Published on: 10/29/2021 • 5 min read

Build Back Better Act – Updates to Biden’s Plans

Note: This is the new legislation that is significantly different from prior versions and framework. It is not final, but it lessens the impact on your financial and tax plan.

Since the last election cycle, I have been writing about the “Build Back Better” Plans (also called the “Human Infrastructure” or “Reconciliation” plans). Yesterday, President Biden came out with the framework for his new plan (Build Back Better Act – Full Language and Framework)

In the summary below, I will start with a summary of the tax and financial planning changes that are NO LONGER in the bill, and then I will share the provisions that ARE in the bill. You can read the above hyperlinks if you want to see more about what Social Programs are in the bill.

The best news is what is not in there (at this point)

If you read many of my earlier articles, I highlighted the things that were worrying me in the prior framework (the $3.5 Trillion Plan). Of those, here is what is NOT in the bill:

- Estate and Gift Tax Exemptions: No change in the Unified Credit (still $11.7 million and is going up to $12 million in 2022.

- Family Limited Partnerships: No changes in discounting strategies.

- Grantor Trusts: No provisions to change Intentionally Defective Grantor Trusts (or even Irrevocable Life Insurance Trusts) – so all good to go with GRATs, SLATs, EDGTs and ILITs.

- Tax Rates: No changes to the current earned income tax brackets or corporate tax brackets or even capital gains taxes will not be taxed at a higher rate (was thought to be as high as 39.6% at one point.

- Billionaires Tax: There will be no annual payment of taxes on unrealized gains.

- Mega IRAs: No Changes – no forced withdrawals or distributions.

- Roth Conversions: No change, still allowed at any income levels.

- IRA Investments: There is no language to limit your ability to invest in accredited investments or private deals in your IRAs (but still subject to potential UBIT issues, so beware).

- Carried Interest: There are no changes where some taxpayers are paying capital gains rates for carried interest.

- 1031 Exchanges: 1031 Exchanges (tax-free exchanges) on real estate will still be allowed.

Build Back Better – Impacts Related to Your Tax and Financial Planning (Current Provisions)

Per the Biden Administration (although the plan has not yet been finalized or scored by the Congressional Budget Office), the plan is fully paid for and no one making under $400,000 will pay a penny more in taxes. We will see…but for now, here are the “pay for” provisions:

- 15% Minimum Tax on Corporations: Imposing a 15% minimum tax on the corporate profits that large corporations—those with over $1 billion in profits—report to shareholders. The framework also includes a 1% surcharge on corporate stock buybacks, which corporate executives too often use to enrich themselves rather than investing workers and growing their businesses.

- 15% Minimum Tax on Foreign Profits: Adopting a 15% country-by-country minimum tax on foreign profits of U.S. corporations.

- Surtax on Income over $10 Million: Applying a 5% percent rate on income above $10 million, and an additional 3% surtax on income above $25 million (this will be much lower for trusts and estates with a surtax at $200,000)

- Pass Through Distributions: For businesses that are pass-through (LLCs, LPs, S-Corps), the new rules will close the “loopholes” that allows business owners to not pay payroll tax on non-wage distributions. In this provision, higher income taxpayers will pay the 3.8% Net Investment Income Tax (Obamacare Tax) on their business distributions – so pay the NIIT or take a bonus and pay payroll taxes.

- IRS Enforcement/Hiring: Per the framework, the IRS will be hiring enforcement agents who are trained to pursue wealthy evaders, modernizing outdated IRS technology, and investing in taxpayer service, so regular Americans can get their questions answered and access to the credits and benefits they are entitled to. The focus will be on more audits for individuals with incomes greater than $400,000.

- State and Local Taxes (SALT): Possibly a 5 year repeal of the State and Local Income Tax (mostly for Texas Property Taxes) Cap. May have AGI limits and increased deduction from $10k to $80k.

- Back-Door Roth IRAs: After 12/31/2021, you will no longer be able to convert IRA contributions with basis (that are tax free) and we will no longer be ablet to rollover 401(k) pre-tax basis to Roth IRAs (Mega-Roth Contributions).

- Crypto Wash Sales: There is language that will now subject Crypto (Bitcoin) sales to the same wash sale rules that securities have related to realizing losses.

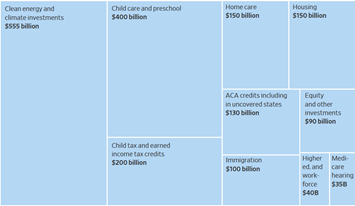

What Policies are being Funded ($1.85 Trillion in New Spending/Programs):

Also, here are links to some of our prior articles on:

- Tax Update – August 2021 – Democrat Reconciliation Human Infrastructure Deal

- June 2021 Update – FPA Tax and Estate Planning Knowledge Circle

- Estate Tax Law and Strategy Changes are Coming

- 10 Most Asked Tax Questions so Far in 2021

- 2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

- American Rescue Plan

- 2021 Income Tax Update – Alert

- Key Estate and Income Tax Planning Takeaways from the “Blue Wave” Democratic Victories

- Year-End Tax Planning Checklist – 2020

- Secure Act (and the loss of the Lifetime Stretch IRA and Changes in RMDs)

- Qualified Opportunity Zone (Investment Considerations and Tax Benefits)

- Review of Real Estate 1031 Exchanges

- Tax Cuts and Jobs Act (good to know and review if any “repeal”)

- For Individuals

- For Business Owners

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*