Published on: 05/07/2020 • 8 min read

Coping with Market Volatility: Understand How Your Behavioral Biases Can Affect Investment Decisions

During these difficult times, especially during a Coronavirus triggered a recession, many of us make poor investment decisions that can be biased based on our emotions of greed and fear. Smart investors, per Warren Buffet, should be “greedy when others are fearful and fearful when others are greedy”. In other words, by low and sell high. Sounds simple, but as Stephen Covey says, “what is common sense isn’t common practice”.

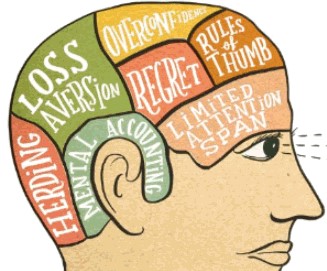

So why do investors make so many emotional investment mistakes – especially when worried about the economy or even possibly layoffs. When it comes to your finances, “go with your gut” might not be the wisest adage to follow. In fact, it may work against you, particularly in periods of market turbulence. Before jumping to conclusions about your finances, consider what biases may be at work beneath your conscious radar. Much of this can be explained through the science and research of Behavioral Finance. Below I will talk and summarize some areas that I read in a Morningstar Report titled “How Behavioral Science Can help (investors and) Advisors During Market Turmoil. These behavioral biases, described and summarized below, may be adversely impacting your financial decisions and possibly derailing your Financial Plan while you are riding this Stock Market Roller Coaster.

One example of these behavioral bias is Recency bias that refers to the tendency for recent events to have a stronger influence on your decisions than more distant events. For example, when the market was in the midst of an 11-year bull run, you may have increased your investments in equities, hoping to take advantage of any further gains. By contrast, if you were severely burned by market performance during the past several weeks, you may be hesitant about continuing or increasing your investments once the market settles down. Consider that neither of these perspectives may be entirely rational given that investment decisions should be based on your individual goals, time horizon, and risk tolerance.

Loss-aversion bias describes the tendency to fear losses more than celebrate equivalent gains. For example, you may experience joy at the thought of finding yourself $5,000 richer, but the thought of losing $5,000 might provoke a far greater fear. Loss aversion could cause you to hold on to a losing investment too long, with the fear of turning a paper loss into a real loss. In a down market, of course, most of your investments may show paper losses, so you might consider whether you are holding on to an investment that would be wise to sell within the context of your overall strategy.

It’s only natural to be concerned when the market drops. But expecting volatility and having a sound financial strategy in place may be the best defense when events roil the markets. This might also help prevent you from making investment decisions influenced by biases.

If you think you might be basing your decisions on biases rather than facts, contact us. We can offer an important third-party perspective by helping you align your investment portfolio and decisions with your overall financial plan.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. However, if you truly have a plan and thoughtful portfolio allocation aligned with that plan, you most likely will have a higher level of success and avoid “buying high and selling low”.

Although there is no assurance that working with a financial professional will improve investment results, a professional can evaluate your objectives and available resources and help you consider appropriate long-term financial strategies.

List of Ten of the Behavioral Biases that may be Influencing your Investment Decisions:

- Recency Bias: When we predict what’s going to happen in the future, our minds naturally reach for what happened most recently. In part, that is because our brains have an easier time remembering what just happened versus what occurred further in the past. Although this shortcut usually works out for us in everyday life, it can result in us placing undue importance on recent events when we make investing decisions. For many investors, this means that when their portfolio drops 10%, recency bias convinces them that it will continue dropping.

- Herding Behavior: When you’re choosing which restaurant to order takeout from, you might consider looking at their reviews online. If one restaurant has plenty of rave reviews, while the other has only a few subpar comments, you will choose the restaurant with plenty of rave reviews. With restaurants and many other parts of our lives, it can be a good idea to follow the crowd. During market volatility, however, many investors are overreacting, so the crowd’s usually going in the wrong direction and going against the crowd, especially during times of uncertainty, can feel extremely unnatural.

- Action Bias: “Well, at least you tried.” This common consolation can be comforting and justified in many decisions. Prior research has found that the urge to take dramatic action can trick us in cases where the statistically correct choice is thoughtful inaction. During times of volatility, sometimes resisting the urge to “Sell! Sell! Sell!” could be the right decision. Doing nothing while markets are dropping is extremely hard for us, however, because it goes against our instinct to take action. In our minds, it hurts less to try something and lose, compared with doing nothing and losing the same amount. If investors don’t calmly think about the appropriate course of action and give in to action bias instead, it can make their losses objectively worse, but, to them, it can feel subjectively better.

- Overconfidence Bias: Do you believe you are an above-average driver? If you said yes, you have agreed with about 90% of all drivers in a famous study of everyday people who said they were above-average drivers. Even though we know we all can’t be above-average drivers, our minds tell us that we must be better than the rest. This is overconfidence bias. We all tend to be unrealistically optimistic about our chances of success. When it comes to making investment decisions, this can result in investors making rash choices and believing that, when push comes to shove, they will be spared the pain others will experience.

- Confirmation Bias: Even if we try to engage in proper research before making a decision, our minds will automatically pay more attention to information that supports our current beliefs. Confirmation bias is our tendency to find and interpret information in a way that supports our opinion, and it can derail even the most well-meaning investor who is trying to keep up with the news.

- Loss-Aversion Bias: One of the most well-known and often-cited behavioral biases, loss aversion, also comes into play with investing. Specifically, a 10% portfolio loss feels a lot worse than a 10% gain for many investors because we are loss-averse: Experiencing a loss generally feels twice as bad as gaining the same amount. As market volatility continues, investors may experience strong emotional reactions that cloud judgment.

- Familiarity Bias: Familiarity bias occurs when an investor has a preference for a familiar investment despite there being other viable options that can also add to portfolio diversification. An asset they have owned before and have had a positive experience can feel less risky and hence is often the “go-to” asset when looking to generate returns. Sort of like the ease of catching up with an old friend.

- Anchoring Bias: This is a cognitive and information processing bias, where people use a default number or “anchor” and do not adjust adequately, and end up using statistically arbitrary, psychologically determined anchor points. An example of anchoring and adjustment bias would be when an investor owns stock at 200 and it drops to 150 but the investor wants to wait until it gets back to 200 (the “anchor” price), even though there is significant negative news that should cause the stock to decline further.

- Snake Bit Effect: The snake bite effect happens when people take substantial draw-downs in their investment in stocks or other types of assets and they tend to seek to avoid risk as a result of their losses. Often this bias can lead to a portfolio that is over-weighted in conservative investments and does not meet an investor’s desire to keep up with inflation or have capital appreciation in their portfolio.

- Cognitive Dissonance Bias: Often investors will ignore newly acquired information because it conflicts with previous views due to cognitive dissonance bias. Most people avoid potentially relevant information to avoid psychological conflicts.

Disclaimer: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions (“STA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from STA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. STA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the STA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are an STA client, please remember to contact STA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*