get a similar incremental rise in volatility over the next couple of months, we do think investors should be careful not to de-risk their portfolios unnecessarily, as we believe the extreme levels of cash sitting on the sideline may come flowing right back into equities when we get a definitive election outcome.

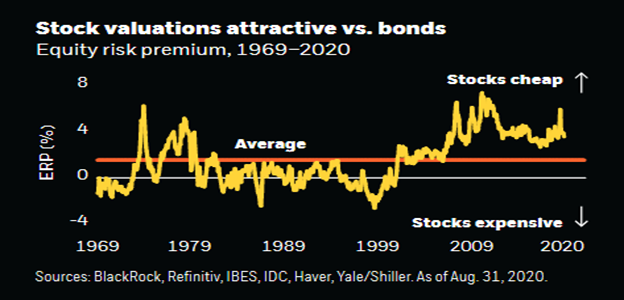

This is especially true with equity valuations looking more attractive based on the equity risk premium compared to bonds.

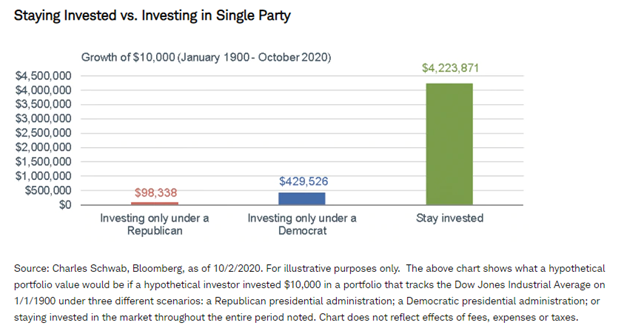

Further we would caution against positioning based on which party is likely to win. As a study by Charles Schwab shows, the party that is in office appears to play a lesser role on portfolio performance than one may think, with the best strategy historically being to remain invested while keeping a long-term view. And it is this long-term view that makes us favor focusing on the market fundamentals at this stage in the cycle.

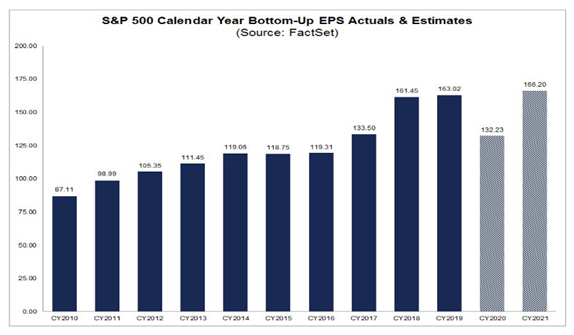

What do some of the fundamentals say? For the third quarter, we have analysts expecting an earnings decline of 21% for the S&P 500 as of October 2nd. This would be the second largest year-over-year decline in earnings since the second quarter of 2009. But, we think these expectations may be setting the stage for companies to beat on their forecasts. We have already seen a gradual improvement in expectations since June 30, before the phased reopening of the economy really gathered steam. What is more, is we think companies may signal a rosier picture moving forward with earnings guidance as it appears that the economic restart is gathering some momentum despite high COVID-19 case counts. For the S&P 500 alone, we have already seen 17 of 18 companies report positive earnings per share surprises, and 16 of 18 of those companies have beaten their top line estimates.

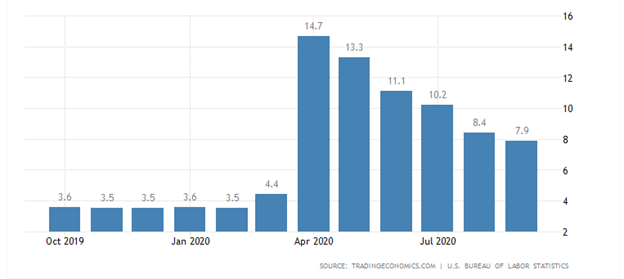

We then have the employment picture which is improving. Although unemployment remains well above pre-pandemic levels, the US unemployment rate dropped to 7.9% last month, after peaking at 14.7% in April as we see a slow but steady improvement aided by stimulus and prospects for a vaccine.

This could loom large, as full employment is a key objective for the Federal Reserve in determining monetary policy. As they have communicated, they are willing to let inflation run above 2% if necessary, to get back to full employment. While it is unlikely to stoke short-term inflation, this policy may eventually bring on marginally higher inflation rates.

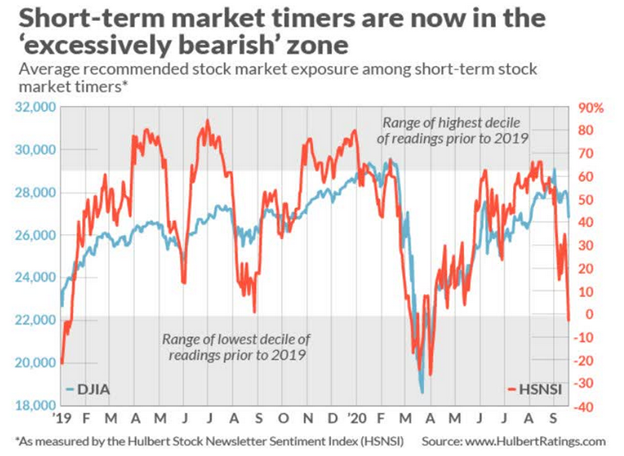

Lastly, we have short-term market timers positioned for downside volatility as this chart shows for the Dow Jones Industrial Average. Investors should be weary whenever they are with the crowd because even though there is often comfort in the crowd, bullish or bearish crowding can be contrarian indicators.

This dynamic, combined with additional stimulus potential, either before the election which would be a positive surprise, or after the election facilitated by election outcomes, and investors that get too defensive ahead of the election might regret not having more exposure to risk assets to close the year.

[/toggle]

What are the appropriate checklists for year-end tax planning?

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

From our experience, tax planners often develop checklists to guide taxpayers toward year-end strategies that might help reduce taxes. Throughout the year, we publish many timely tax-related articles (summarized here). In August this year, we also published our Top 10 Tax Planning Ideas for 2020. The tax filing season is now behind us. We have put together a year-end checklist of things that you should review. We have grouped the list into several different categories, such as “Filing Status” or “Employee Matters,” for ease of reading. As year-end approaches review each category that applies to your situation and consult with your tax advisor. Also, as this is an election year, we created a pice to compare the Trump vs. Biden Tax Policies.

Click Here To Read The Full Article

Is ESG Investing Another Bull-Market Craze or Here to Stay?

Written by Kevin Lenox, CFA®, CFP®

The environmental, social and governance (ESG) investing craze has become an ethical gold rush on Wall Street, as investors are attracted by the allure of earning higher returns while investing in “good” companies that occupy the moral high ground. Asset growth into ESG strategies has surged in 2020, as virtue signaling has gone mainstream. It’s woke. It’s trendy. It’s likely the hype surpasses the reality of what ESG will deliver to future investors.

Click Here To Read The Full Article

Medicare Open Enrollment Period Begins October 15th

Written by Scott A. Bishop, MBA, CPA/PFS, CFP®

What is the Medicare open enrollment period?

The Medicare open enrollment period is the time during which people with Medicare can make new choices and pick plans that work best for them. Each year, Medicare plans typically change what they cost and cover. In addition, your health-care needs may have changed over the past year. The open enrollment period is your opportunity to switch Medicare health and prescription drug plans to better suit your needs.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*