Published on: 07/17/2020 • 7 min read

Avidian Report – Elections are Around the Corner

INSIDE THIS EDITION:

Elections are Around the Corner

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

With the focus all year around COVID-19 and the economic impacts, some investors have lost sight of the fact we have a presidential election only 4 months away. With work-from-home orders still in place, second lockdowns possible, and restricted social activity persisting in many geographies, 4 months may seem like an eternity away. However, the reality is that the election will be here before we know it and as such, it is not too early to begin thinking about the election season and the potential economic and market ramifications it could have. That is why, this week, we are going to shift gears in our commentary a bit and begin to consider what elections in the context of the current economic environment might mean for markets and portfolios going forward.

[toggle title=’Read More’]

But first, it is useful to look at the table below. It provides a snapshot of the data that comprise the Weekly Economic Index. The data paints a pretty clear picture in our eyes – we have a domestic economy that is in many ways in tatters, but with the data inflecting higher, investors are hanging their hat on stocks continuing their march higher, especially with the support of government stimulus.

Yet, as we have often cited, the economy and the stock market are disjointed now with stocks being bid up higher while things like consumer sentiment continue to sag.

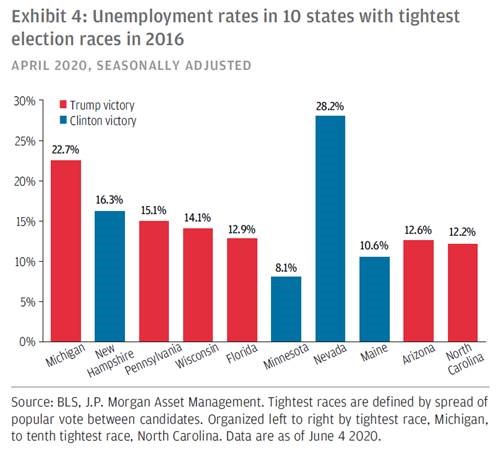

In fact, it is this contradictory data that provides the backdrop likely to fuel elevated stock market volatility as we move toward the November election; especially as we fight COVID-19, are mired in a deep recession, and experience the highest unemployment rate since the Great Depression.

Historically, incumbent presidents have won reelection unless there was a recession during their term. So, if history is to serve as a guide, the current recession is likely to make a Trump reelection bid highly uncertain. To be successful, President Trump will either have to convince voters he has managed Coronavirus appropriately by driving the reopening of the economy, or by relying on his signature issues such as immigration, trade protectionism and infrastructure to earn another term.

If he manages to be reelected, a second Trump term would likely yield a continuation to some degree of what we have seen over the 4 years – increasing protectionism and continuity in policy. However, whether markets would react well to this outcome is a bit of a coin toss that largely depends on whether an economic recovery has follow-through into November. That would certainly make the electorate and investors feel more confident that the path forward is more promising.

If a democrat wins on the other hand, we might assign a slightly higher probability to seeing a pullback of the equity market given the possibility that corporate taxes would rise. And this is an interesting point that might affect the most heavily weighted sector – Technology. Based on research done by BCA Research, a rise in the corporate tax rate from 21% to 28% would have reduced the trailing earnings per share reported by technology sector companies by 13.5%.

Regardless who wins the 2020 US election, a gridlock government is our base case scenario, with Democrats controlling the House and Republicans holding the majority in the Senate. This would be a favorable outcome in that it would increase the chance that no dramatic policy shift occurs. Remember, investors dislike uncertainty and this would help eliminate some of that.

That said, we do believe that from an investment standpoint, the upcoming election should not necessarily change how investors are thinking about the market and their exposure to stocks and bonds. While we concede that it is tempting to let short-term thinking override long-term decision-making, we urge investors to resist. Although returns are typically lower and volatility is higher in election years, those finding are heavily influenced by recessions and market events, such as the tech bubble in 2000 and the financial crisis in 2008. Further, the research shows that even in those years, average returns were still positive.

Moreover, regardless if the government is led by a Democrat-, Republican- majority, or a divided government, markets tend to grind higher over time, achieving positive returns. Similarly, the economy tends to continue growing, albeit never in a straight line.

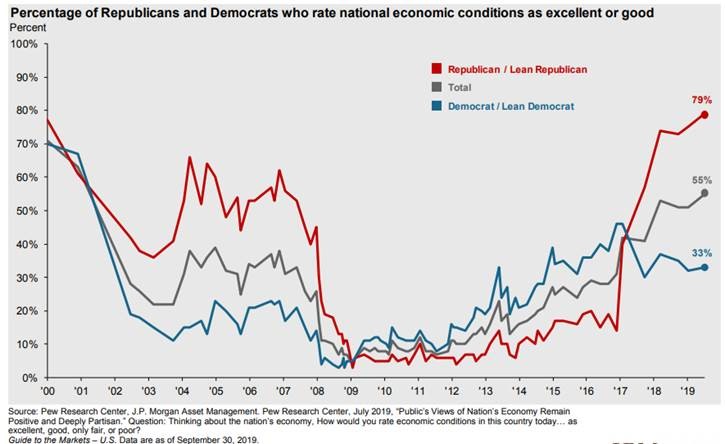

The chart below shows a poll conducted by the Pew Research Center, which categorizes respondents by political affiliation and asks them to rate current economic conditions. What you can see is how people’s feelings about the economy are often biased when political views are involved.

This can lead investors to be under-allocated to risk assets like stocks or even pull out of the market if they feel strongly negative about a president. We strongly urge investors to resist this temptation. Sure, the market may react in the short-term to the election results come November, but history has proven over and over that in the intermediate- and longer-term, equity markets are largely driven by economic fundamentals. It is this factor, that investors should truly be focused on to ensure they do not commit unforced errors in judgement that can hurt long-term investment results.

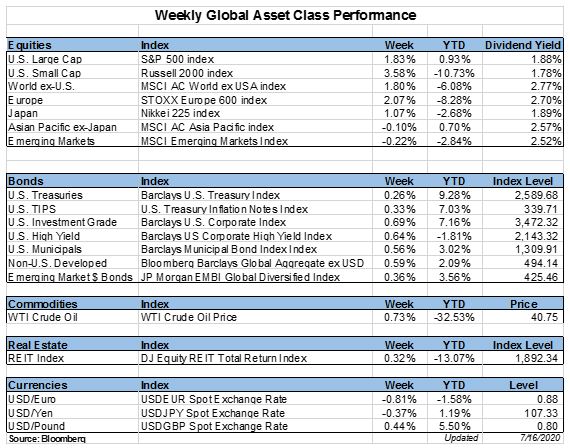

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*